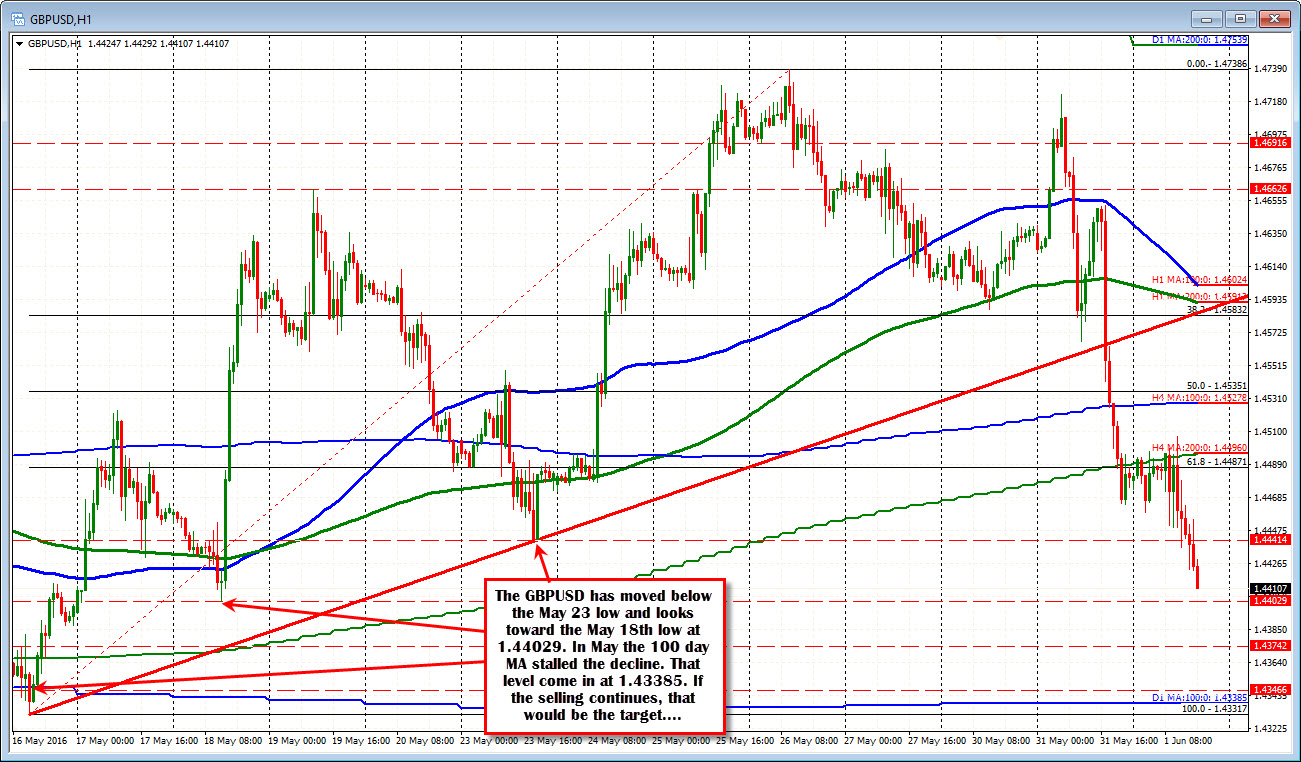

GBPUSD trades at session lows as ISM data awaited.

The GBPUSD has pushed to new session lows as the GBP gets pressured from all sides. Not only is the GBPUSD lower, but the GBPJPY is trading near the lows, and the EURGBP is trading near highs.

If there is a glimmer of a slowing of the move lower, it might come from the EURGBP which has just tested the 50% of the move down from the May 4th high at 0.77553. The high price reached 0.77554. If EURGBP stalls and comes back down, that might in turn, give a boost to the GBPUSD pair. We will see.

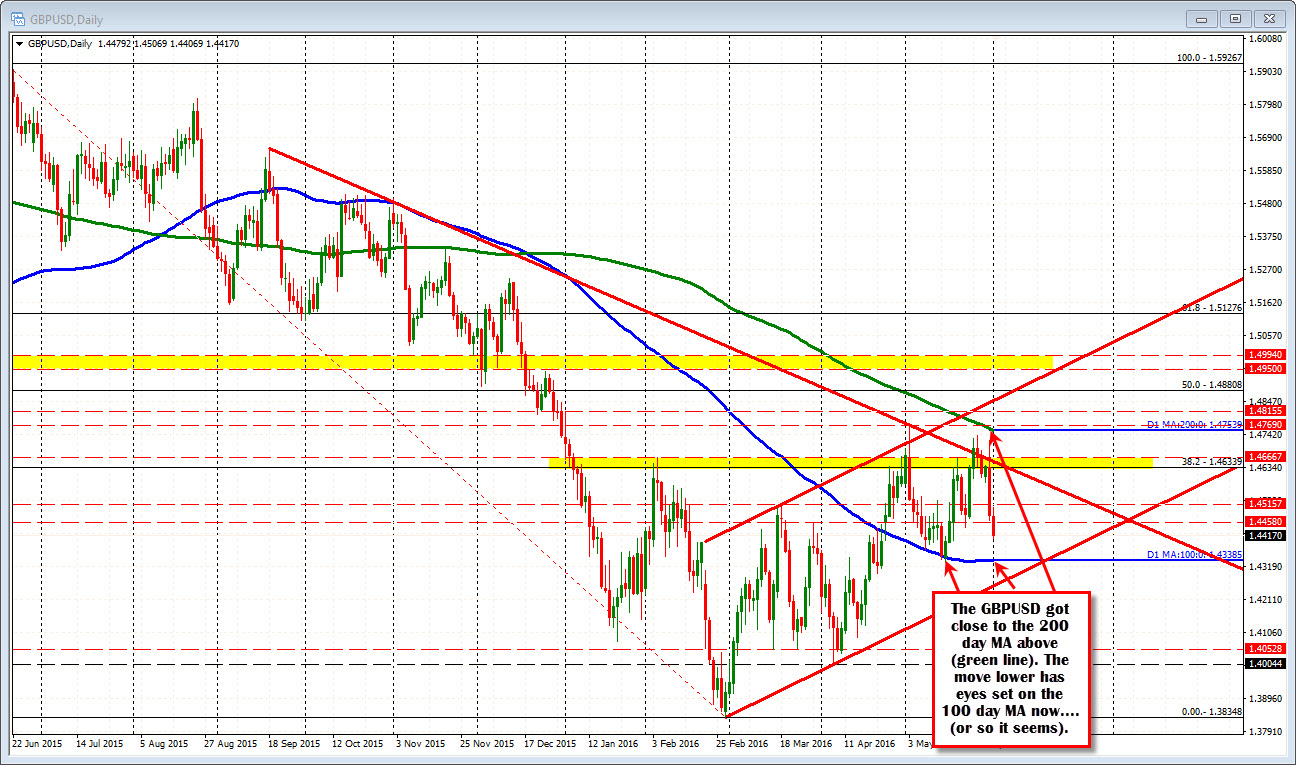

Looking at the daily chart, the pair is entering the lower range from May. That range bottomed near the 100 day MA (currently at 1.43385). Yesterday/last week, the price got close (sorta) to the 200 day MA (green line in the chart below). The pair has not traded above the 200 day MA since November 5th, 2015. So you would expect a reluctance on the first test. The rotation lower - if it gets down to test the 100 day MA - should find buyers on the test again.

Of course the Brexit vote is coming up so although polls will gyrate the pair around, it is probably wise to lean against support and resistance. The 100 day MA would be support. The 200 day MA would be resistance.