Sellers enter after ISM spike

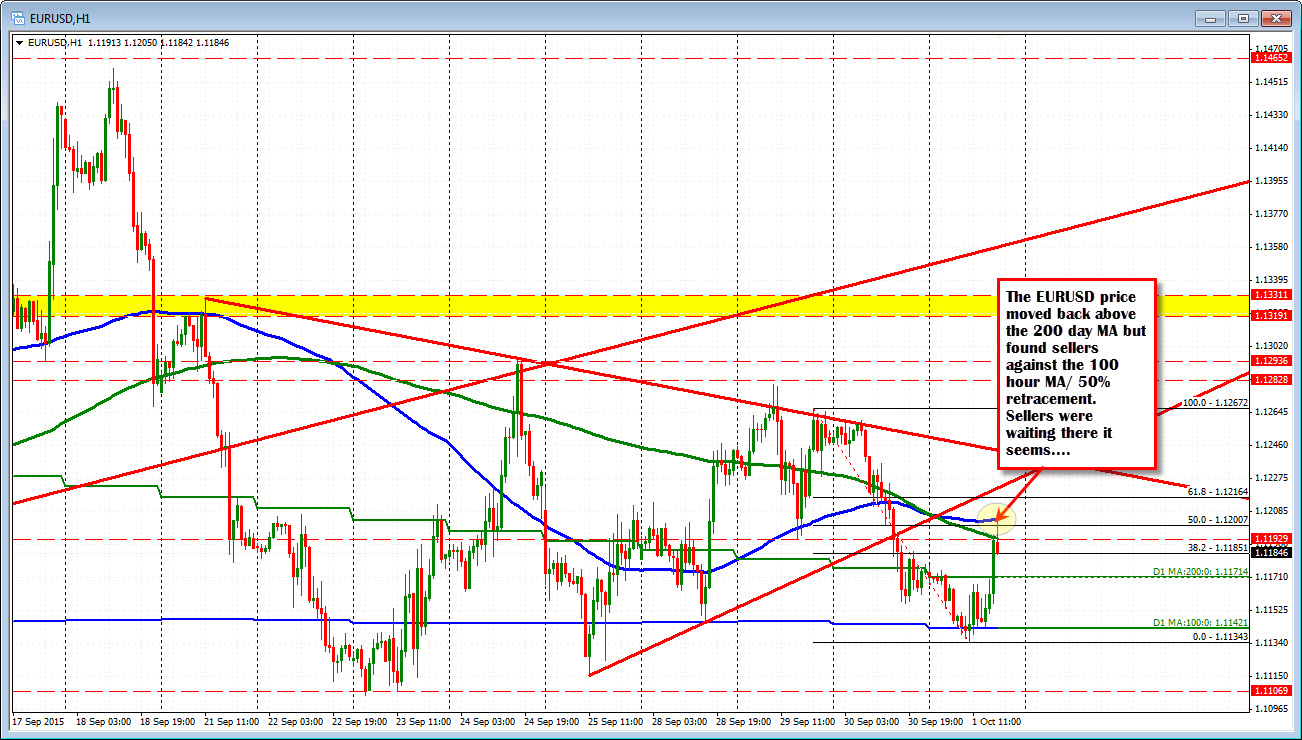

The EURUSD extended to the 100 hour MA resistance target at 1.1203 after the ISM data and found sellers (see prior post). The regional indices were already showing weakness. So it seems that the market was waiting for the weak number and rally to sell into it.

The price has now rotated back below the 200 hour MA now at 1.1194 and I would think that sellers would keep a lid on it by using the 1.1200/03 area as the ceiling/risk as traders position for the the NFP payroll report tomorrow.

On the downside now, the 200 day MA does not disappear of course. This level was broken on the way up today. It - along with the 100 day MA at the 1.1142 level - will need to be broken and stay broken if the downside momentum is to continue going forward. Let's face it, the market had a shot to sell below the 100 day MA today and they did not exactly take advantage of that break. So the market is still sitting on a fence. It might not be totally decided until 8:30 AM tomorrow when US employment is released.

What we do know is at the very least, the key levels are certainly lining up.