Weatherford International Lowered to BB from BBB-

Shares of Weatherford International are down 11.4% after Fitch downgraded the oil services company and left it with a negative outlook.

"The downgrade reflects Fitch's lower and longer services recovery profile assumption resulting in the forecasted leverage profile remaining above our through-the-cycle levels for a 'BBB-'/'BB+' credit over the rating horizon. Fitch expects Weatherford's cash flow and leverage profiles to be significantly weaker than previously forecast. Fitch's base case currently forecasts 2015 debt/EBITDA of 5.6x compared to our previous April estimate of 3.2x. The difference is mainly a result of less than expected debt reduction and lower activity and pricing pressure during the second half of 2015."

The company has $7.5 billion of debt outstanding and a market cap of about $4 billion (after today's rout).

Shares of the company are down 77% since August 2014.

Expect persistent headwinds in high yield from ratings agencies downgrades. It's like 3 years ago when a Eurozone sovereign was getting downgraded every week. The drumbeat of from the ratings agencies made it impossible to buy the euro.

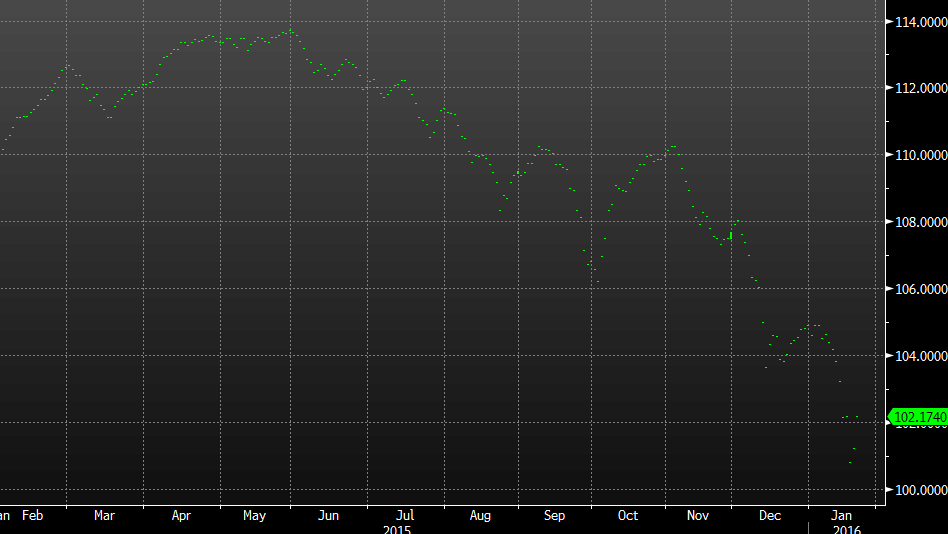

Here's the S&P US issued high yield corporate bond total return index: