The 'headline' is the Australian private Capital Expenditure for Q2

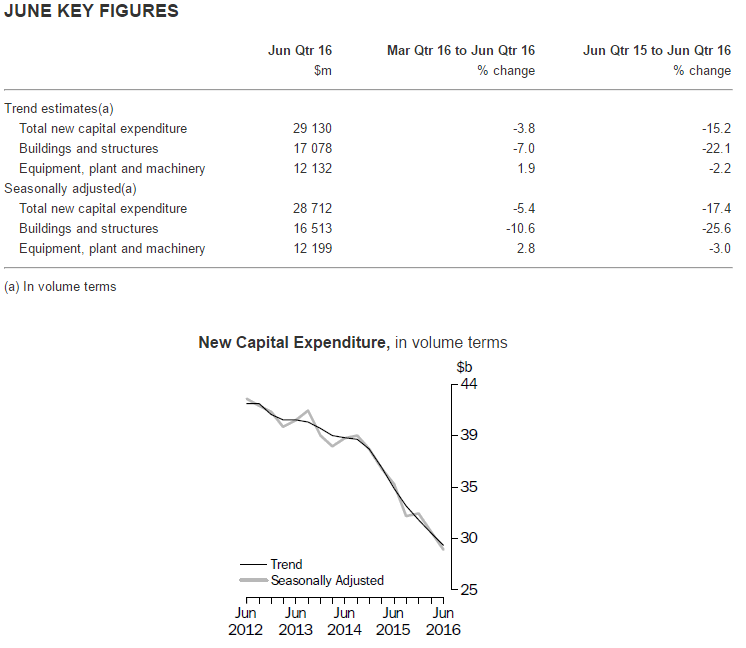

Comes in at -5.4%

- expected -4%, prior -5.2%

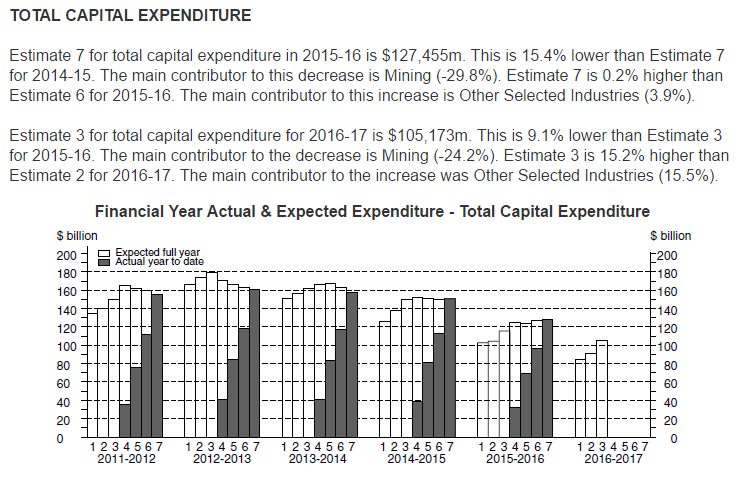

OK ... of just as much (if not more) focus is the 3rd estimate for 2016/17 (I previewed it here). I'll grab it ASAP and BRB! (and more too)

- 3rd estimate for 2016/17 is at 105.2bn AUD (well ahead of the 97bn consensus estimate)

- Q2 Building, structures investment down 10.6% q/q

- Q2 Equipment, plant and machinery up 2.8% q/q

More:

If you are looking for some good news from this data set, the beat on the '3rd estimate' is some for you:

But, but, but, you say ... what about the capex cliff? OK, that's a reasonable point and its not a positive, but its not a new point, we've been talking about for a LOOOOOONG time. Falling private capital expenditure is not new news... what is new today is the beat on the 3rd estimate.

ps. Don't despair though, if you want some bad news check out the retail sales data .... bleah ... flat on the month and not good at all.