Retail sales and PPI not so hot

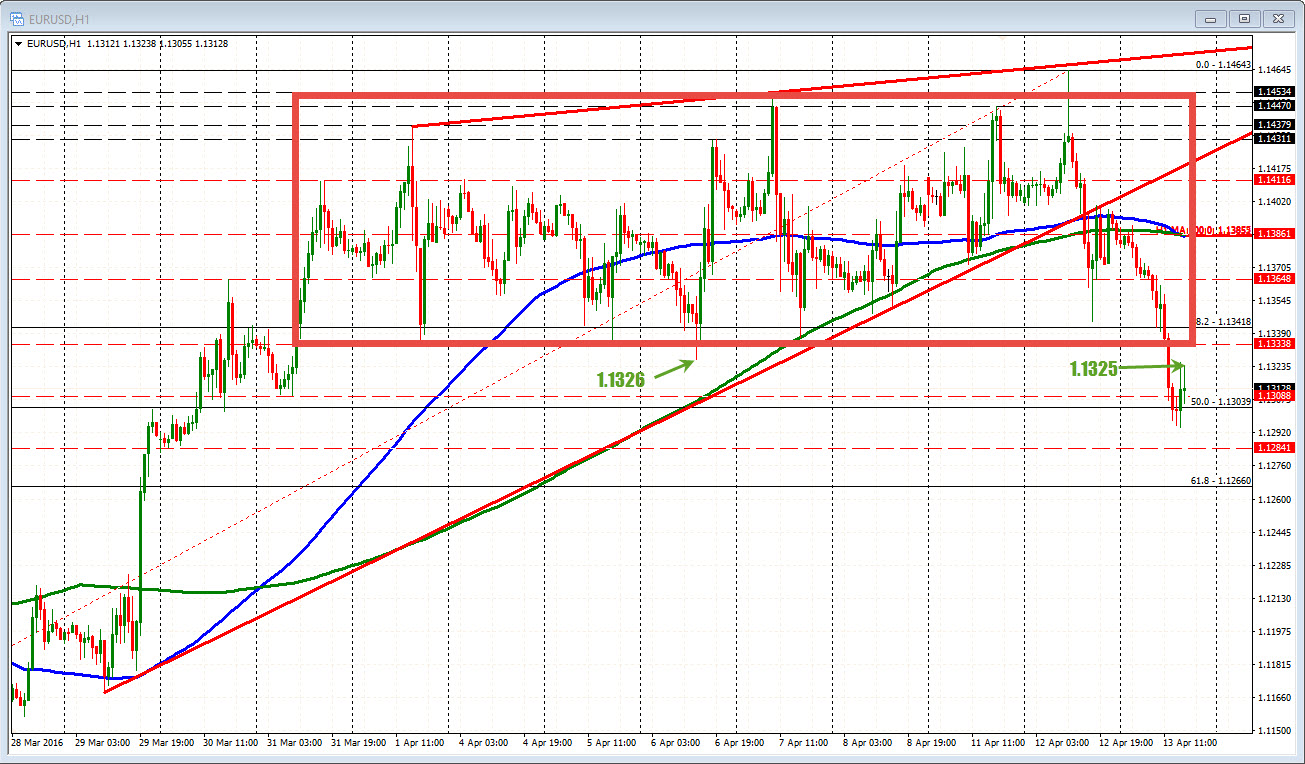

The US data was not so hot today and the fall seen in the EURUSD before the report retraced higher. The low for the day was reached prior to the releases at 1.12945. The high corrective point has come in at 1.1325 so far. The low after the release has dipped to 1.1306.

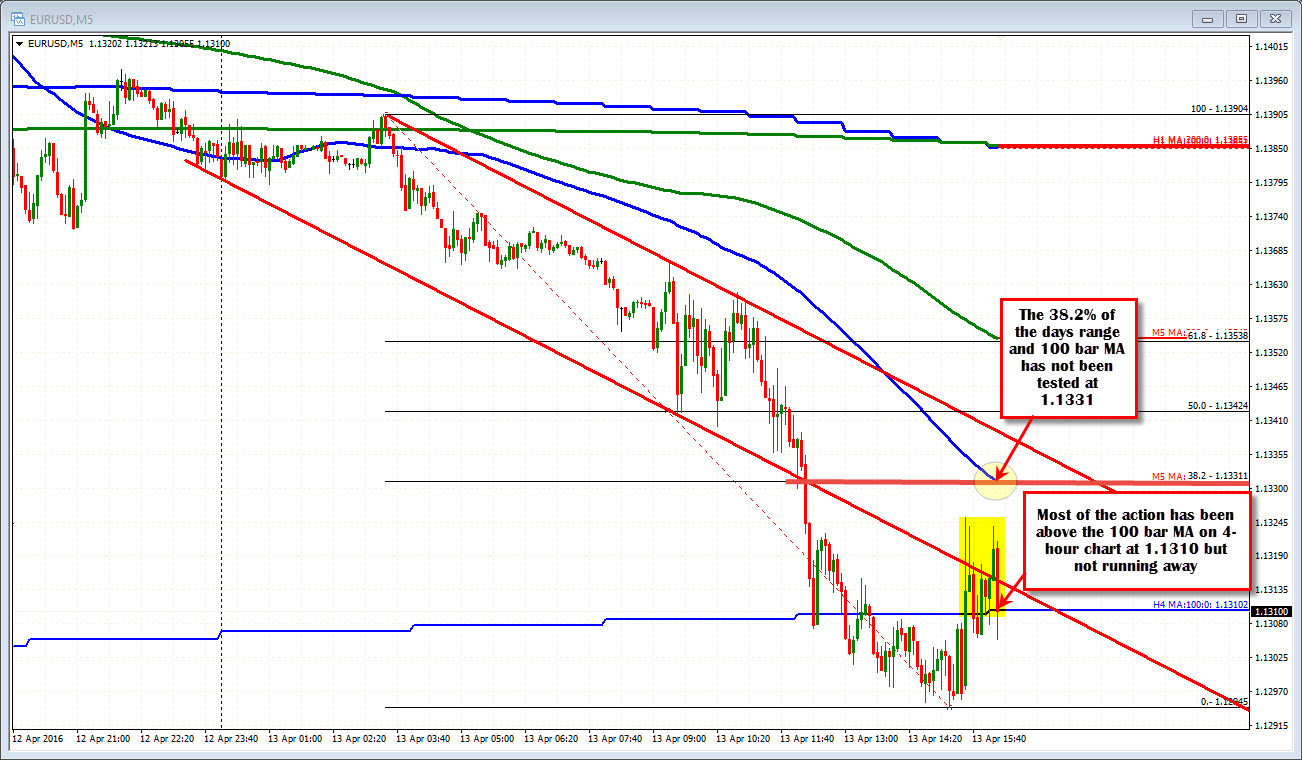

Looking at the 5- minute chart below, the overlay of the 100 bar MA on the 4-hour chart comes in at 1.13102 currently. The price is trading mostly above that level since the reports. That shows some reluctance to move lower. Having said that, the topside correction price has stalled ahead of the 100 bar MA and the 38.2% of the move down today. Both come in at 1.1331.

That is the micro view...

Zooming out, today we finally got out of the 8 day trading range that has confined the pair for the last 9 or so trading days. The pair traded 99.9% of the time between the 1.1453 on the topside to 1.13338 on the downside. There was a move lower on April 6th that took the price to 1.1326. There was a move above the ceiling at 1.1464 just yesterday. The high corrective price since the data today? 1.1325. So traders are trying to keep a lid on the pair (or so it seems). A move back above the 1.1326 and then back into the RED BOX in the chart below will be a disappointment.

So we sit on the edge with buyers on the weaker data hoping the price moves back into the red box, while sellers are looking for a sustained break back below the 100 bar MA on the 4 hour chart at the 1.1310 level.

Any guesses?