Bloomberg reports on new data from the China Household Finance Survey, a large-scale survey of household income and assets headed by Professor Li Gan of Southwestern University of Finance and Economics, provides fresh insights into who has been driving the recent rally in China's markets....

- The survey was conducted at the end of 2014

- Covers some 4,000 households across the country

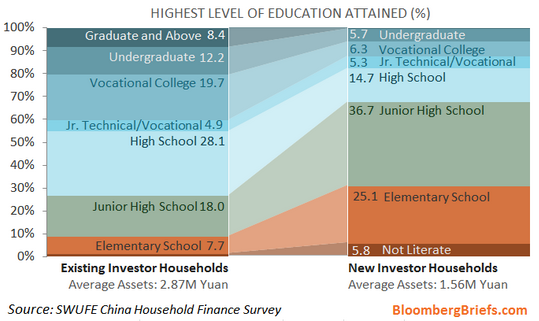

- Finds that the biggest new investors in China's equity markets have below a high school education and relatively low levels of asset ownership

- More than two thirds of new equity investors exited the education system by middle school - which in China means around the age of 15

- More than 30 percent exited at age 12 or below

- Household wealth for new investors is about half the level of existing investors

Hmmm. Note the survey was conducted at the end of 2014. So ... the high-school drop-outs are having a good run so far then, yeah?