Or is it done correcting the Friday moves.

Traders today reversed some of the dollar gains seen in trading on Friday but reached some lower extremes (for the dollar that is) and is now working (retracing) back higher.

EURUSD

The EURUSD started the NY session with a 25 pip trading range. That was extended to 47 pips (still well below the 70 pip average seen over the last 22 trading days but better than 25 pips). The stall point? The 100 day MA and 38.2% retracement level. That was a tough level and traders traded against it. PS. Those same traders may have bought at the lows which were against the 200 day MA (at 1.11459). Although the range is still narrow, there is a technically defined ceiling against the 100 day MA/38.2% retracement and technically defined floor against the 200 day MA at 1.11459.

USDJPY

The USDJPY fell below a trend connecting the recent lows. That break could not extend toward the next target at the 101.41 level . The price is now back above the trend line and the 200 bar MA on the 4 hour chart at the 101.71 level. That move was tested on Friday and earlier today before the break. Look for support against the MA line and trend line now. Traders will trade and the sellers seemed to have their shot to take more. They failed on the break.

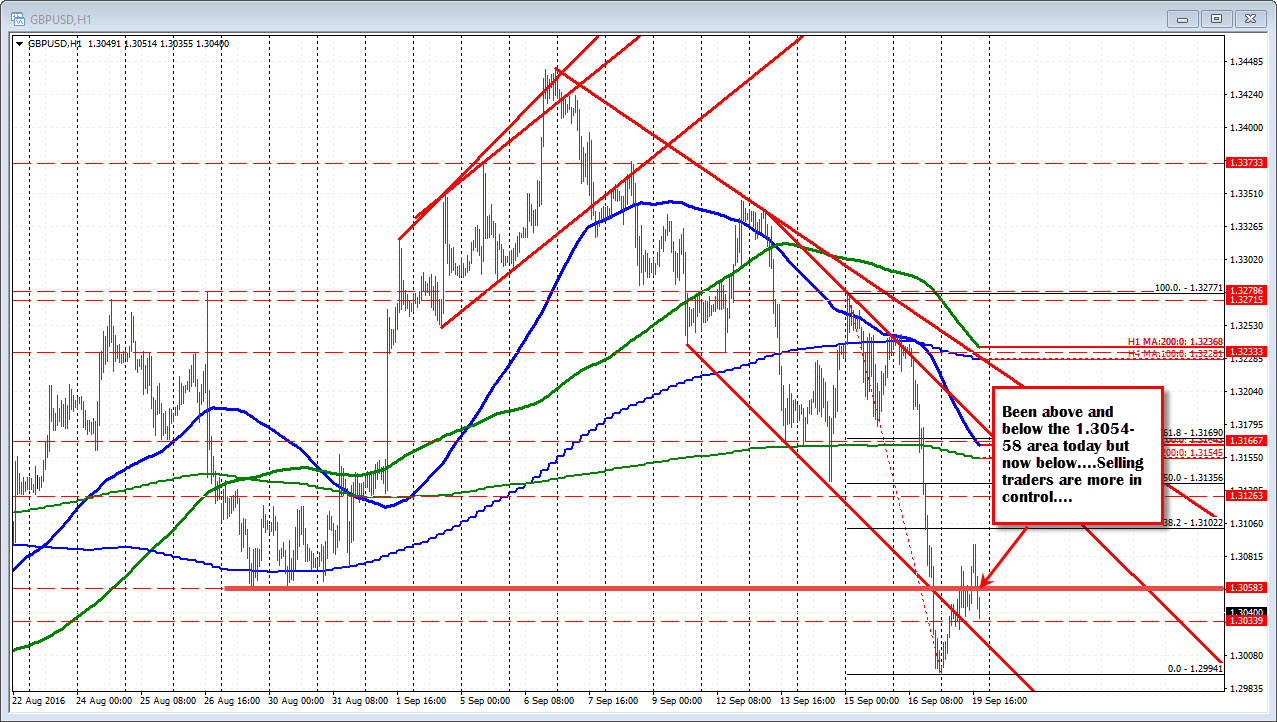

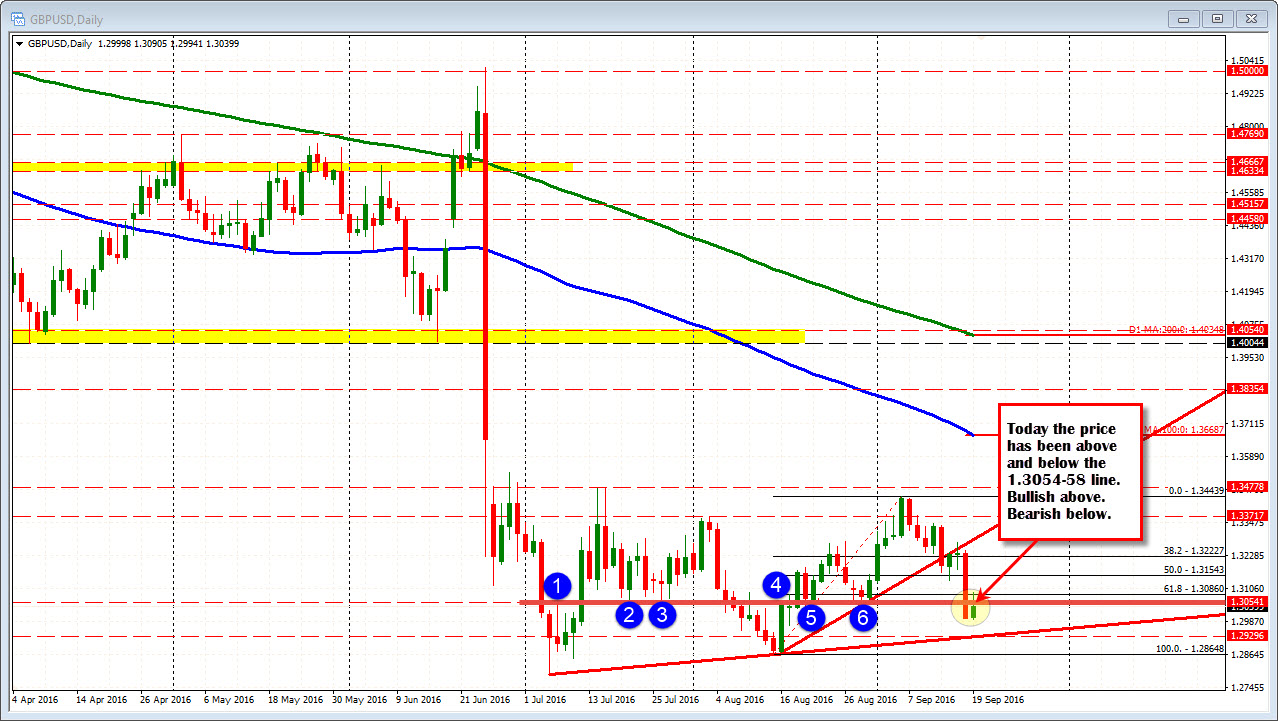

GBPUSD

The GBPUSD moved above broken trend line resistance and above the 1.3054-58 area. THe price extended to 1.3090 but has rotated back lower.

For this pair, for me, it is about above 1.3054-58 or below that level. If below = more bearish. If above = more bullish. We are below that area now.

Now traders are trading. So understand that the market may bounce off the 200 bar MA on the USDJPY but if it can't get above the NY session highs and work toward the 102.00 level and then the 200 hour MA at 102.17, the buyers can turn to sellers.

Traders will trade ups and downs in this environment before the Fed/BOJ. So define your risk levels to trade. If it works focus on your targets. If it fails, get out. There will be another trade.