A look around the major GBP pairs

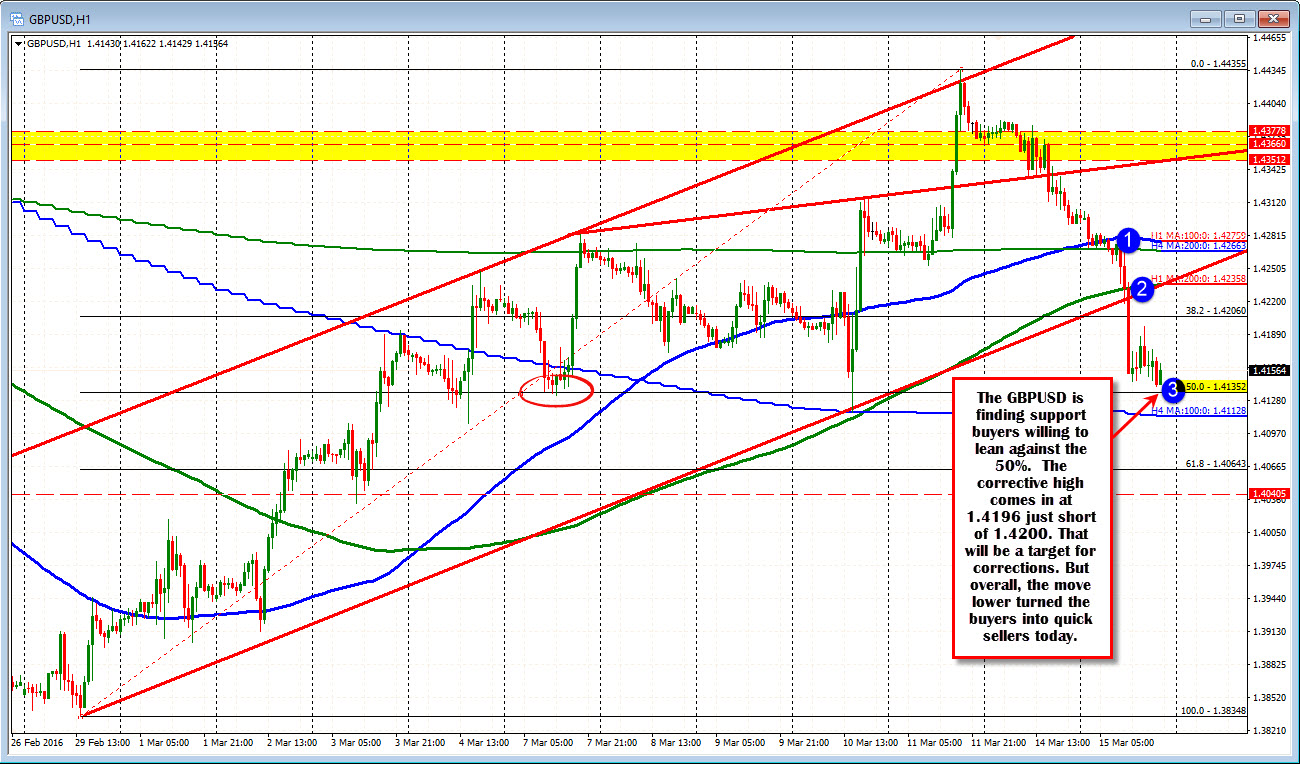

GBPUSD

The GBPUSD got it's push in the Asian Pacific and London trading session. The fall started on the break of the 100 hour MA and the 200 bar MA on the 4 hour chart (see 1 in the chart below). The break of a trend line and 200 hour MA, gave another push but has stalled near the 50% of the move up from the February 29th low. That level comes in at 1.4135. The lows for the day has made it to 1.4141. Traders are leaning against the level. The correction has taken the price to a 1.4196 - just below the 1.4200 level.

On a break, there should be stops but be aware the 100 bar MA on the 4-hour chart comes in at 1.41128.

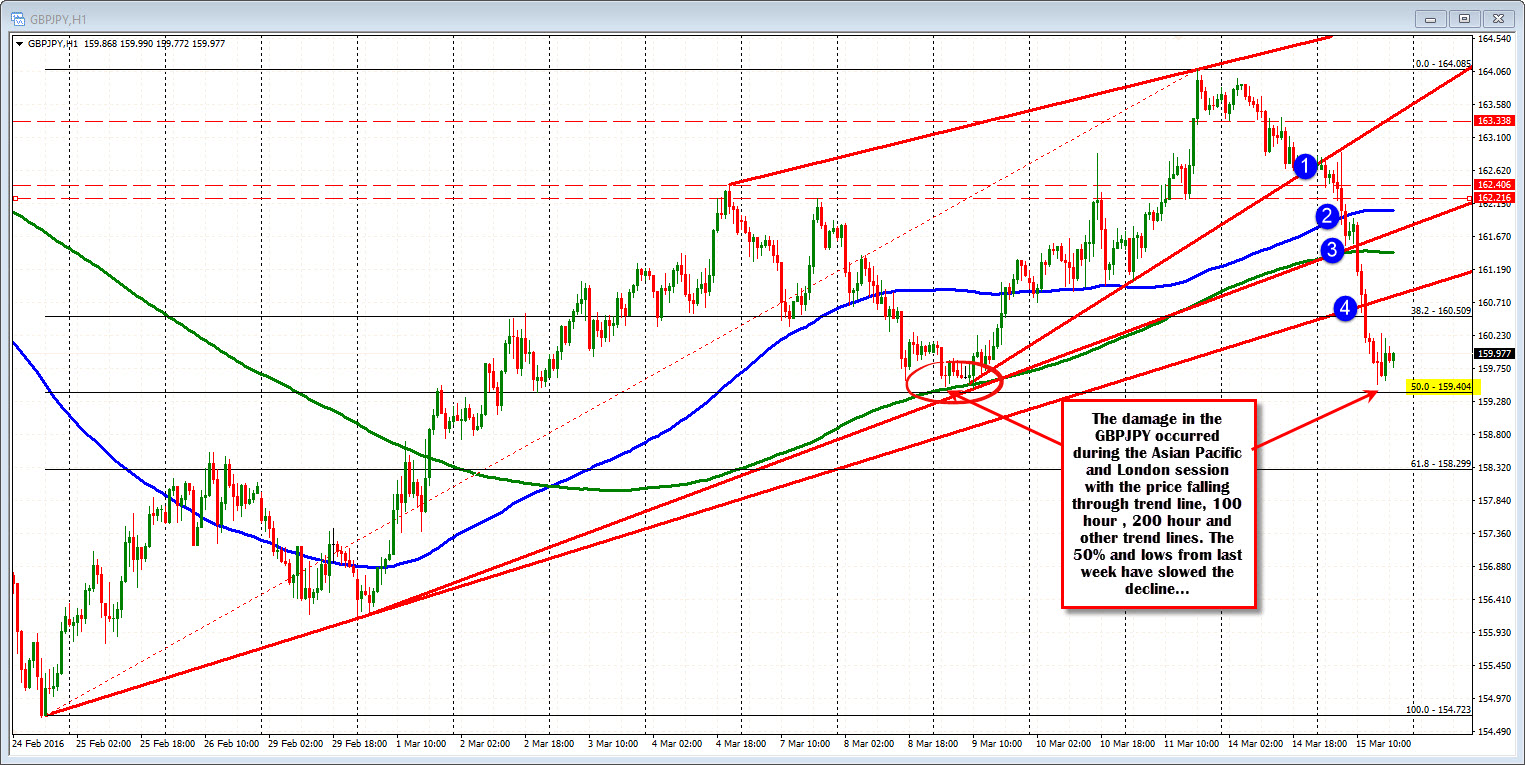

GBPJPY

The BOJ kept rates unchanged. They distanced themselves from negative rates. They warned of slower economy though. The JPY pairs including the GBPJPY fell sharply today.

For the GBPJPY, technicallly, they had bee trending higher. I high was reached on Friday at 164.085. Yesterday, the high could not be taken out and buyers turned to sellers. The price came down to trend line support.

Today,

- That trend line was broken,

- As was the 100 hour MA (blue line),

- The 200 hour MA (green line) and a trend line rising from March 1 and

- Another trend line going back to February 24th.

The lows from last week (March 9) and the 50% retracement have stalled the pair over the last 5 hours. It is time for consolidation.

EURGBP

The market giveth and it taketh away. On Friday, the EURGBP gave sellers a sharp move to the downside. That move started at 0.7847 and finished at 0.77375. Yesterday, that low was taken out by a few pips but activity was contained. Technically, however, the 200 hour MA and the 200 bar MA on the 4-hour chart were gathered together at the 0.7745 level and that is where the base was formed.

Today, the pair based at the 100 hour MA, got going higher, and then shot higher in the London trading session. The high today has touched 0.7847 - fractions of a pip above the high from Friday. We remain knocking on that door as I type.