It's Friday....

The GBPUSD is trading in a 93 pip trading ranges which compared to the EURUSD (at 62 pips) is much higher, it still is relatively confined given recent volatility.

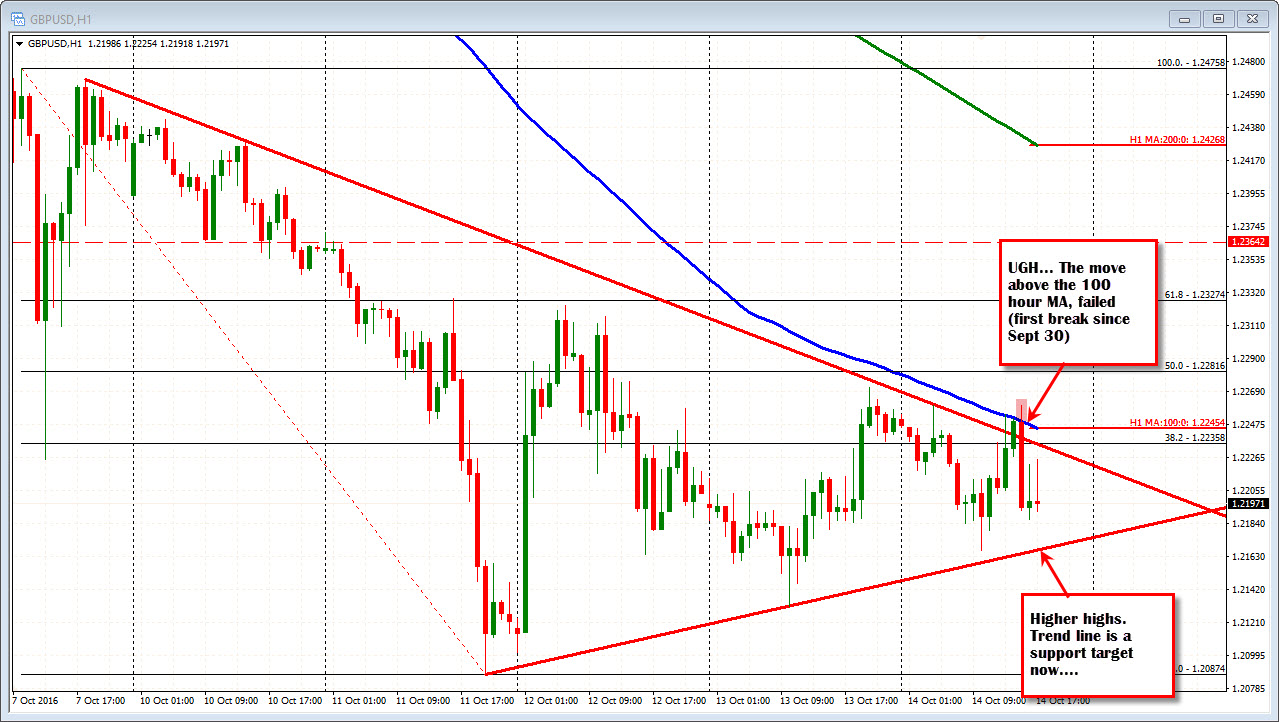

Technically, the price tested - and even moved above - the 100 hour MA at the day highs (currently the MA is at 1.22456), but it is one of those markets where there tends to be a lot of failed moves. So although it was the first break above the 100 hour MA, since September 30, it really did not find the momentum buyers you might expect.

That is ok. Failed breaks - like this one - can tell traders a lot and provide trading opportunities. However, you have to be ready for them, and understand if you zig instead of zag you can get hurt. For example, you can be a buyer on the break of the technical level (like the 100 hour MA) and be exiting minutes (if not seconds) later as the break fails miserably. Such is trading in these types of markets. You are not alone.

What can you do?

- Trade failures instead of breaks.

- Get out if you go with the break and it fails. Take your loss. You need to trade this market and Friday does not help much.

What next?

The 100 hour MA remains above and a level of importance. Trade against it. Trade failed breaks, Trade a break and cut if it fails.

On the downside, the low this week occurred on Tuesday, Thursday was a higher high. Today is a higher high. There is a lower trend line at 1.2170. Like at the 100 hour MA, you can trade against the level (i.e. buy a dip with a stop somewhere below), trade a failed break (if it goes below and moves back above quickly) or trade a break and get out if it fails. It is the best we can do.

Trading in between, and you might get pushed around with the ups and down swings.