Highlights of the January 2015 Canadian GDP report:

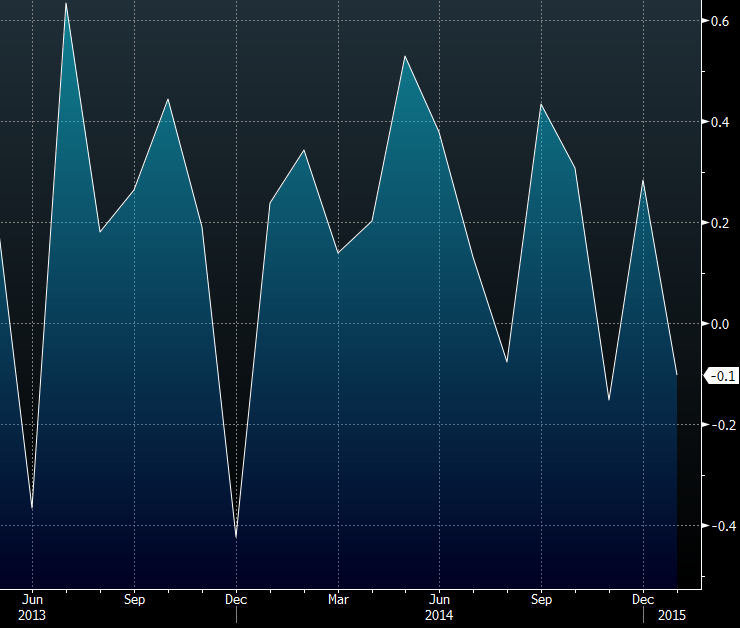

- In December GDP rose 0.3%

- In year-over-year terms, GDP rose 2.4% in January versus 2.4% expected

- December GDP rose 2.8% y/y

Yesterday, Bank of Canada Governor Stephen Poloz was talking up and 'atrocious' first quarter but it wasn't as bad as expected.

USD/CAD quickly down to 1.2746 from 1.2785 but I think that with an Iran deal looming and oil under pressure, the better trade is to buy the dip. It's just a matter of timing it right.

Canadian GDP

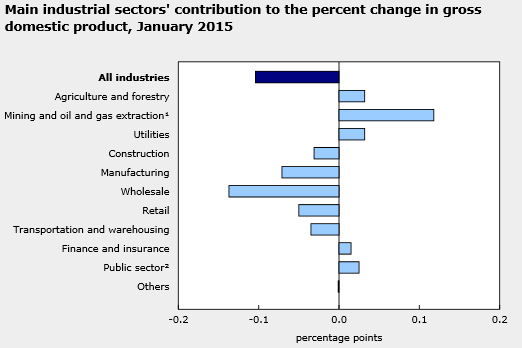

The internals of the report are bizarre. Goods production rose 0.3% in the month, primarily as a result of increases in oil and gas extraction, utilities and the agriculture and forestry sector. The drag was a -0.3% output reading in the service industries in the first decline in 11 months.

Digging down even further, a 2.6% drop in January wholesale trade was a hefty trade and it was caused by weak sales of building materials, which points to a cold January as a drag.

This is what the report says on oil and gas:

"Mining, quarrying, and oil and gas extraction rose 1.4% in January, after declining 0.9% in December, mainly because of an increase in non-conventional oil extraction.

Following a 2.1% decline in December, oil and gas extraction increased 2.6% in January. Non-conventional oil extraction posted a notable gain, following two consecutive monthly declines, as production rose following maintenance in the fourth quarter at some oil sands facilities. However, both conventional crude petroleum and natural gas extraction were down in January.

Support activities for mining and oil and gas extraction fell 2.0% in January, as a result of declines in rigging services."

Overall, mining and oil and gas extraction were the largest boosts to GDP.