Trades below the 1.0500 level but seeing a bounce

The EURUSD has moved to new session lows in early NY trading. That move has taken the price to a low of 1.0493 but we are seeing a rebound back up toward the 1.0510 level.

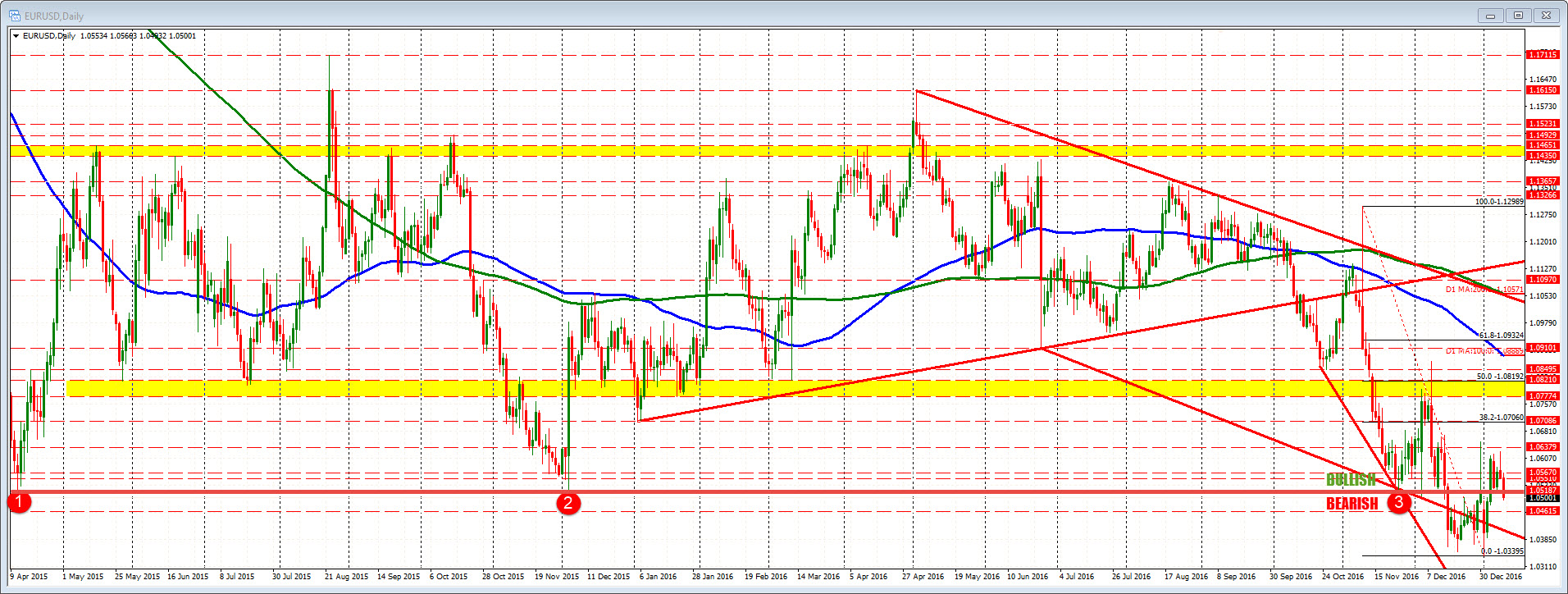

Nevertheless, in the process the pair has moved below the 1.0518-21 area. Swing lows from April 2015, Dec 2015, November 2016 came in at those levels, making it a level of importance for traders.

Since mid December, the price has been above and below that area with most of the 2nd half of December trading below. The last 4 trading days have seen activity back above - until right now that is. The bears/sellers are making another play to the downside. Stay below is more bearish. Move above is more bullish.

Looking at the hourly chart, the price moved back below the 200 hour MA AND the 38.2% retracement at the 1.0517/184 levels (respectively). Needless to say, that increases that areas importance. If the Daily and hourly charts are in sync with a level, traders like to use the level as a risk defining level. Once again....stay below is more bearish. Move back above and the sellers become uneasy and we should see a move back higher as sellers cover/buyers return.

The next lower targets comes in at

- The 50% retracement (see chart below) at 1.0483.

- The 100 bar MA n the 4 hour chart comes in at 1.0475,

- Also remember the 1.0462 level which was the low price of 2015 (from March 2015). A move below that level would increase the bearishness for the pair.