There are no shortage of opinions

The EURUSD has corrected from the surge higher yesterday that saw the pair move up by about 1.6% despite rate falls and more QE from the ECB. Stocks are doing well in Europe today. The S&P futures in the US are up about 18 points in the US.

The pairs correction has taken the price back below the 1.1100 level. Is it correct? It makes sense fundamentally. Now, yesterday was not an aberration. It did in fact trade 5 different handles. It also had some bullish technical clues kick in (after there were first signs of more bearishness). That, along with some fundamental news (from ECB and the US with employment claims) got traders offsides and scrambling. However, it did not fit the fundamental picture exactly right. I believe, however, that the fundamental story does not define risk. The technical price action will do that and the price action reflected that yesterday.

So what about the correction today. Where do we stand technicallly?

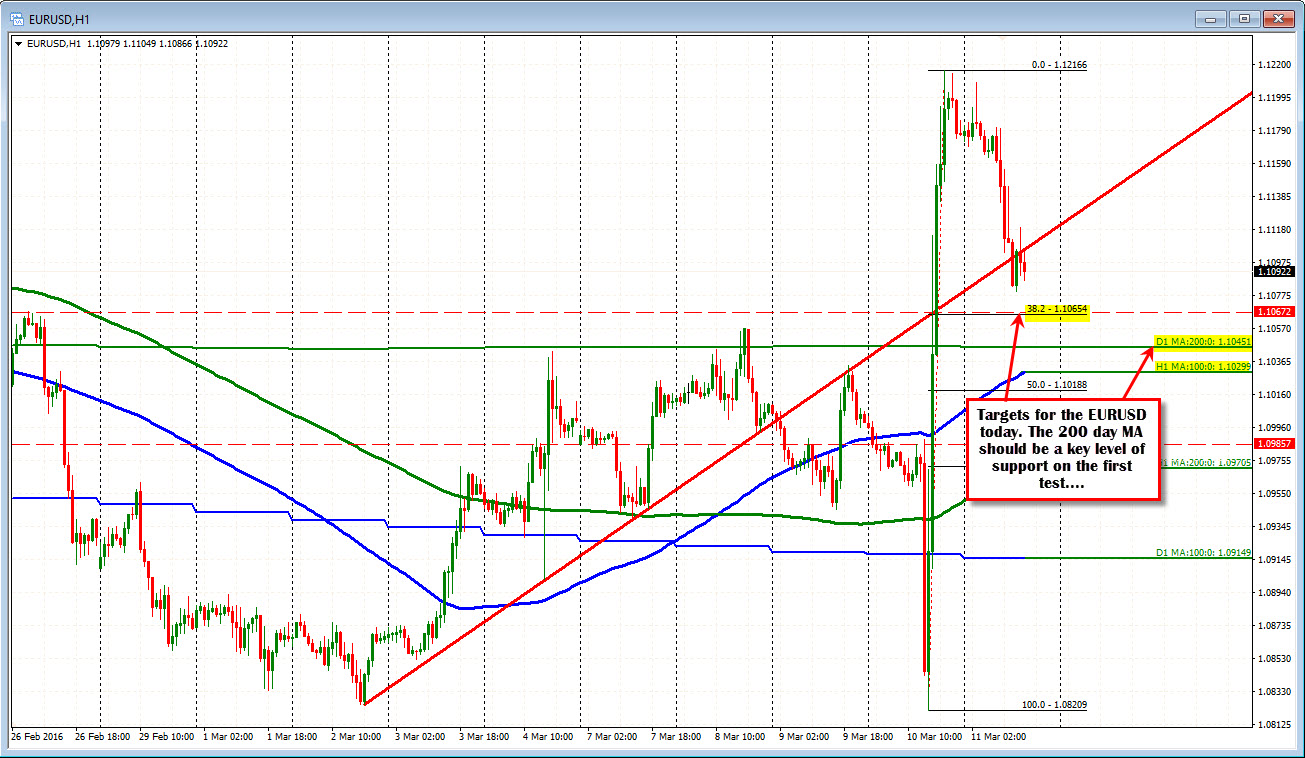

The low reached 1.1079. From what I can see there is nothing all that special about that level on EURUSD chart. Better support comes in at the 38.2% at 1.1065 level. The key 200 day MA comes in at 1.10452 and 100 hour MA comes in at 1.1030 (see hourly chart above) We could push toward those levels - although I would expect strong support against the 200 day MA on the first test so be aware. In addition, we may also need a little help from a cousin currency pair.

That help may have to come from the EURGBP chart. Looking at it (see below), the 100 and 200 hour along with the 50% retracement all combined to form a pretty strong support level at the 0.7750 area (give or take a pip or two). That seems to be strong enough support to have an impact on the EURUSD too and the decline has slowed. If that support area can be broken, it should help the downside for the EURUSD. It is a good support level though.

Where is risk for the EURUSD?

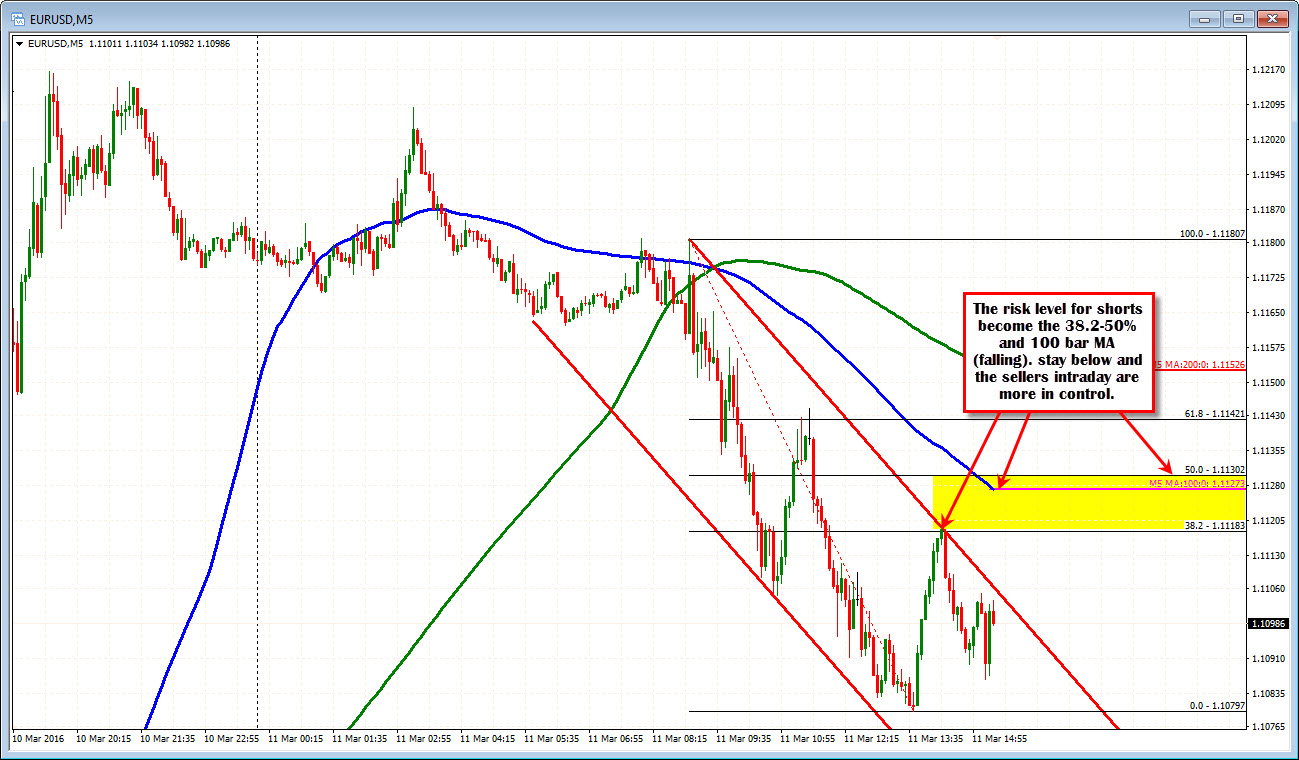

Look for the 1.1118-30 to provide upside resistance (see 5-minute chart below). IT represents the 38.2-50% of what was the trend leg lower today. ALso the 100 bar MA is in that area.

It is Friday. US import price index and Canada employment are on tap. Then traders will ease into the weekend. Remember Friday's can be tricky as positions are squared before the weekend risk period. So flows can dominate.