EUR/USD gets a lift after weak durable goods orders

The durable goods orders report whipsawed the market. The strong headline was a mirage because all the key internal metrics were soft.

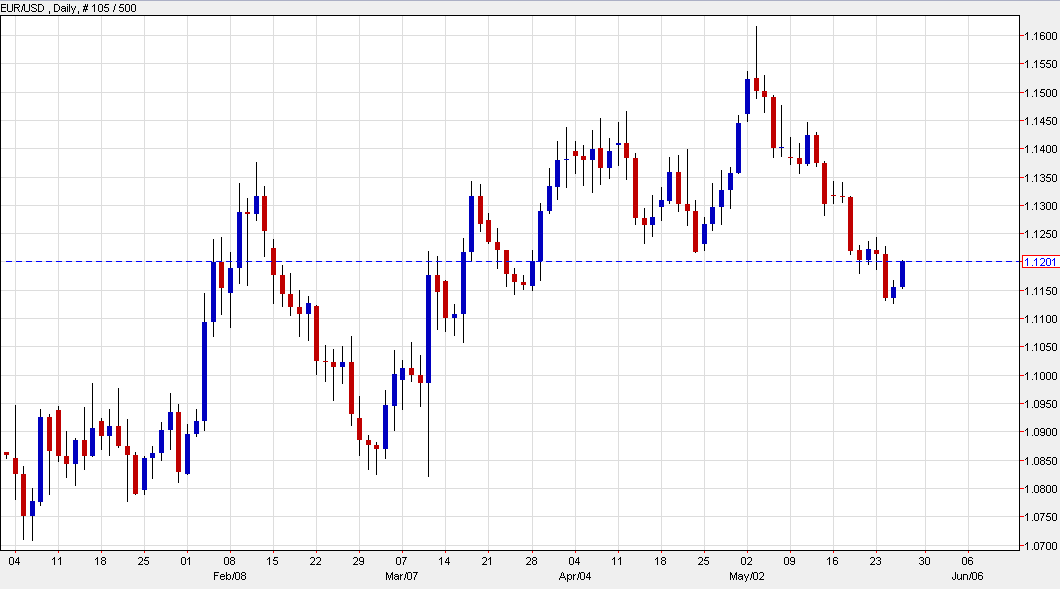

The euro was slow to turn but has now jumped to 1.1201 from 1.1165 at the time of the data.

On Tuesday it looked like the euro was finally breaking down on hawkish Fed talk but it's bounced right back with today's gains.

The Fed has largely ignored weak durable goods over the past year but the June decision is setting up to be a close call and every number matters.

More broadly, the US dollar is quickly down 25 pips against the yen and the commodity currencies as well.