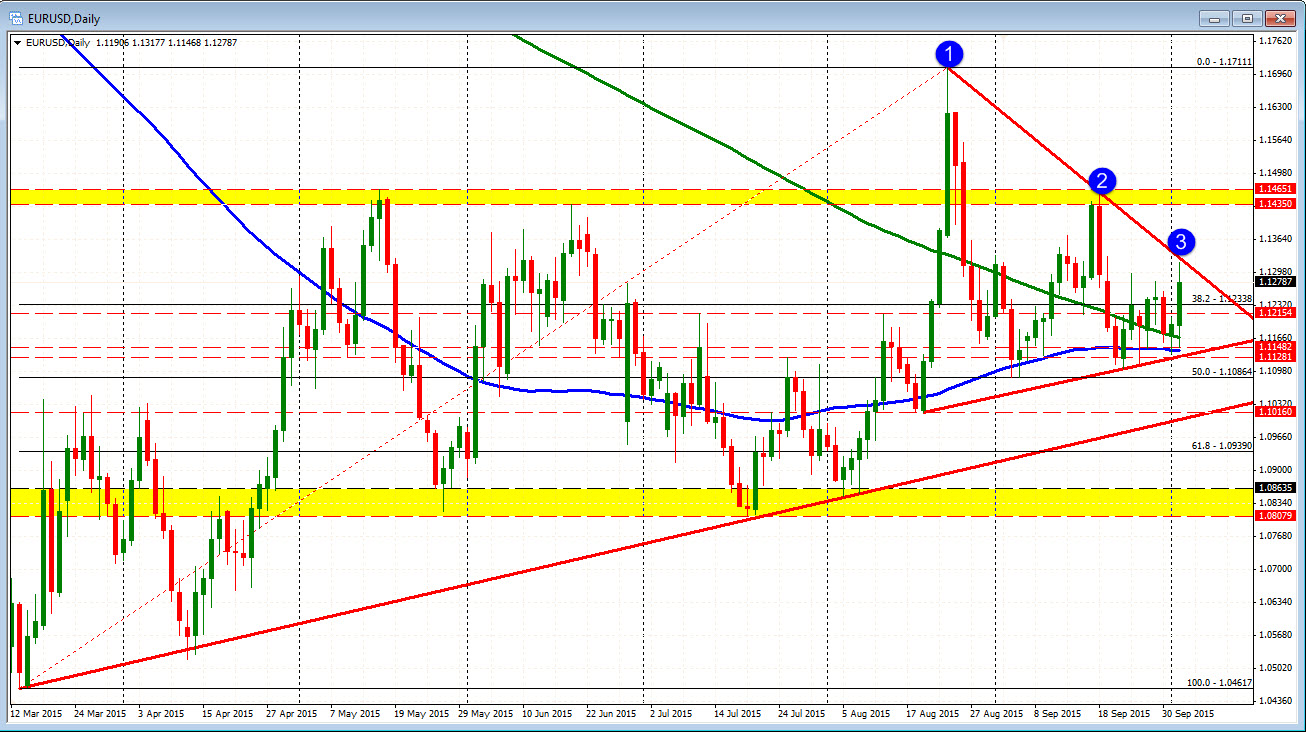

Midpoint of move down from September high at 1.1281

The EURUSD has been down here on 4 separate occasions. The 1st move held but the rebound was modest. That led to a look below the level on the 2nd test, but that break failed (it was still early). The 3rd look bounced and a new high was made. This is the 4th look. Will the buyers keep the bid?

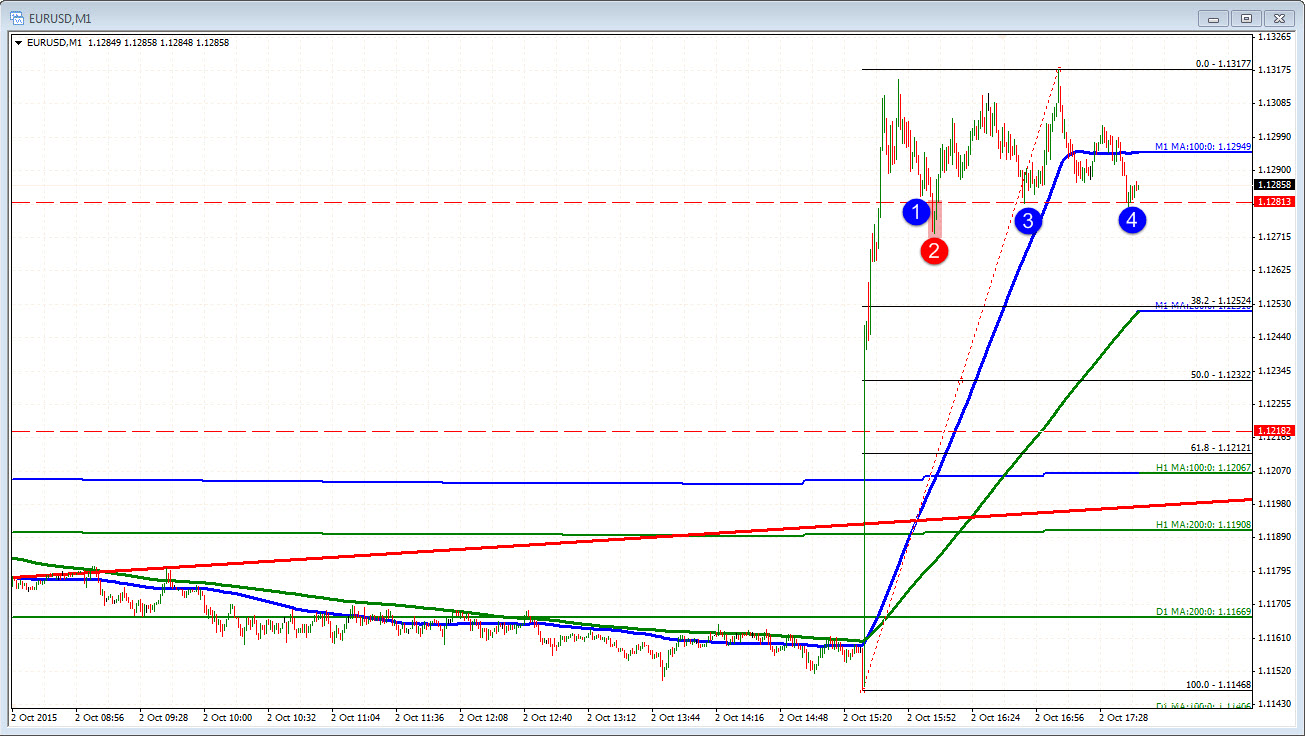

The analysts are coming out with visions of Dec rate "liftoff". Goldmans Jan Hatzius was on CNBC saying he is sticking with a Dec liftoff in a close call. Others point out there are two more employment reports until the December meeting. The Fed will try to swerve around the weakness (what choice do they have - they are painted in the corner). This is helping to contribute to the corrective move as focus shifts. A move below could see a look toward the 1.1252 level. This is the 38.2% of the move up today.

Also contributing technically, is the inability to get above the topside trend line on the daily chart.

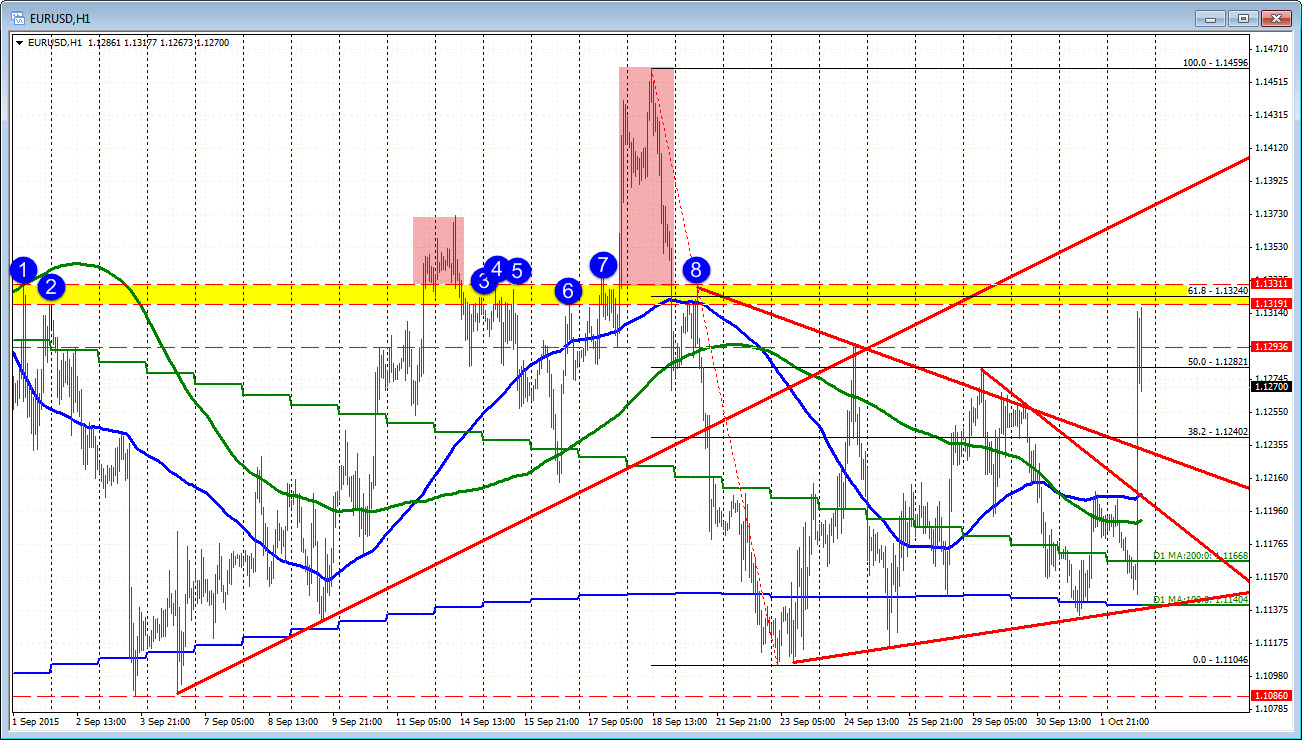

On the hourly chart, the resistance area held the line. This was the last target I had for the pair in the pre-market report of tech levels CLICK HERE.

PS the pair has moved below the 1.1281 level and traded down to 1.1267. London/Europe looking to get outta here in the next hour or so.