Australian Industry Group Performance of Manufacturing Index

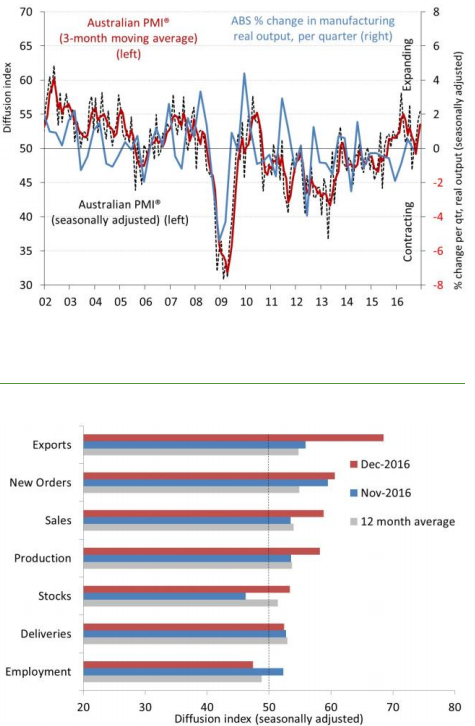

Comes in at 55.4 for December, up 1.2 points from November's 54.2

Some solid rises for the numbers in this survey, but a notable decline in employment:

- Production 58.2 (+4.7 from November)

- New orders 60.6 (+1.1)

- Exports 68.5 (+12.6)

- Employment 47.4 (-4.9)

Wages, though, higher; up 8.5 points to 62.3

As a heads up for inflationary pressures in the sector, input prices were up marginally to 62.8 (+0.3)

AiG's 'key findings':

- Six of the seven activity sub-indexes improved from November

- Strong expansions in new orders (60.6 points) and sales (58.8 points) continued in December, while exports surged ahead (68.5 points), Production (58.2 points) also expanded more strongly while deliveries (52.4 points) continued to grow

- Employment (47.4 points) slipped in December, in line with recently weaker jobs growth

- Five of the eight sub-sectors expanded in December (on a three month moving average basis). Both food & beverages (57.1 points) and petroleum & chemical products (56.5 points) continue to perform strongly. Machinery & equipment (55.0 points) is showing signs of continued resilience. Non-metallic mineral products (57.9 points) bounced back to expansionary conditions while printing & recorded media (48.3 points) slipped from stable to mild contraction. Metal products (48.0 points) and textiles & clothing (44.3 points) remained contractionary, but at a weaker pace of contraction than previously

- Comments from manufacturers in December indicate that demand (albeit somewhat mixed) appears to be improving again after a weak patch in the latter half of 2016. The recovery in commodity prices has led to better conditions for manufacturers exposed to the mining sector, with some revival of mining investment and maintenance spending. However, surging energy costs, weaker local demand and slower spending on particular major projects is depressing activity for some manufacturers.