Released at 7:30 PM ET

Just to be aware, the Australian CPI for the 4 Q will be released at 7:30 PM ET/0030 GMT. The expectation is for a rise of 0.3%. The trimmed mean which takes out the most volatile components is expected to risk by 0.5%. The YoY is expected to rise by 1.6% vs 1.5% last. The Trimmed Mean YoY is expected to remain steady at 2.1%.

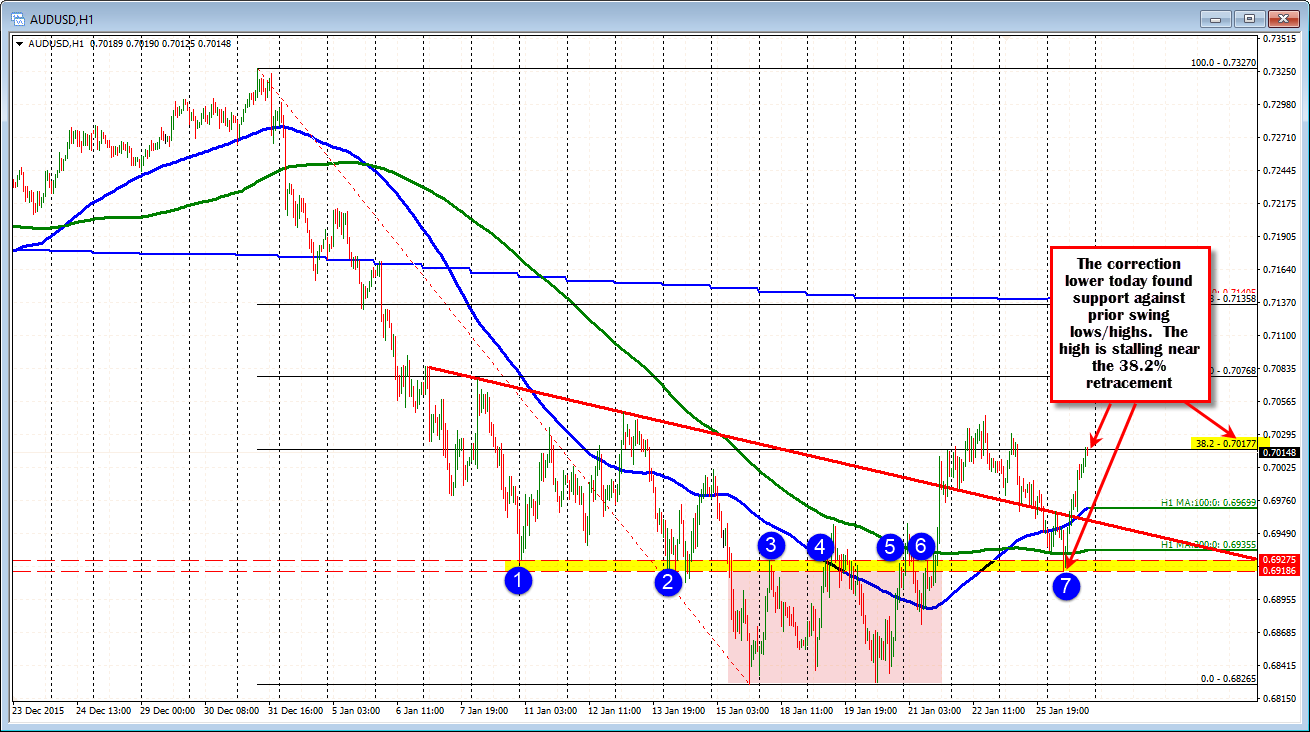

The AUDUSD has rallied today after an earlier fall on the back of weaker stocks in Shanghai. The move lower stalled at the 0.6918-27 area where there have been a number of swing lows and highs going back to Jan 11. The last three trading days have been able to stay above this area that divide bullish from more bearish.

The rally has stalled near the 38.2% retracement.

On a lower number tonight, the 100 hour MA at the 0.6969 level be eyed. A move below that level has other support targets to be below including the broken trend line and the 200 hour MA currently at 0.6935. The key floor will be the yellow area. A break below will put the seller back in firm control.

ON the topside, the most recent swing highs at 0.7045 and 0.7047 (from Jan 13 and Jan 27) will be the first hurdle followed by the 0.7077 level (50% of the move down from the end of December high). That level also corresponds with the high price from January 8th. A break above that level (and staying above) will have traders thinking in terms of a test of the 100 day MA at 0.7140. The price spent most of December trading above the 100 day moving average. So anything is indeed possible (see chart below).