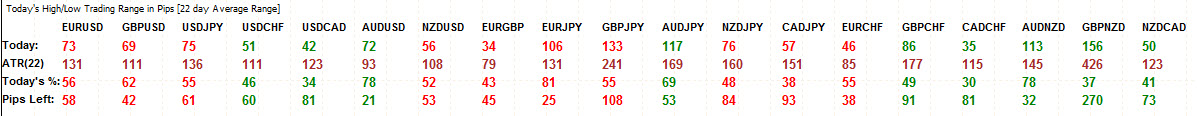

Trading at day lows

The EURUSD has traded new fresh day lows as NY traders enter. The pair is trading in a narrow trading range of 73 pips (in fact all of the major currency pairs and crosses are below their 22 day average). So there is room to roam on a break. There is no economic data out of the US today. The US stock futures are modestly lower in pre-open trading.

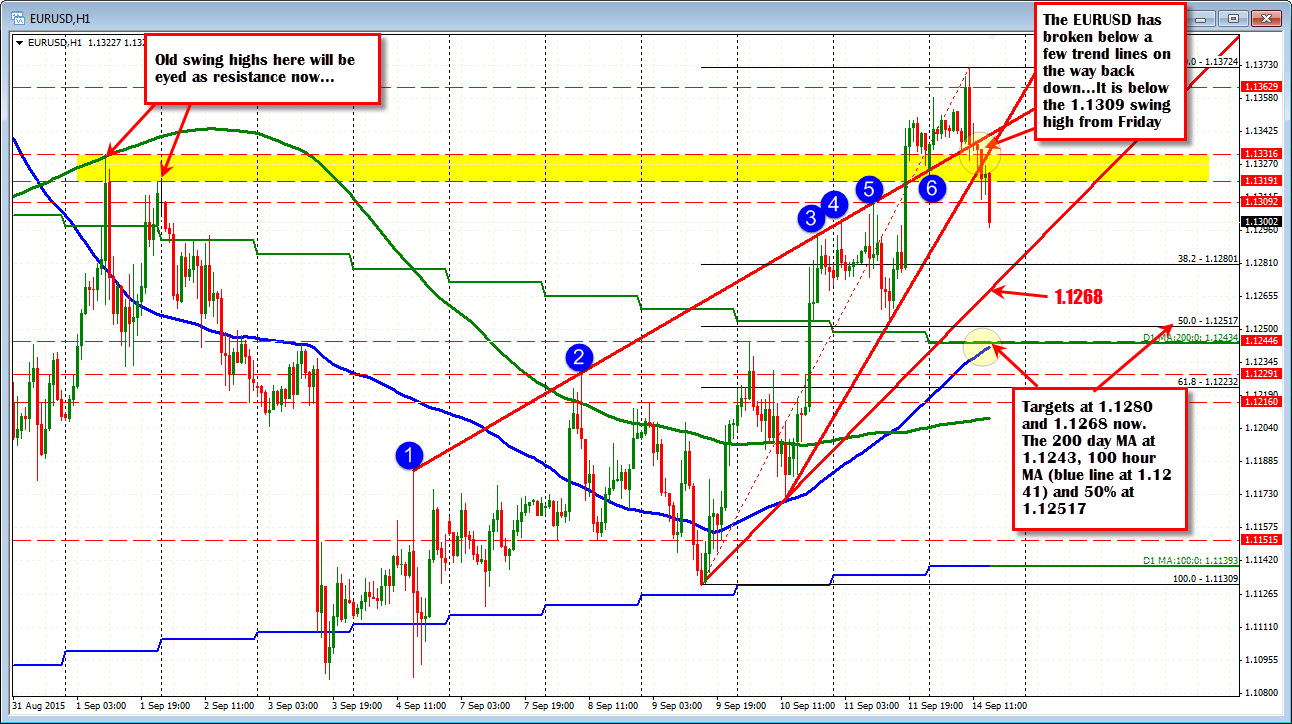

The pair initially moved higher, extending the gains seen during last week. However, the price peaked at some old trend lines (see daily chart below).

The fall has taken the price to the 1.1300 area. This is below the 1.1309 level on Friday which was a swing high (see hourly chart below). The 1.1280 level is the 38.2% of the move higher last week and is the next downside target.should momentum continue. A move back above the 1.1309 level and then a move above the 1.1319-31 level will negate the bearishness seen so far in the London session.

On the downside, the next targets to get and stay below include the 1.1280 level (38.2% of the trend move higher) and the lowest trend line in the hourly chart above at the 1.1268 currently (and moving higher of course). Note the cluster of support in the 1.1241-517 area where the 100 hour MA (at 1.1241 currently and moving higher), the 200 day MA (green step line at 1.12434) and the 50% retracement at 1.12517 all come together.

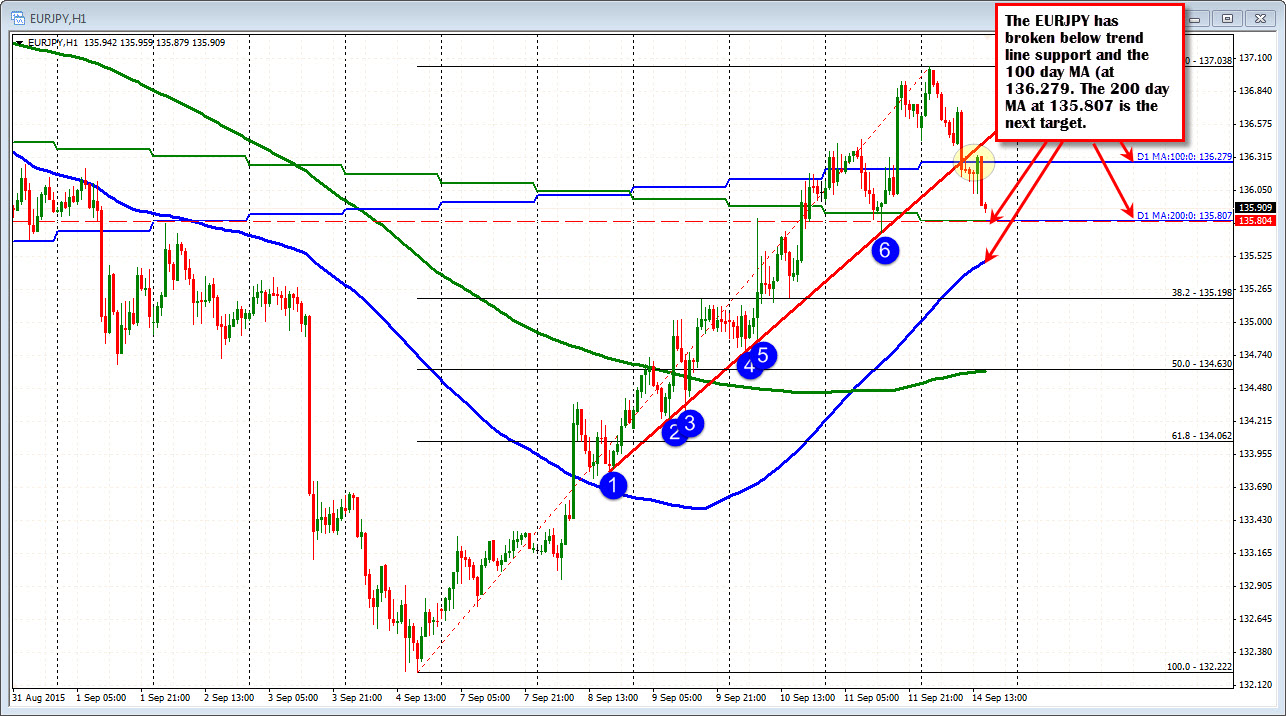

Moving in tandem with the EURUSD is the EURJPY (at least in the London session). That pair has moved below trend line support on the hourly chart and also below the 100 day MA at the 136.279 level - see blue step line in the hourly chart below). The 200 day MA is being approached at 135.807. A move below that level would next target the 100 hour MA (blue smooth line in the chart below) at the 135.49 currently (and moving higher). The 38.2% at 135.198 is also a downside target.