Monday hangover...

As the GBPUSD heads lower on the focus heading back to the BREXIT polls, the EURUSD has moved down in some sympathy with it's neighbor. However, the EURGBP is gapping higher as well. So be cautious as traders get their feet under them after the EURUSD sharp rise after the weak US employment report on Friday. Remember FOMC Chair Yellen will be speaking during the NY session (12:30 PM ET/1630 GMT). The market will be all ears. My guess is she talks about the risks of forcing things (with Brexit and the weaker employment report) but tries to keep doors open at the same time.

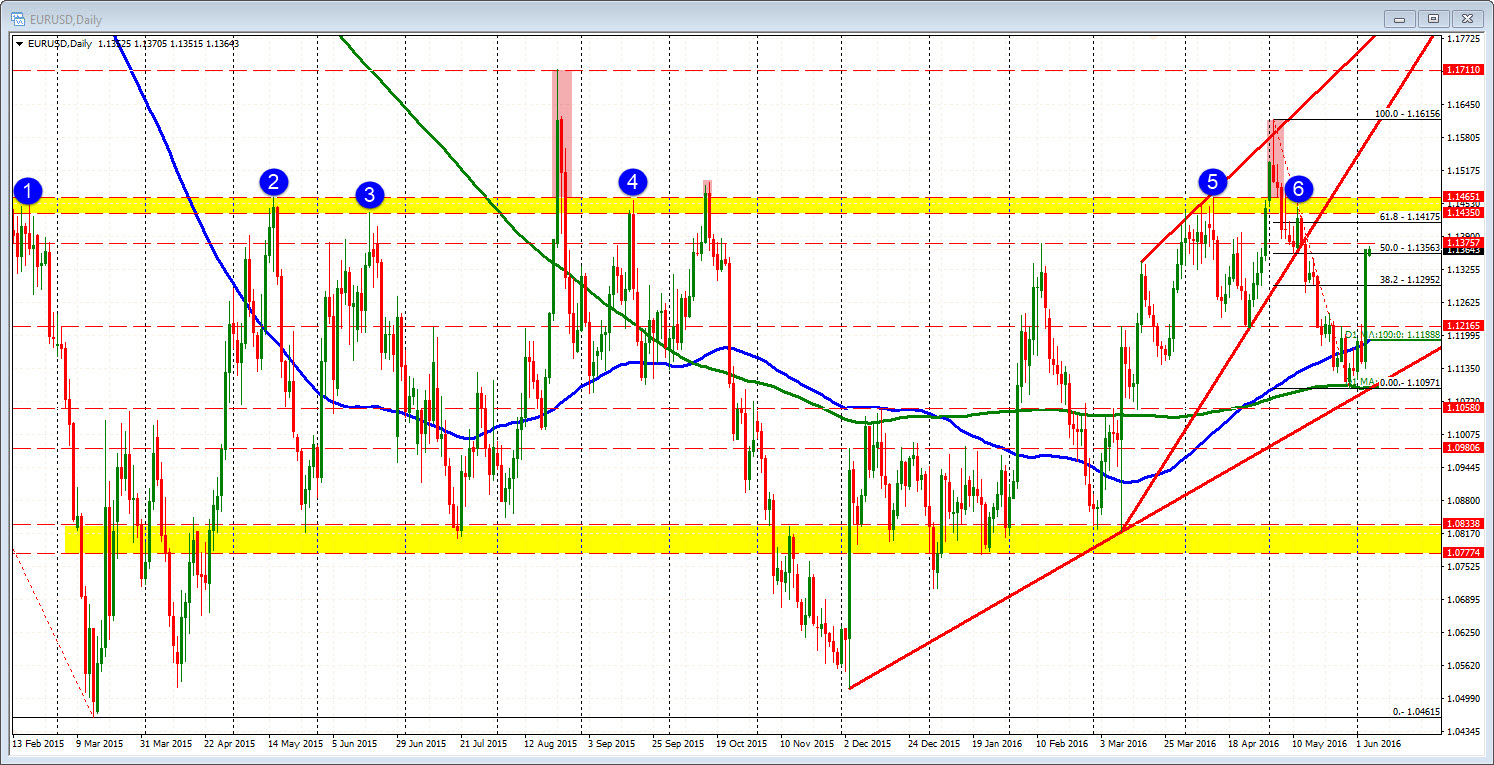

Technically, the price has traded above and below the 50% retracement of the move down from the May 3rd high to the May 30 low. That level comes in at 1.1356. The low today so far has gotten down to 1.1351. The swing high price from May 17th was 1.1347. That area (down to 1.1347) is close support for traders looking to buy an early dip in the week.

A move below can wander down to the 1.1295-1.1300 level with a Monday hangover trade. So it is not the end of the world should the price move below (1.1347) but let's just say, the longs and buyers feel pretty good above it.

On the topside, given further upside will look toward 1.13757 (swing high from Feb 11). Above that 1.1417 (61.8%). From there, the 1.1435 to 1.1465 levels will be targets. There were a number of swing highs going back to mid Feb that stalled and rotated lower in this key upside area (see chart below). There have only been 6 closes above that area. There have been 6 tests that stalled in the area, followed by good moves lower. That area - if tested - should be a key technical level this week.