Cracks lower

The EURGBP is the new dog for the day, falling by 1.14% as London traders exit for the day and shut their books on the quarter end as well.

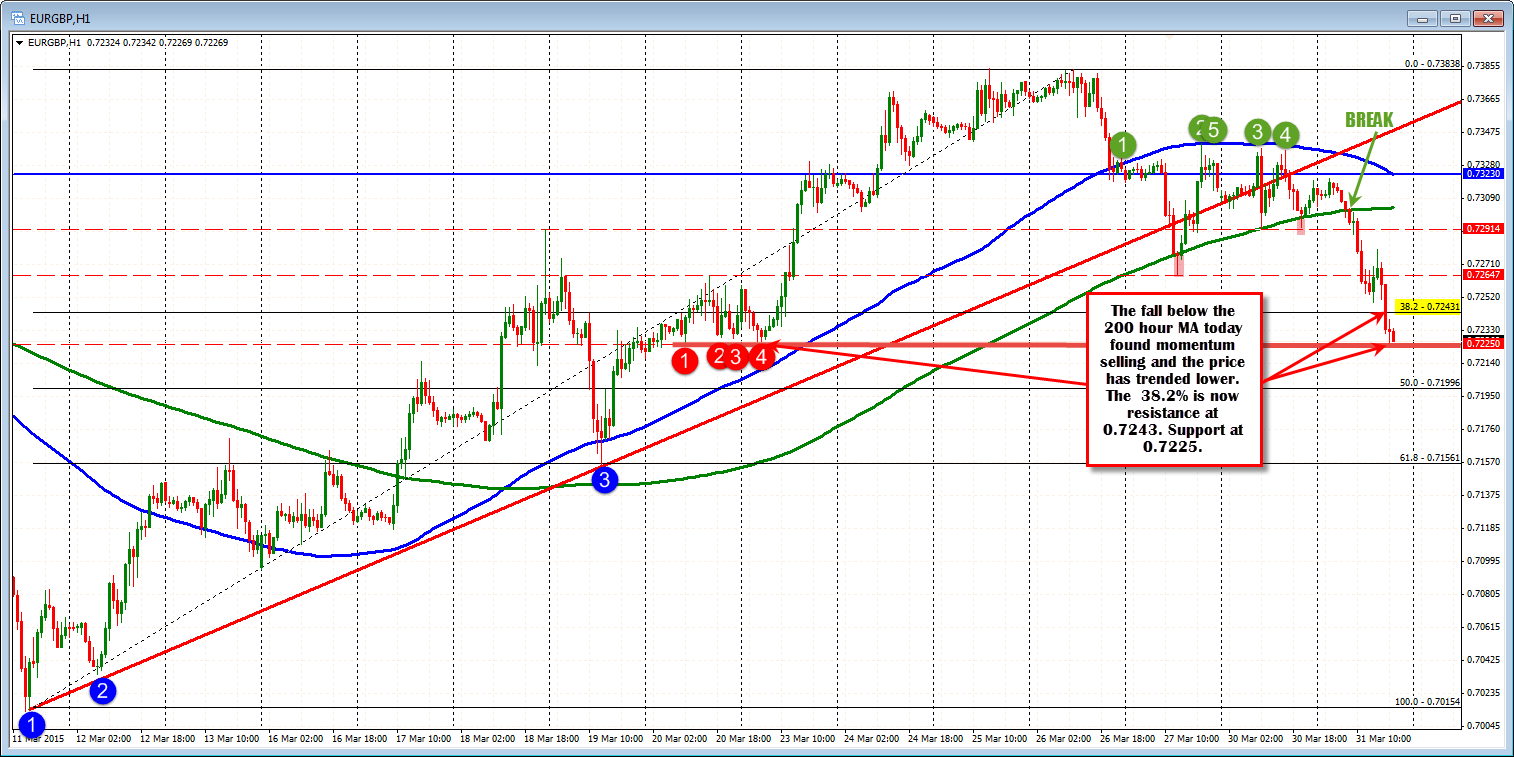

The selling today has taken the price away from the 38.2% retracement on the daily chart (see chart at 0.72923) and through trend line support as well (see daily chart above). The break and subsequent momentum has turned the bias back to the downside (bearish) for the pair.

Looking at the hourly chart, there has been a turn to the bearish side as well from a technical perspective. The price today fell below the 200 hour MA (green line in the chart below) after trying to break but failing over the last couple days of trading . The fall today, finally found the push and the momentum selling, and that has taken the price below the 0.72647 low from Friday, and the 38.2% of the move up from the March 11 low (at 0.7243). This level is now a close risk defining level for sellers.

The pair is currently testing a congestion low at the 0.7225 level. There should be cause for pause at the level as profit takers from shorts above lean against the level to define and limit risk. However, I would also expect stops near the 0.7220 level if the expected support does not hold. So far there are nibbles against the level.

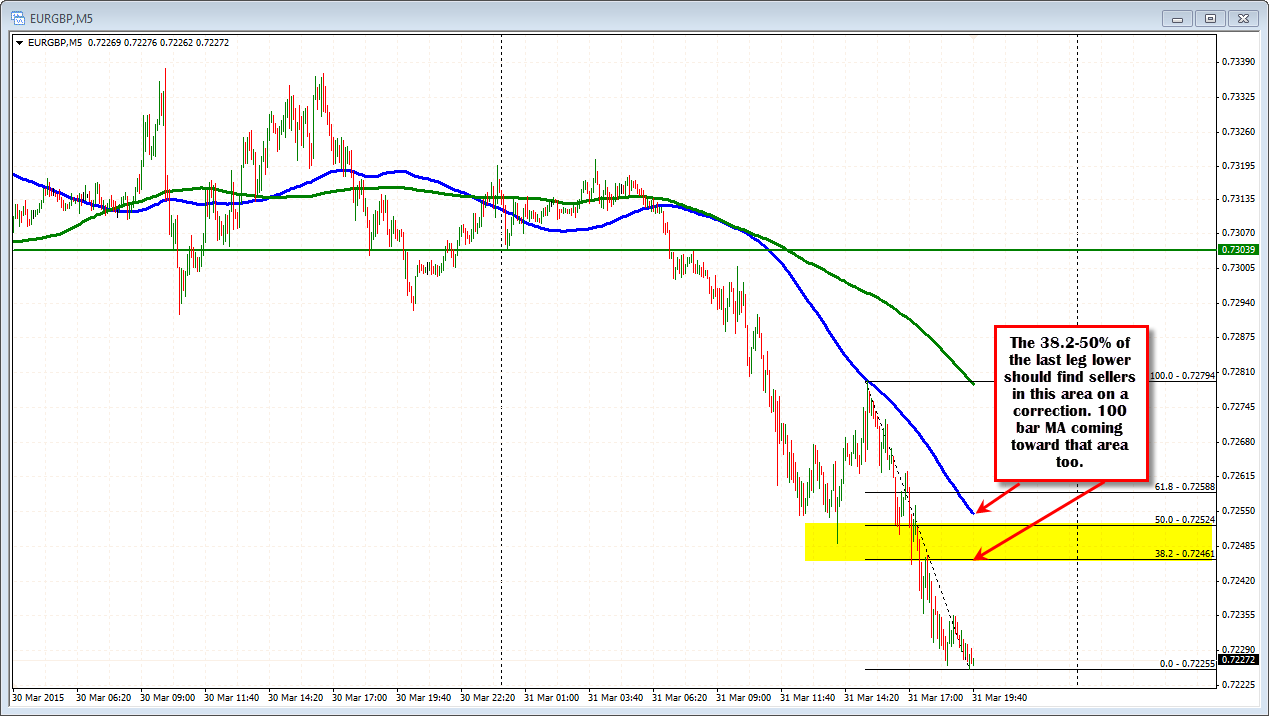

Where can a correction take us? Looking at the 5 minute chart the 38.2%-50% of the last leg lower in the pair comes in at the 0.7246-52 level. We know the 38.2% off the hourly chart at the 0.7243. As a result corrections should find resistance in that area on any rally. Staying below keeps the sellers firmly in control and the buyers nervous for further declines.

Fundamentally, the BOE may not tighten soon, but it is unlikely that they ease conditions further. As a result, the fundamentals support a bearish bias. Technically, the charts are more in synch with today's action.