How the BOC forecasts changed in the quarterly Monetary Policy Report

The prior report was released in April

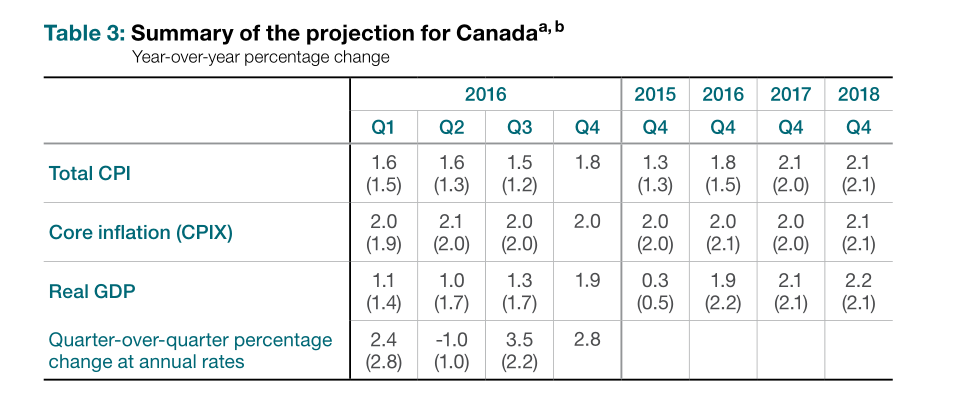

- Real GDP is expected to grow by 1.3 per cent in 2016 (vs 1.7%), 2.2 per cent in 2017 (vs 2.3%) and 2.1 per cent in 2018 (vs 2.0%)

- Sees Q2 CPI at 1.6% vs 1.3% in April MPR

- Sees Q3 CPI at 1.5%, up from 1.2% in April

- Sees Q3 core CPI unchanged at 2.0%

- Contributions of exports to growth downgraded to 0.3% from 1.1%

- Alberta fires cut GDP by 1.1 pp (annualized) in Q2

Foreign 2016 GDP forecasts:

- US 2.0% vs 2.0% prior

- Eurozone 1.6% vs 1.4% prior

- Japan 0.5% vs 0.5% prior

- China 6.4% vs 6.5% prior

- Oil importers 3.4% vs 3.6% prior

- 'rest of world' 0.9% vs 1.5% prior

- World 2.9% vs 3.0% prior

The BOC sees the Brexit trimming global GDP by 'about' 0.2% by the end of 2018.

The underlying theme that non-resource exports will boost growth is the base case and Poloz remains undeterred by a lack of evidence: "The expansion of activity in the non-resource sector will assert itself as the dominant trend in the second half of 2016."