Forex futures net speculative positions as of the close of business on Tuesday May 23, 2017

- EUR long 65K vs 38K long last week. Longs increased 27K. The largest long position since October 2013

- GBP short 24K vs 33K short last week. Shorts trimmed 9K

- JPY short 52K vs 60K short last week. Shorts trimmed 8K

- CHF short 20K vs 21K short last week. Shorts trimmed 1K

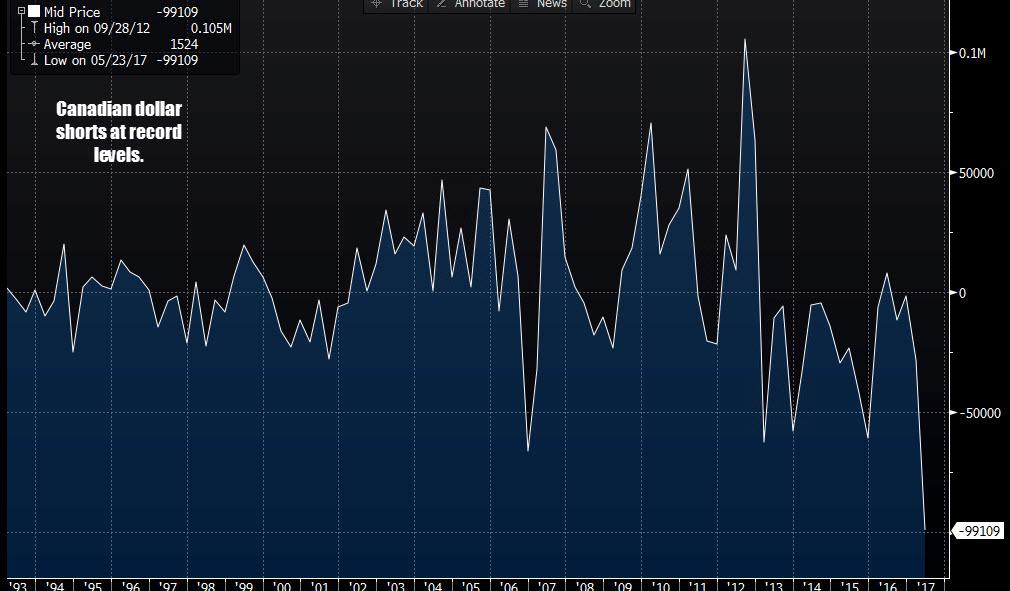

- CAD short 99K vs 98K short. Shorts increased 1K. Record shorts

- AUD long 3K vs 6K long. Longs trimmed 3K

- NZD short 9K vs 12K short last week. Shorts trimmed 3K.

Highlights for the week:

The EUR longs increased by 27K in the current week to long 65K. That is the largest long position since October 29, 2013. The EURUSD is trading near the lows for the week, but the corrective move from Tuesday's high has been modest. The range for the week was only 108 pips. This is the 2nd lowest range for the EURUSD since 2014.

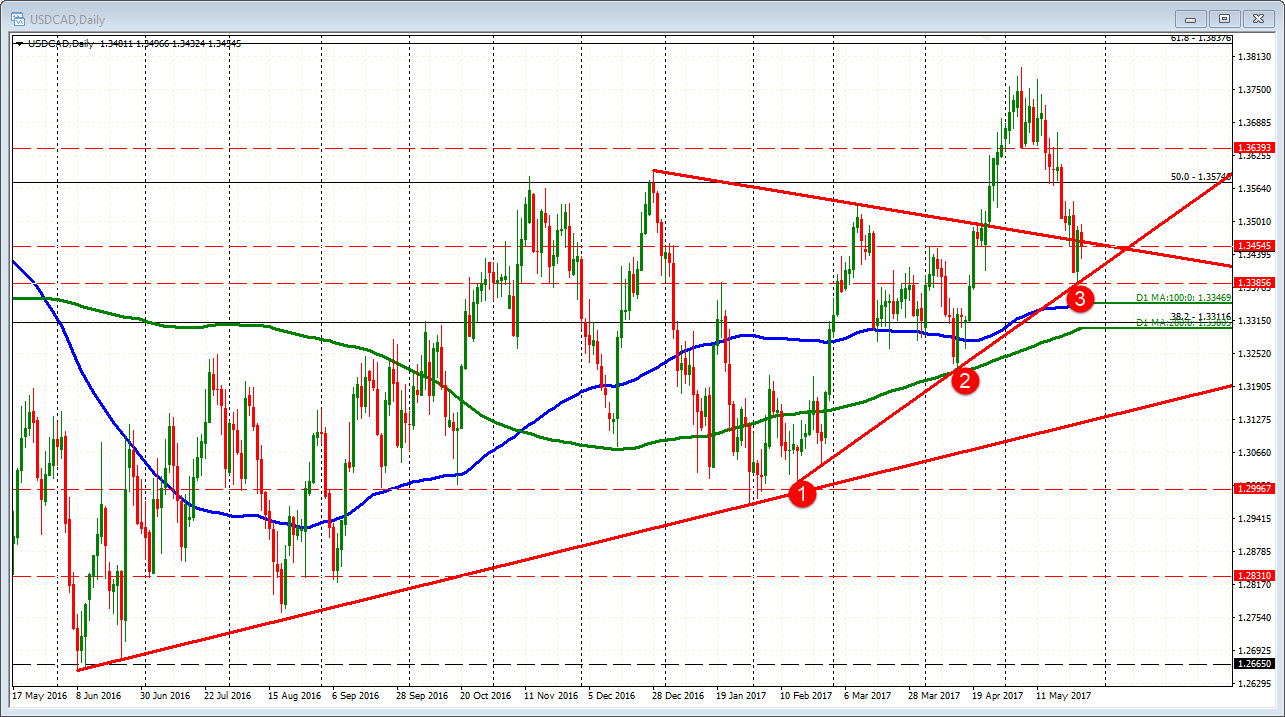

The Canada dollar short increased this week by only 1K, but it still represents a record short for that currency. The USDCAD has been moving lower (CAD higher) since May 5th peak at at 1.3792. The low on Thursday this week reached 1.3386, the lowest level since April 19th. The net record shorts in the currency are not doing so well.

The low this week in the USDCAD bottomed against a trend line. Maybe, the shorts will be rewarded with higher prices next week. Speculative positions are hoping for a rally in the USDCAD (a lower CAD).