Sits in tight range

The EURUSD is off to a slow start this week but is seeing some increased buying interest as NA traders enter.

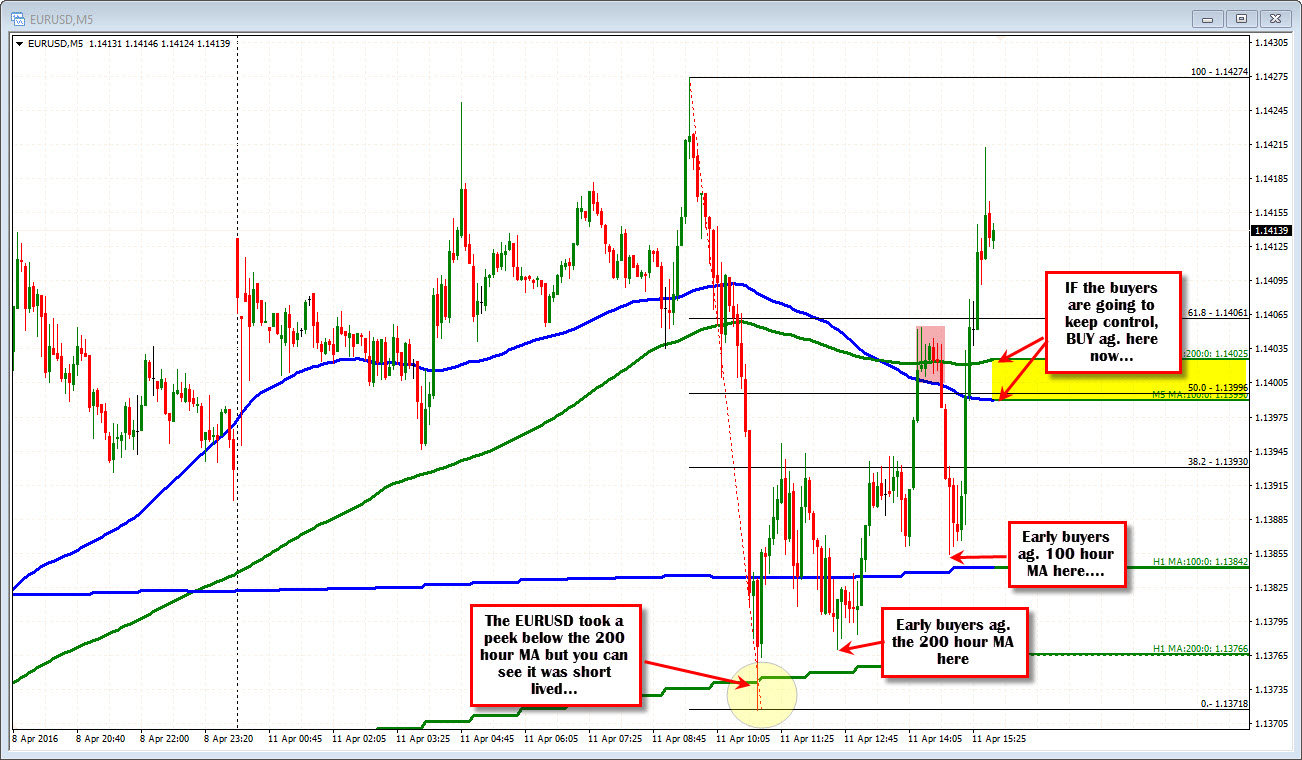

In the London morning session, the pair tested the 200 hour MA (currently at 1.13766 and rising) and found buyers leaning against that MA level. The subsequent rally has taken the price back toward the highs for the day at 1.1425 and 1.1427 (both swing highs on the hourly chart above).

The trading range today is a light 56 pips. The 22 day average is 86 pips. So there is room to roam on a break (higher or lower). The swing highs from last week extended to 1.1431 and 1.1453. On April 1 the EURUSD reached 1.1438. The highs today could not initial test those levels. Will the recent push gather the momentum to get above? The price needs to get above those topside targets and stay above.

If so, looking at the 5 minute chart, the 100 and 200 bar MA area at 1.1399 and 1.1402 is now support. Looking at that chart, gives a view inside the soul of the market today. Yes, the market fell from Asian Pacific highs but the buyers came in against the 200 hour MA and then the 100 hour MA. The 100 and 200 bar MAs (blue and green smooth lines in the chart below have been respected (for the most part). If the recent buying is to hold and keep the upside the way to go, those levels will be risk now. Key time for the EURUSD in the early week. IF the buyers want it, this is test #1. On a move below, waters get muddy. The battle continues between the 100 and 200 hour below and all the swing highs.