Better data all around today

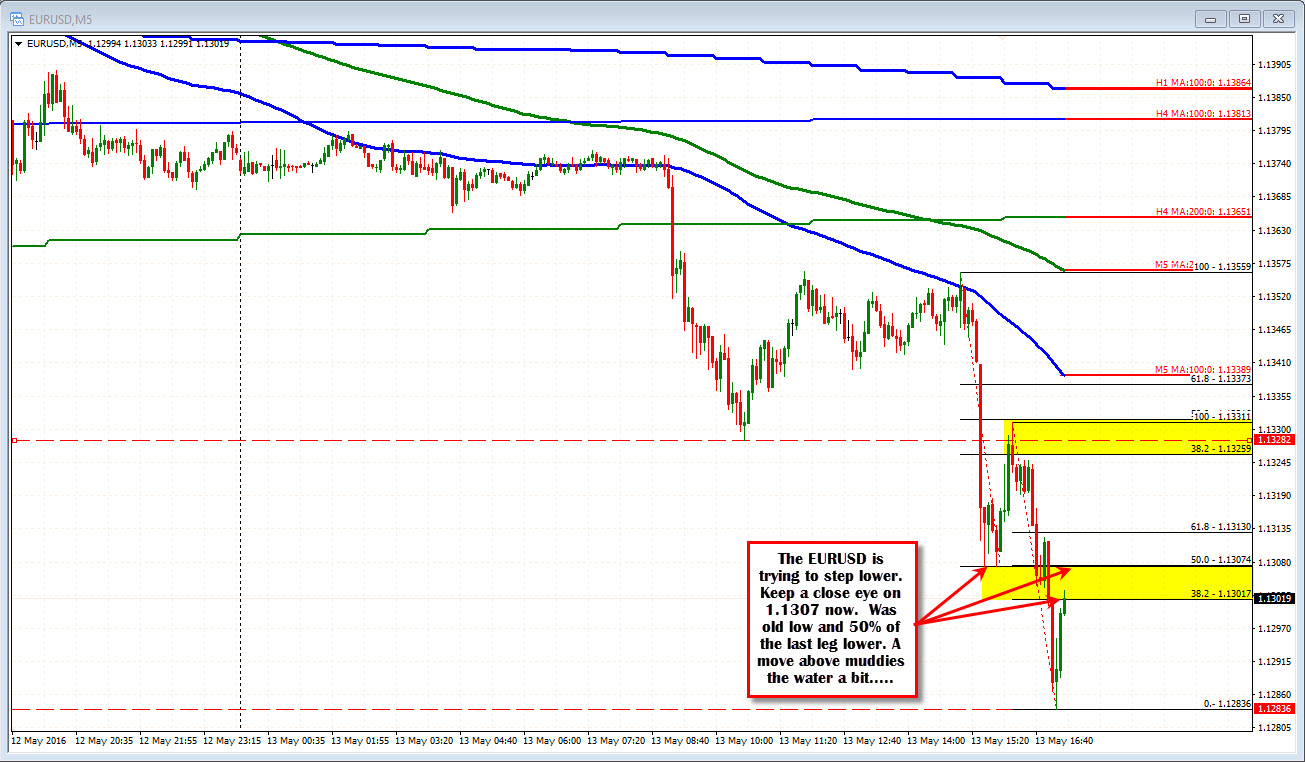

The EURUSD has gotten a second push lower now - falling to new session lows and moving below the 1.1300 level as well. The pair is currently correcting off that low.

The correction off the ORIGINAL low (i.e. after retail sales) extended to the 50% of the last trend move lower and held. The sellers were then able to push to new lows at the 1.1283 level on the better Michigan sentiment.

The 2nd correction (for the NY session) is on as I type, and traders will now eye 1.1307 as a level to lean against if the sellers are to remain in control. That level represents the 50% of the last 50 pip move lower (see chart below) AND the double bottom from the post-retail sales move (see chart above)

This week has had it's share of moves and reversals on disappointment. Today, the price action has seen moves and corrections, but so far the corrections have been able to find sellers at levels that make sense.

A move back above the 1.1307 level is not the end of the world (I know it is only 5 pips away but the 1.1312 level is also an important level for me - 38.2% of the move from the March 2016 low). However, if it can hold, that shows that the sellers remain in control. Given the breaks lower that we are seeing, that says a lot.