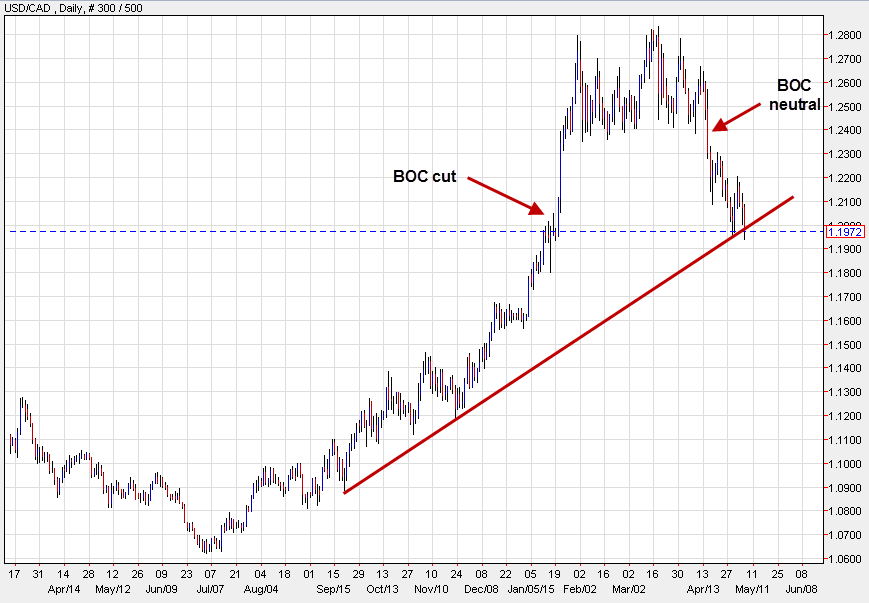

USD/CAD surged on the Jan 19 Bank of Canada rate cut but that move has been erased.

The Bank of Canada shifted to a clear neutral stance on April 14 and that sent USD/CAD back down below 1.2000. A bigger driver has been the rebound in oil prices. WTI crude rose back above $60 yesterday and prices have risen 50% from the lows.

Yesterday, voters in Alberta elected a new government that promised to raise corporate taxes and review how much royalties oil companies pay the government. The win has weighed on Canadian oil company shares but hasn't hurt the Canadian dollar, which is a surprise to me.

At the moment, it's all about the US dollar as another squeeze gets underway in EUR/USD. Last at 1.1360.