Brent drops under $50 for the first time since Jan 30th

Bear fever is gripping oil markets. Worries over growth (generally and in China), the OPEC pumps still at full power, Iran saying they could pump an extra 500kbpd within a week when sanctions are lifted (& 1mbpd within a month), US rig counts on the rise, it's all bearish for the black stuff

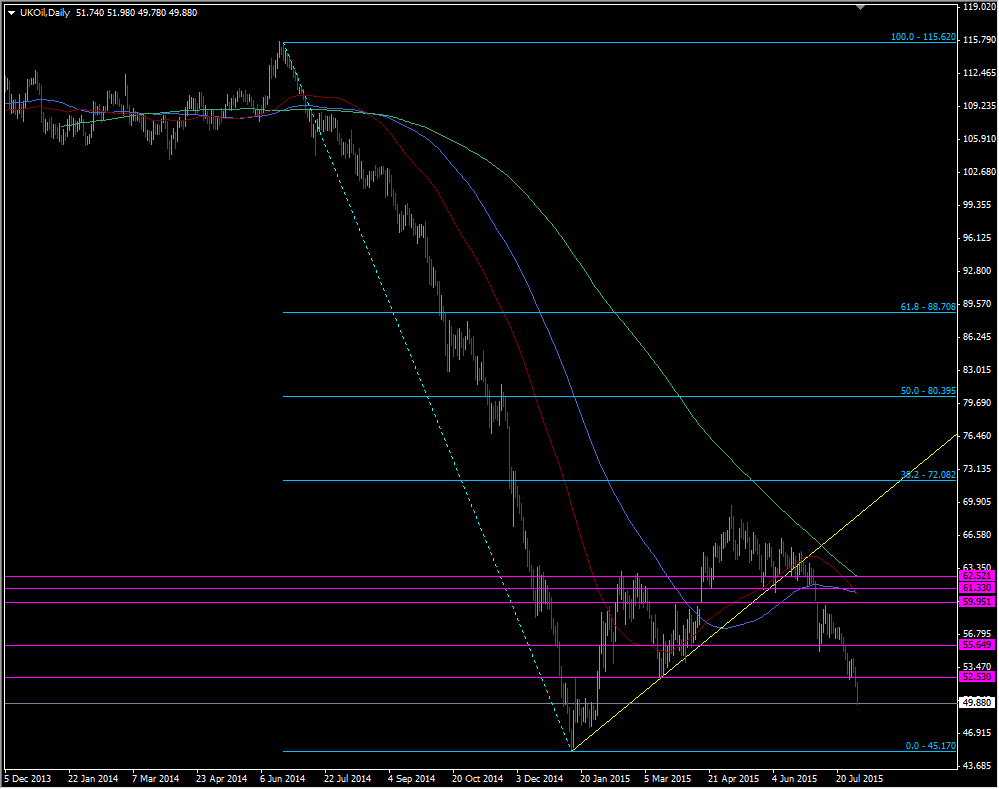

Brent is under 50 bucks at 49.90 and there's minor support between here and around 49.35/40, then 47.60/80. The Jan low at 45.17 is now very much in reach. 52.50 is resistance on the upside

Brent crude daily chart

WTI is back down through the broken Jan resistance line and if that finds resistance coming in then the downside beckons. 43.50 is the next decent support

USDCAD has had a look at 1.3100 and pulled up 12 pips short of the big figure. As I wrote about earlier, that's a strong confirmation of the break up. It's not making new highs on the back of new lows in oil, partly due to USD being softer and risk trades in general heading south. Treasuries are back in fashion also with 10's now down 4 bps to 2.15%