Deutsche Bank strategist George Saravelos says to stop whining about globalisation

- Its not irreversible

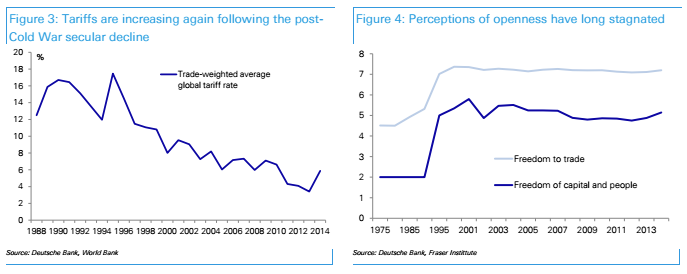

- Globalization ebbs and flows over long cycles

- And right now it is ebbing, and Trump's election win will see an acceleration of this shift: "the peak and potential unwind of globalization."

Saravelos writes in his note: "Deglobalization Is Here: What It Means for Global Macro:"

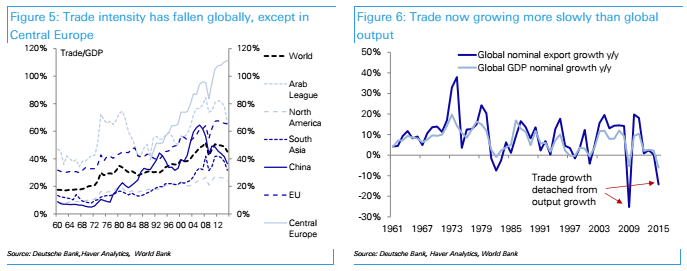

- The weakness in global trade, the rise of anti-globalization politics and the decrease in capital mobility all point towards a reversal of the neo-liberal word order constructed since World War II. In this note we introduce a framework to think about the impact of de-globalization on global macro

- First, we argue de-globalization will shrink international trade imbalances. Because these are mirror images of international capital flows, de-globalization should also shrink the pool of global savings. Surplus nations such as Germany and Japan will have to spend more while deficit nations such as the US will have to pay more to borrow, which means Treasury yields will rise

- Second, we expect de-globalization to negatively impact financial markets, particularly the availability of dollar funding. Reserve manager commercial bank dollar deposits are falling. Central bank swap lines can no longer be taken for granted. The potential repatriation of more than a trillion dollars of offshore US corporate earnings could aggravate dollar funding pressure further

- We expect de-globalization to lead to a slowdown in FDI flows and a shortening of global value chains. More protective anti-trust rulings could slow productivity further. The multinational business model is at particular risk

- As a negative supply shock, we expect de-globalization will put upward pressure on inflation, particularly when combined with large US deficit spending. "Safe haven" property hotspots in the world's major capitals may be the exception, housing bubbles may be at risk of pricking ... While inflationary pressures will build, real estate will be an exception as property bubbles burst. One reason is restriction on foreign ownership. Canada, Australia and New Zealand have already moved in that direction, while London is probing foreign ownership on account of increasing public outrage at property prices. From a macro perspective, a popping of the major house price bubbles would be consistent with converging current account imbalances. Note that the economies with arguably the largest bubbles also run some of the most extreme current account deficits. There is a strong negative causal link between house prices and current accounts, driven largely by wealth effects.

- De-globalization should also improve the effectiveness of local monetary policy via more powerful FX transmission, potentially leading to greater global policy divergence and raising FX volatility similar to the late 1970s. The main victim of de-globalization in FX should be Asia EM.