For the 2nd day in a row. BUT be on the lookout for a break

That was the headline from yesterday (sans the "Part II"). Yesterday the range from high to low was 45 pips. Today the EURUSD has a 43 pip trading range.

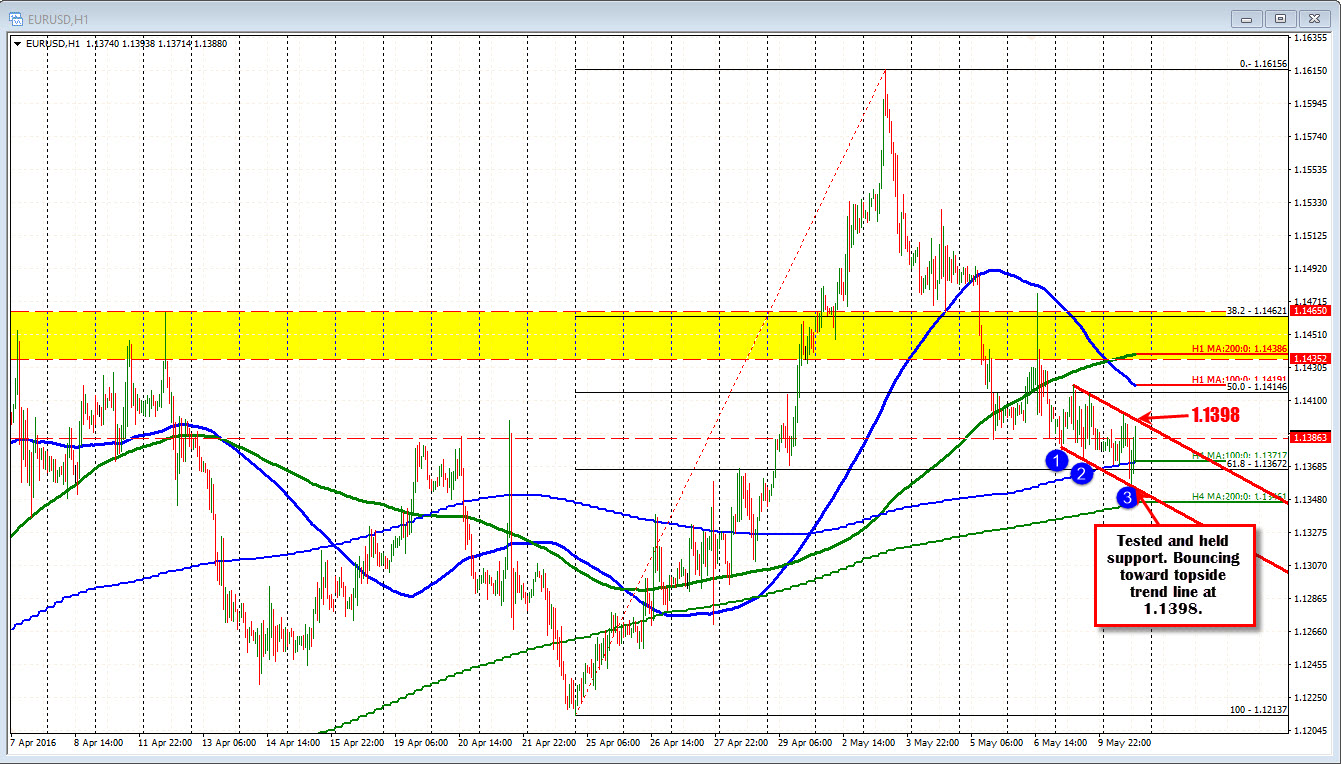

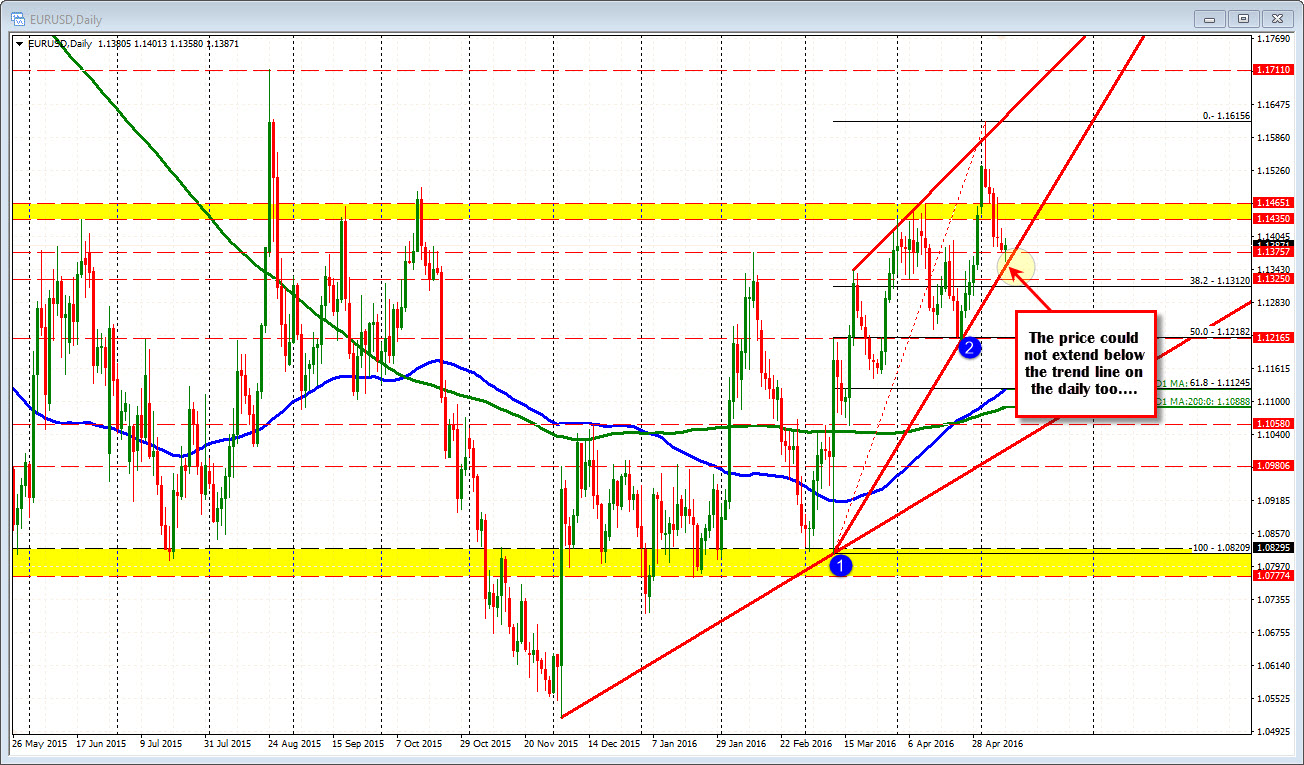

The price did move lower earlier today and tested a trend line support on the hourly chart (see chart above) AND a trend line on the daily chart too (see chart below). Buyers showed a willingness to lean against the dualing trend lines (perhaps with stops on a break - why not).

I don't expect the pair to remain confined forever. As pointed out yesterday the 1.1435-65 area has a special place in my technical heart. Since Feb 2015, the price of the EURUSD has only closed 6 days above that area. It is an extreme that cannot hold a rally on a break above. Before that area comes the 100 hour MA at the 1.1418 currently (blue line in the hourly chart above) and the 200 hour MA is at 1.14386. . So the mine field to the topside is getting crowded with resistance. On the downside with the dual support from the hourly and the daily holding today, the buyers showed what they are willing to do with defined and limited risk.

How do you feel? Do you have a strong conviction fundamentally? Do you sell a rally (more patient sellers will likely wait for the 1.1420 -35 area)? Or buy (more patient buyers can wait for those trend lines again) with the the eye on breaking and staying above the 1.1435-65 at some point?