What preview of Australian Capex data would be complete without mentioning the 'mining investment boom' unwind?

The fall in mining investment is not news, its been ongoing for a good few years now, the question is the replacement of this with non-mining related capital expenditure. This has been weak, weaker than expected, and its a concern going forward. Even RBA governor Glenn Stevens, who is otherwise sanguine on the path for the Australian economy (2015 had the highest employment growth in a decade and low inflation, dual mandate ... 'sorted') is perturbed by low capex:

- "Capital spending outside of mining is considerably weaker now than I would have expected ... There is very little sign at this point of intentions to invest more and the level of investment remains quite low"

Quite.

For today:

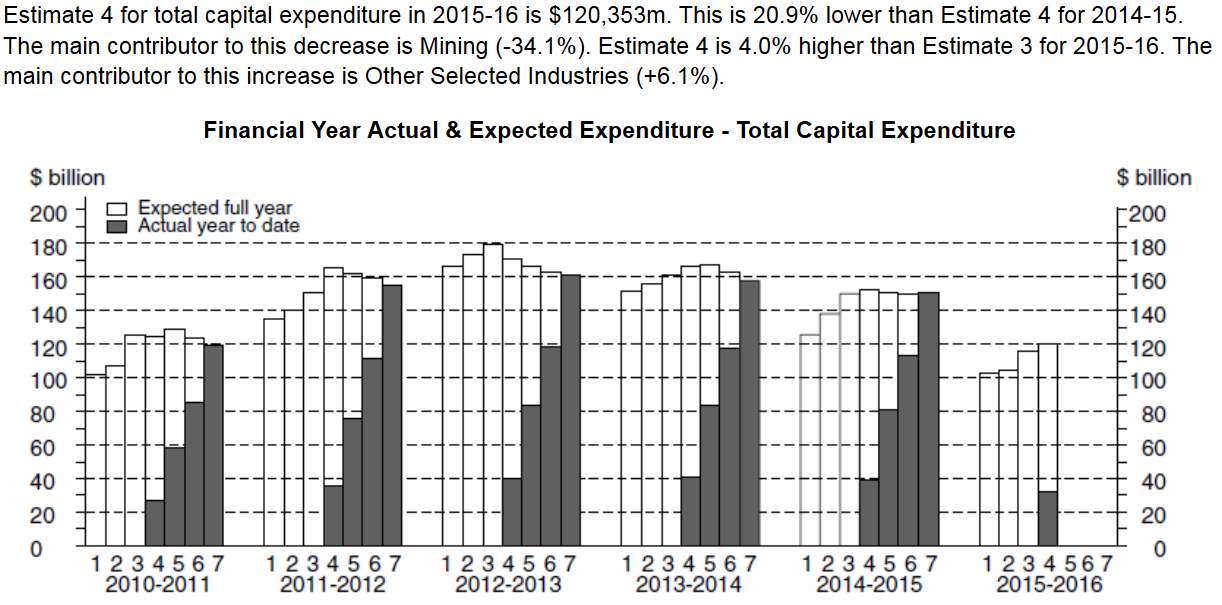

- The 'headline' number is expected to be -3.0% q/q for total capex,

- After a prior of -9.2% (for the September quarter of 2015).

The 'prior' was a dreadful miss (expected was -2.9%, actual was the mirror, -9.2%). From the prior result:

The capex survey includes 3 estimates:

- Spending in the quarter just passed

- Updated estimate for the current fiscal year

- An estimate for investment expectations for next year

Its long been a critique of the survey that it does not capture investment intentions for the services sector accurately. The survey excludes several sectors, like the health and educations, which are growing. Excluding these, in effect, cuts out about half of non-mining related capital spending items.

Note also, the survey was conducted during January & early February, coinciding with the global market volatility and equity market slump. This is likely to have been a negative for intentions.

Westpac estimates are:

- Estimate (5) for 2015/16 is expected to be similar to the fourth, at $119bn, -21% on the previous year

- Estimate (1) for 2016/17 expected to be around $87bn, -15% on the first estimate for 2015/16

Along with pretty much every one else I am not looking for too many positives in the data, the market is downbeat on capex. The surprise would be an improvement, or perhaps more than a surprise, it'd be a shock.

Due at 0030GMT.