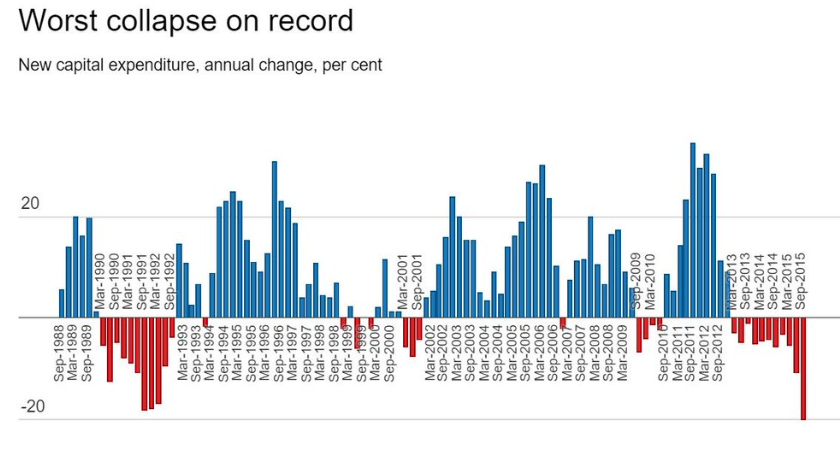

Q3 capex decline was the worst on record

Private capital expenditure fell 9.2% in the third quarter in Australia, data released yesterday showed. That's the worst fall since records began nearly 30 years ago.

Economists were looking for just a 2.9% decline but resource companies have been shutting down spending including a 29.6% drop in mining investment this year.

In addition, planned investment is down 21% compared to a year ago.

The Sydney Morning Herald produced this graphic.

The RBA meets on Tuesday but the main numbers to watch will be Wednesday's Q3 GDP reading. Given the soft reports this week, watch for something well below the +0.6% q/q consensus.

What's amazing so far is how resilient the Australian dollar has been. AUD/USD fell to 0.7220 on the headlines from 0.7260 and eventually touched 0.7210 but it's bounced back to 0.7230.

Given all that hit AUD/USD in Q3, if it can make it through the next few months, the bottom that JPMorgan talked about today makes a lot of sense.