April is the month with some of the strongest seasonal patterns of the year. We take a look at some of the seasonal patterns that stand out in the forex market and elsewhere.

#1: Commodit-anything in April

Commodity currencies are like a magic trick in April… pick a card, any card. It’s the best month for CAD, NZD and AUD.

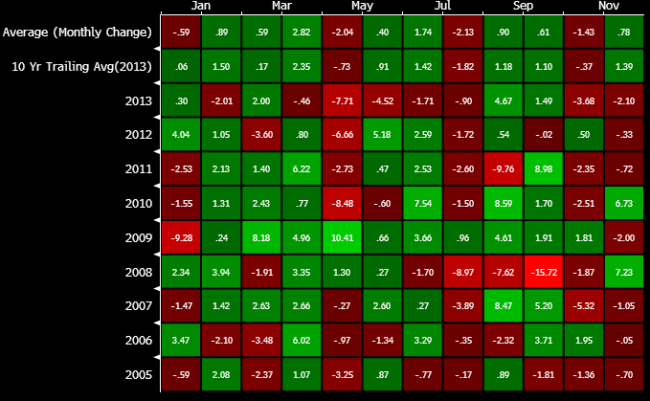

April is easily the best month for AUD/USD longs, averaging a whopping 2.82%. The Aussie has gained in 8 of the past 9 Aprils and the lone exception was last year. Even then, AUD/USD rose in the first half of the month before starting a collapse than continued through August. The pattern in AUD/USD is so sweet that I argued for buying dips last month to be prepared for when the calendar rolls over.

AUDUSD April seasonals

No surprise that it’s also a great month for NZD/USD, averaging a 2.4% gain in the long term and 1.4% over the past 10 years. Be quick to take profits on NZD/USD longs, however, May has been dreadful for the kiwi, averaging a nearly 5% decline in the past four years.

To wrap up the commodity story, April is also the best month for USD/CAD shorts. The pair has declined in 7 of the past 8 years as the Canadian tundra thaws and optimism returns. The average 1.8% fall in the pair is by far the biggest decline on the calendar and the trend holds for 7 of the past 9 years.

With commodity currencies so strong, it’s no surprise that April is a strong month for the physical stuff. On average it’s the best month for the CRB 19-commodity index at +1.9%. Base metals are often winners in the month and it’s a solid month for oil, averaging a 1.1% gain over the past 10 years as part of the early-year bullish pattern. Just today, corn entered a technical bull market climbing 20% from the lows.

One commodity that’s more warm than hot is gold. April is an average month of longs but March is the poorest month on the calendar (a seasonal that played out well this year) so a near-term rebound is possible.

The trade itself on commodity currencies is tricky. They’re coming into the month on an extremely hot streak. If you’re not in already, start small and wait for a dip.