The euro's soft momentum continues as US data helps June Fed expectations

The euro is the one suffering the most from possible Fed action in June. While the buck wins out there and against the yen we're not seeing the same against pairs like the pound and Aussie.

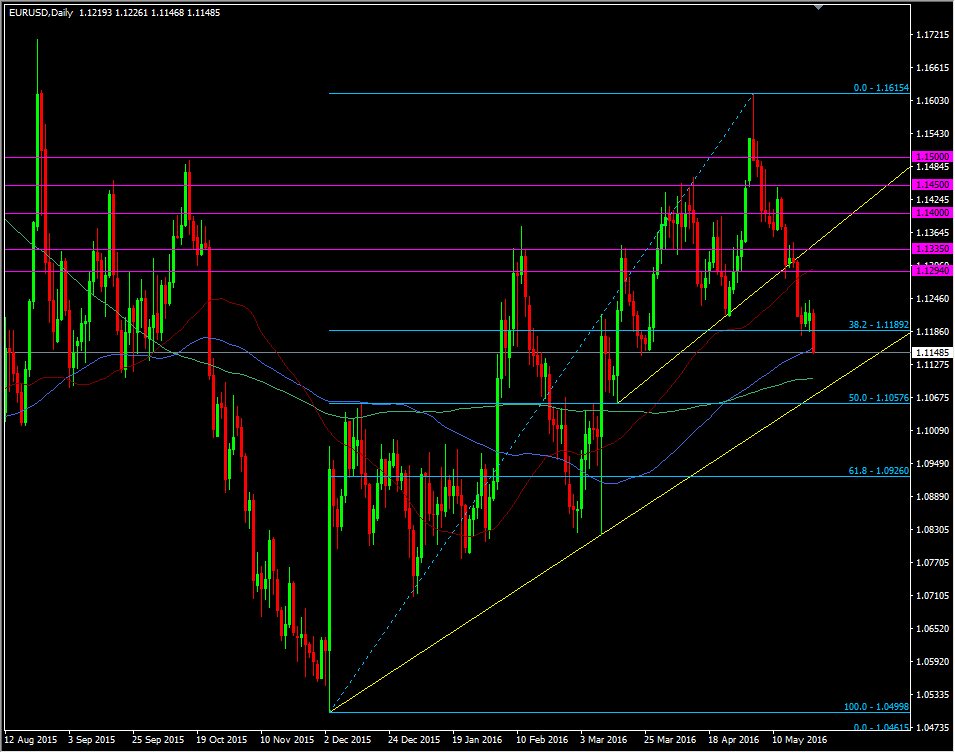

We've nudged down below the 100 dma at 1.1157 and the next target is the 55 wma at 1.1105 and the 200 dma at 1.1102.

EURUSD daily chart

We've still got support based around the March 23/25th lows but the ma's look to be the next strongest levels.

There's enough additional support from the rising trendline at 1.1075 and 50.0 fib of the Dec move up at 1.1058 to give technical traders some decent levels to trade from. I'm going to be watching the area for a long myself and with a view to enter around 1.11110/15.

Should we break the 50.0 fib and the trendline, that would be a strong signal that the upward move this year is possibly over. I think the only time to then fight that would be after the June FOMC and if the Fed hike, when the dust has settled. I still don't believe that the Fed hiking is a reason to see any sustained or massive USD moves.