Don't toss in the towel - Deutsche Bank says

In a strategy note, Deutsche Bank advises clients to buy current USD/JPY dips arguing that it's too early to turn bearish on the pair as Japanese dip-buying and BoJ alertness should support USD/JPY around 118 though offer limited upside.

The following are the main points in DB's rationale behind this call along with its target for this long USD/JPY trade.

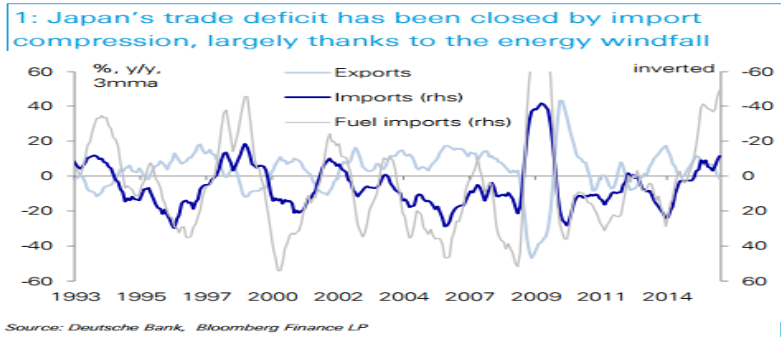

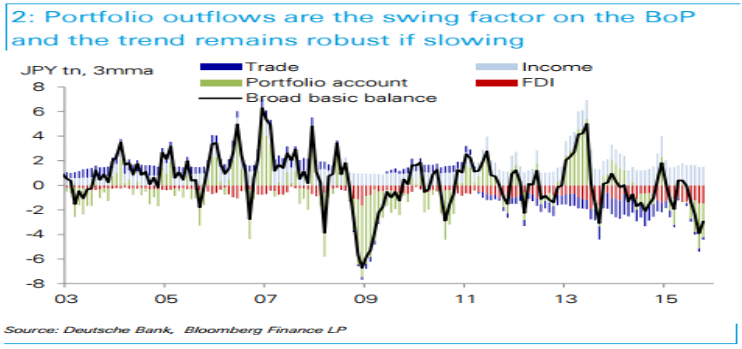

1- Japan's current account: "The force awakens not Japan's balance of payments continues to support USD/JPY and has not turned bearish. On the trade side, although the trade deficit has shrunk to close to zero, this is largely because falling energy import prices have offset the export drag from stuttering growth and depreciation in developing Asia. As oil prices approach rock-bottom, the windfall should peter out, while export headwinds from Asia persist. On the hedging side, the recent widening of the cross-currency basis acts as a new deterrent to currency hedging which corporates have been foregoing over the last year even in the face of a stalling USD/JPY uptrend. Even without a contribution from trade, the current account posts a comfortable surplus thanks to vast investment income. Yet the entire current account surplus is used up by net FDI abroad. Indeed, retained earnings comprise a large chunk of both the current account surplus and FDI outflows. These are offsetting accounting entries rather than cross-border flows, and their sheer size stabilizes the CA/FDI ratio. For now, Japanese corporates enjoy the earnings power to keep investing. Hence, FDI flows will give little impetus to the yen in either direction," DB argues.

2- GPIF: The empire can strike back. "Portfolio flows therefore are the potential swing factor on Japan's BoP. Although monthly volatility has picked up, the quarterly trend of large net outflows is intact. Dollar demand from the GPIF and other institutional investors is less consistent and price-sensitive than in the halcyon days of the re-allocation trade. The GPIF is soon to reach its benchmark allocations to foreign assets, completing the mechanical rotation. Nonetheless, it retains some firepower, and the discretionary bands around the benchmarks allow for tactical trading. Other institutional investors also continue to buy dips in the cross, and retail demand through toshins has become more than secondary force. The contrarian tactic of Japanese investors also means, however, that they tend to take profit on squeezes. This underpins our view that USD/JPY will stay range-bound over the next four months, though short-term volatility could remain high. Japanese investors continue to buy USD assets at the expense of other currencies, especially in fixed income. Hedging ratios remain low. One reason is the widening basis. Indeed the flipside is that foreigners have liked synthetic exposure to JGBs funded in yen. These inflows have at times offset Japanese portfolio outflows on the BoP but are in fact FX-neutral," DB adds.

3- BoJ: The phantom menace. "The BoJ is likely to be more sensitive to an appreciating yen than to other deflationary developments such as falling energy prices. This is consistent with the focus of Abenomics shifting from an unconditional inflation target to (also) a nominal growth target: a stronger yen is harmful in reaching either target, whereas falling energy prices are negative for inflation only. Luckily for the BoJ, the exchange rate is a less evasive policy target than inflation. True, a bold expansion of QQE would have limited FX follow-through even if it could be done in size, which it probably cannot. The depreciation in the broad yen of autumn 2014 was possible because the BoJ enjoyed the first-mover advantage. Yet even in a sharply competitive global FX space, conventional tools can still be effective in capping appreciation against the dollar. At the very least, Kuroda's capacity for jawboning remains high. Last week's talk of Japan not being out of deflation was perhaps a shot from the hip, but a European-style reconsideration of the zero lower bound or explicit concerns over regional beggaring-thy-neighbour tactics would go a long way toward reinforcing the Abe put. Hence, although the BoJ lacks the firepower to engineer a significantly weaker yen, it probably has adequate tools to defend the 118 level against more than transitory risk-off shocks," DB projects.

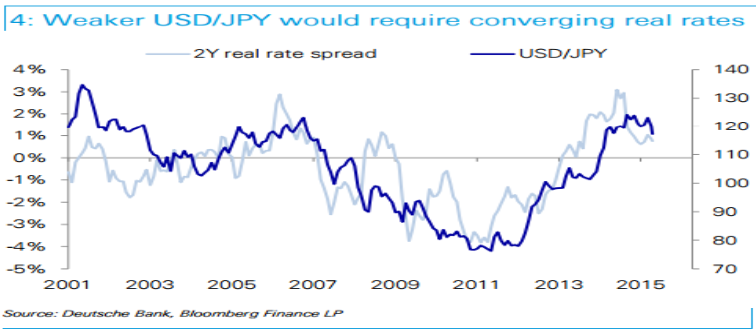

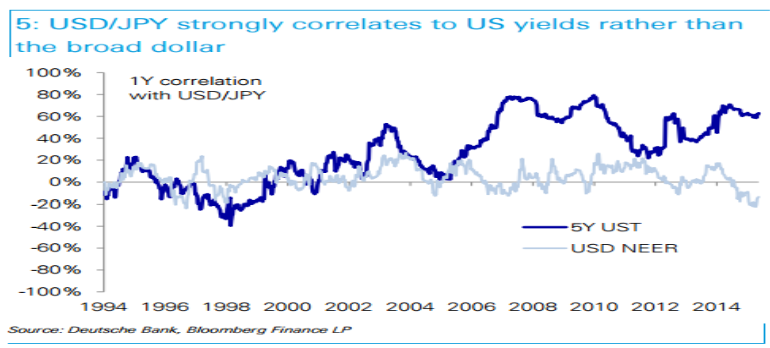

4- Fed: The return of the Jedi. "While Japanese dip-buying and BoJ alertness should put a floor under the cross from the Japanese side, any upside needs to come from the US. Bulls need not rely on a strong broad dollar, with which USD/JPY historically has a tenuous link in the medium-term. The main correlation is with US yields, which are nicely cushioned by two factors. First, market pricing for two Fed hikes is extremely dovish and the risk is for the market to converge with the Fed. The threat to the US economy pertains to growth, whereas the buoyant labour market probably calls for tighter policy than the market prices. Second, although global term premiums have taken a hit as China exports deflation and uncertainty, the PBoC's reserve run-down also acts as an automatic stabilizer to yields. Similarly, the drag on inflation expectations from oil is offset by reserve drawdown in oil-producing economies. The risk to US yields, in our view, is the PBoC capitulating against outflows and allowing CNY to find a new equilibrium quickly. Yet in light of the degree of intervention in December this amounts to an improbably extreme regime break," DB adds.

5- Positioning: The attack of the longs. "Positioning in the yen last week flipped to marginal longs for the first time since October 2012. Threemonth risk reversals are as a result stretched on any measure. Skew aside, we like buying USD/JPY at current levels, viewing it as the lower-end of a 118-126 range for this year," DB notes.

Long USD/JPY target: "Buy USD/JPY but take profit at 125," DB advises.

For trade ideas from banks, check out eFX Plus.