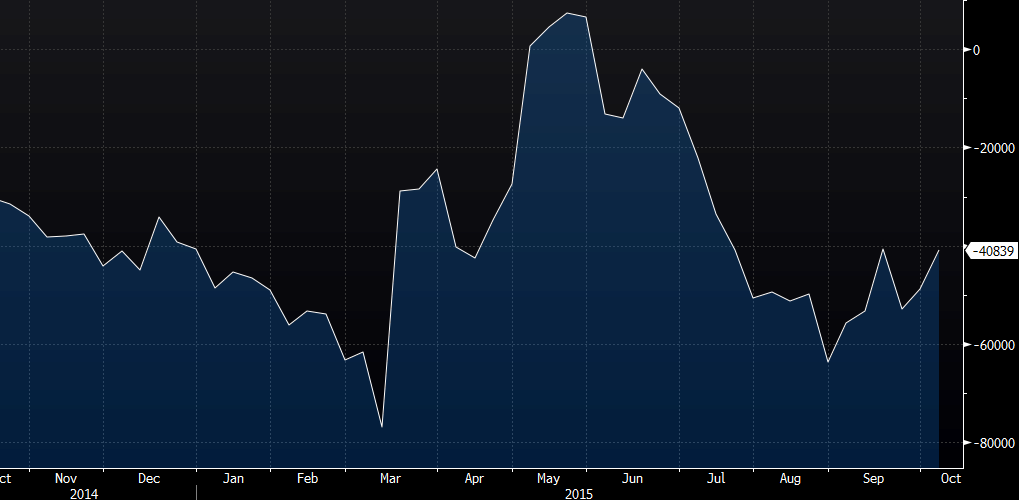

Forex futures market speculative positions data from the CFTC Commitments of Traders report as of the close on 6 October 2015:

- EUR short 89K vs 88k short prior week.

- GBP short 4K vs. 2K short prior week

- JPY short 18K vs. 22K short prior week.

- CAD short 35K vs. 42K short prior week.

- CHF short 4K vs 3K short prior week.

- AUD short 41K vs. 49K short prior week

- NZD short 1K vs. 3K short prior week

- Full report

US dollar longs were cut slightly in the latest data , especially against the commodity currencies. Still, the crowded Australian and Canadian dollar positions had plenty of shorts to chew up and no doubt many of them were feeling it over the past week as AUD/USD climbed for 8 straight days.

Aside from losing money on FX gains, AUD/USD shorts are also paying carry so it could be a quick move back to flat if it can climb above 75-cents (last at 0.7323).

The other thing that stands out is the lack of love for the euro. The euro bottomed way back in early march and it's been a grinding chop higher ever since.

Many of these shorts are under water already and with conviction about Fed hikes fading, it could be a slow stream to the exits and that will keep a bid under the euro in a possible return to 1.17.