That's more like it...

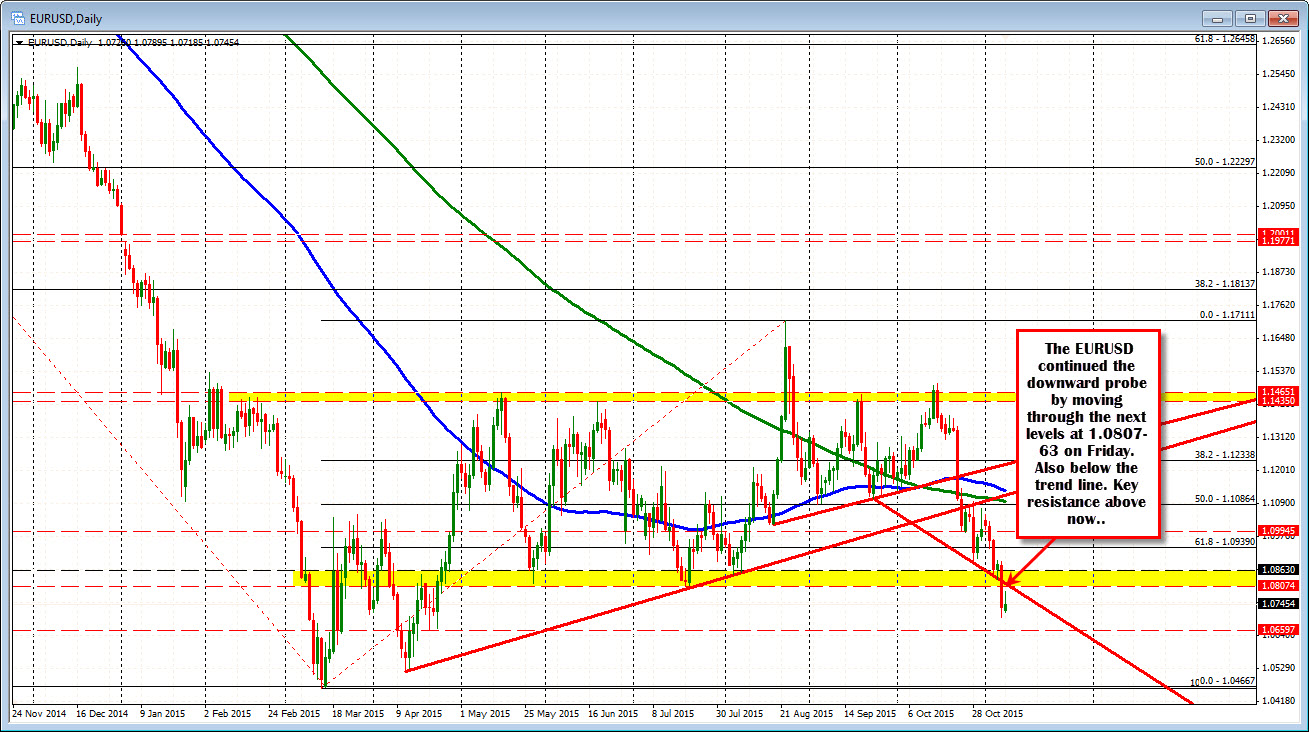

The EURUSD is showing some early NY session selling after grinding higher on reports of a ECB cut in December. The pair nearly got to the 50% of the move down from the Friday's nose dive on the back of the stronger US employment report (at 1.07986 - see chart below). The high today reached just short of 1.0790.

If you polled the market, I would guess most (a vast majority) would say EURUSD should be moving lower going forward, but the EURUSD traded the recent low on the first minute bar after the NFP report and has not traded below that level since. That weighs on any new shorts. Fear from losses scares many a trader.

Then you get a catalyst (like the reminder of ECB policy) and traders remember. The liquidity is just not what it should be. When traders are not trading as much, it can lead to scratching heads.

The "recent" price action in the last few minutes, has taken the price back to unchanged at 1.0737 area. So, the week is starting over (see chart above). Note also how technically, the price has run away from the 100 and 200 bar MAs (blue and green lines at 1.0757 and 1.0769 currently). Traders used those line as support. Now they will use them to define risk above.

On the downside, the 1.0700 level held the line on Friday. If this baby is going lower, that is the next natural level to get to and through. Then traders will be looking toward 1.0660-65 (lows from April 21 and April 23rd). The April 13 low came at at 1.0520, The low for the year is 1.0466 (see daily chart). While looking at the daily chart, note that on Friday, the pair fell below trend line support and the low floor area between 1.0807 and 1.0863 (see yellow area where there were a number of swing lows going back to May). That area is also strong resistance now. Although the high today got close (at 1.07895), the 1.0807 was not really tested.... Good news for sellers. Now we need more sellers (and buyers to dry up).

PS One thing to keep in mind, the Fed has painted themselves in the corner with regard to tightening. But at the same time, they are likely scared to death of a runaway dollar. So Fed officials may start to say things like the "dollar has priced in the move". Be aware.