EURUSD buyers stronger than GBPUSD buyers

The EURUSD and the GBPUSD are both moving higher on the back of the bad day in the US, but the market traders like the EURUSD more. Why? A little thing called Brexit vote will likely put a lid on the GBPUSD.

In fact, the pair made it to the 200 hour MA and is now seeing a pretty good move off the high in that pair (See the chart above). In fact the price has moved back below the 38.2-50% of the move higher. So the waters are muddy (can go either way). The buyers and sellers are more balanced. Support in the GBPUSD now comes in at 1.4497 (100 hour MA).

The EURUSD is off the highs but remains elevated.

The net result is a move higher in the EURGBP.

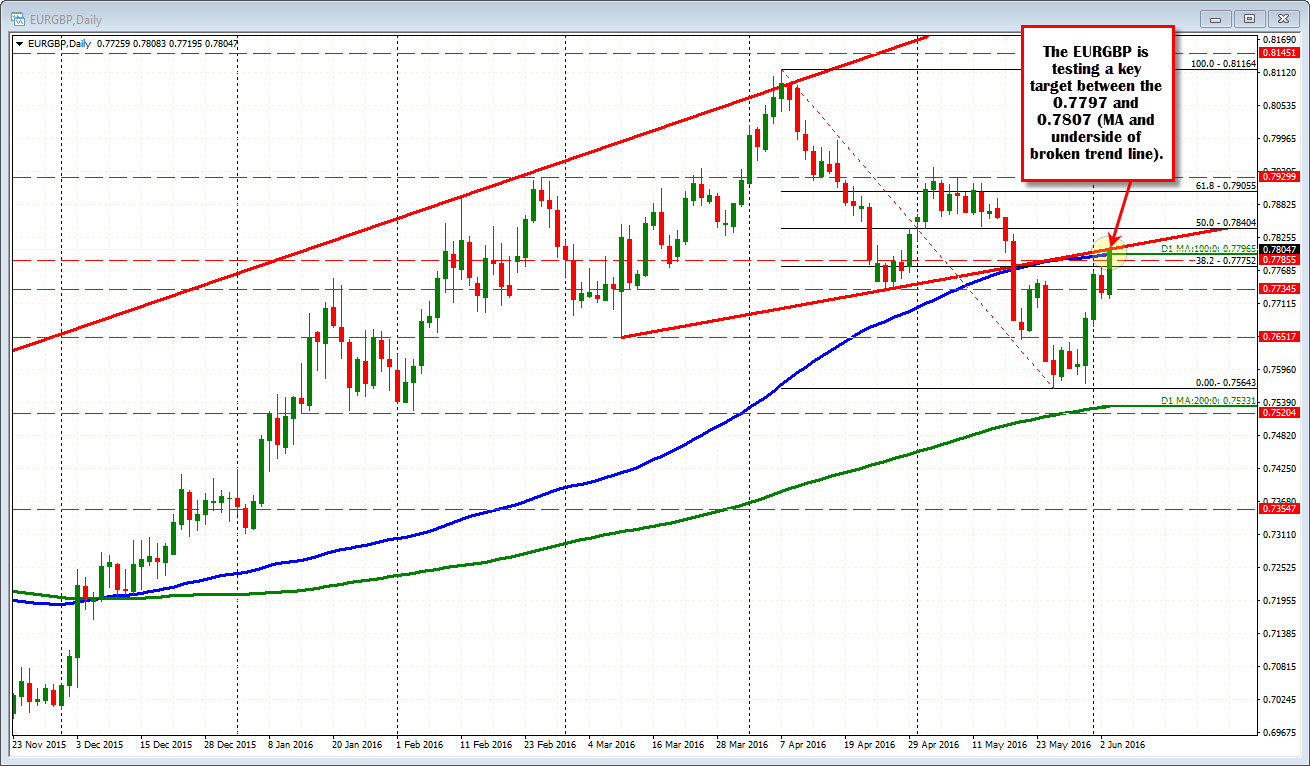

Looking at that pair, the price is testing the next key upside target. That comes in against the 100 day MA and the underside of the broken trend line. Recall a few weeks ago, the price fell below this trend line - it was actually a neck line for a head and shoulders formation. The breaking sent the pair lower.

The move higher today has the pair testing that ceiling and traders are leaning with likely stops above. The trend line comes in at 0.7807. The 100 day MA is at 0.7797. The price is above the 100 day MA, but below the trend line. Key test. A break would next target 0.7840 (50%).