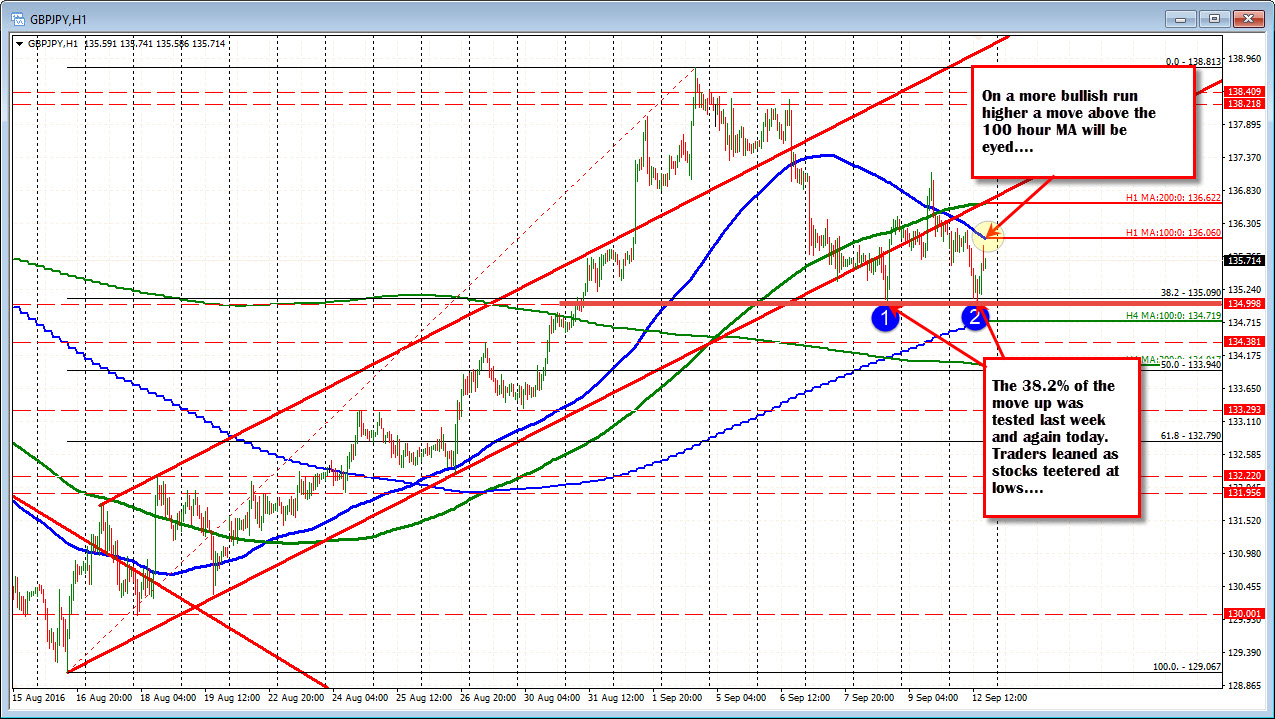

Traders leaning against the 38.2% retracement

The GBPJPY is trading its own trading range.

On the downside, the from last week held near the 38.2% retracement at the 135.09 level (the low went to 135.00). Today as stocks continued lower into the NY opening, the price once again tested that 38.2% level and once again buyers leaned (the lows came in at 135.09 and 135.067 respectively). Risk could be defined and limited.

With the US stocks rebounding into positive territory, the price has rebounded in the NY session with the 100 hour MA at the 136.059 level a target above (the high extended to 135.96). The current price is trading around 135.70.

Drilling down for price action clues in the intraday chart, adding to the resistance target at the 100 hour MA is the 50% of the move down from Friday' s high at the 136.097 and a trend line connecting recent highs (see chart below). ON the downside, there has been some consistent action around the 135.46 area. There have been a number of intraday lows/highs in the area. The 100 bar MA on the 5-minute chart is there.

The price trades between the resistance above and the intraday support below. I suspect that the flows might go with the stock flows. Higher and the GBPJPY (and JPY pairs in general) rebound. Move lower and the pairs support gets tested. The technical levels are defined.....

PS. The USDJPY continues to stay below the 100 hour MA at 102.06 now. A move above that level is needed to push that pair higher.