Up and down day. Range is narrow.

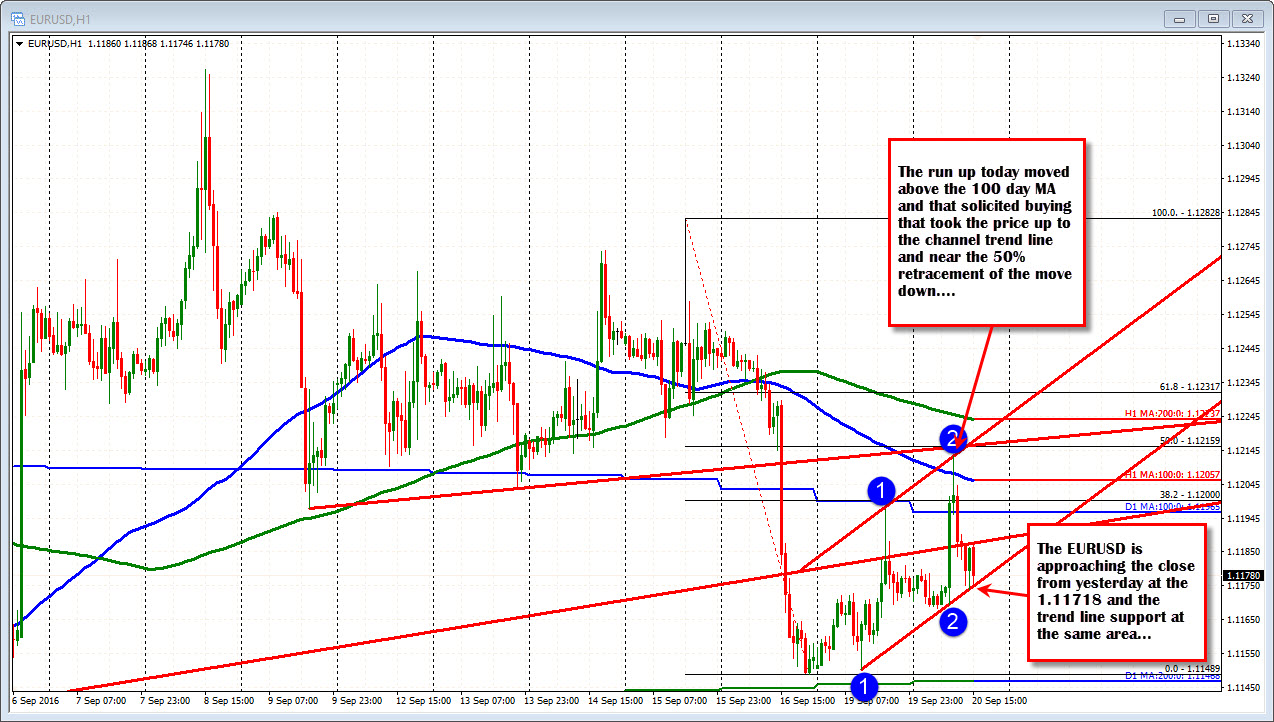

The EURUSD has had an up and down move today - albeit in a narrow trading range. The close yesterday came in at 1.11718. The low has come down to the 1.11738. The price is also moving down to trend line support at that area. There is some hesitation at the level. It is a risk defining level. A move below opens up the selling.

What increases the bearishness technically - at least in a vacuum - is what happened above. The highs for the day extended above the 100 day MA (today at 1.11965), and that break took the price to the topside channel trend line and the 50% of the move down from the September 15 high to the low at the 1.1213 and 1.12159 respectively. Sellers showed up against that area and when the price pushed back below the 100 day MA, the "How strong are the sellers?" is another story.

The strength of the selling is always hard to quantify, but realistically, with the Fed up tomorrow, it is hard to see too much selling (or buying for that matter). If there is a break, look for the bell to ring and the buyers to lean against the low and if that is broken, look for the 200 day MA at 1.11489 to find support.

Yesterday, I spoke of traders trading. Well of course traders trade but what it means to me is that there is more of a balance in this pair. I don't think traders have too big of an ax to grind. So look for those clues at the extremes. If you like a level - like at this trend line - your risk is defined and limited. If you want to be more patient (and not short from above), wait. I expect the market to tread water. It can go up and down. Traders can trade, but It should remain contained.