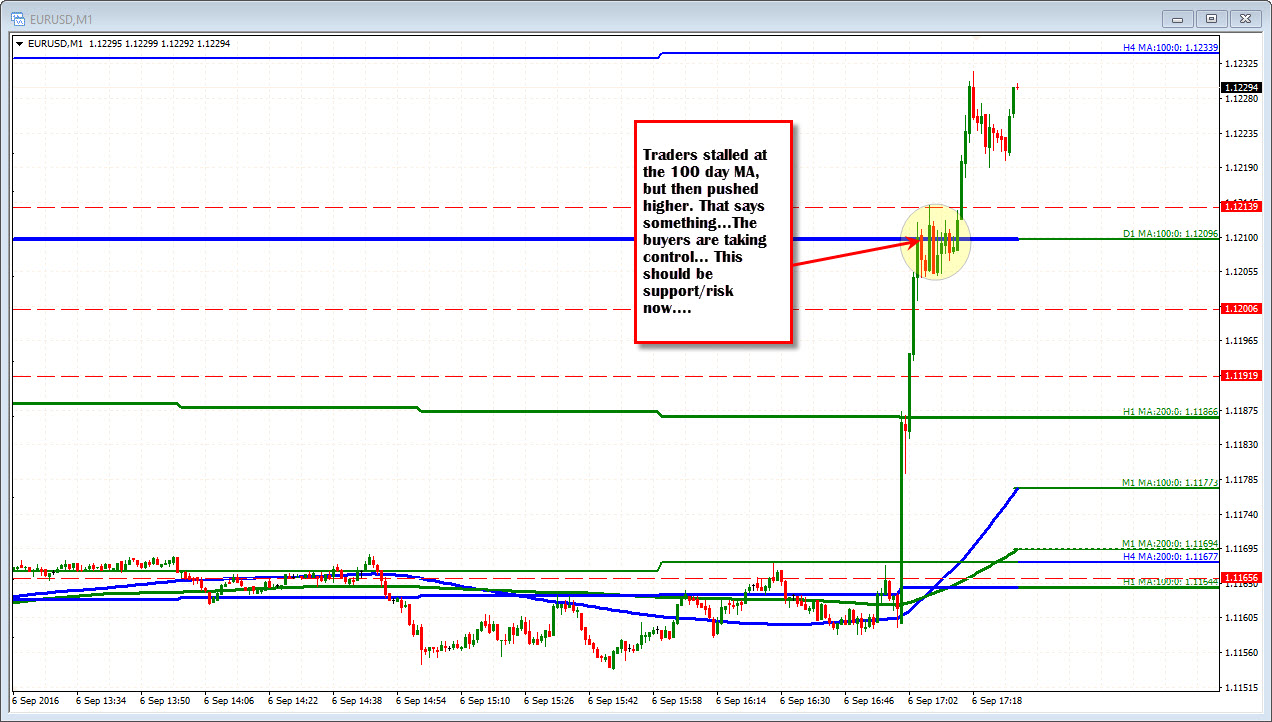

Trades above the 100 day MA

The EURUSD needed a push out of the nest and it got it with the sharp falls in the ISN non manufacturing and the IBD/TIPP Economic optimism indices. The price has raced higher and in the process moved above the 200 hour MA, and now the all important 100 day MA (now a support level for the pair if the buyers are to remain in control).

The range has gone from 29 pips to 91 pips in the process - above the 22-day range of 71 pips.

The next target at the 100 bar MA on the 4-hour chart is being approached at 1.12339. The 50% of the move down from the August high comes in at 1.12439. That area should be a tough nut to crack on the first look (see hourly chart above). There may be some profit taking temptation. However, look for the 100 day MA at 1.12096, to now be a support level for buyers.

Looking at the 1 minute price action the price shot up to this area on the first move higher, traded above and below the MA level for about 10 minutes before surging to the upside.