Locked and loaded for non-farm payrolls and Canadian employment

The US and Canadian employment reports are due at the bottom of the hour. USD/CAD has been a big mover this week as oil prices slide back from the highs, a fire hits the oilsands and the US dollar reasserts itself.

That theme could be flipped on its head when the jobs numbers hit.

ADP employment was soft but the ISM non-manufacturing employment component was strong. Jobs markets in both countries have been surprisingly strong this year given weak domestic and global growth.

For me, I'd like to see a weak US employment number just to see how the dollar reacts. If it can rally despite a soft number, it might be time to get back on the dollar train.

The other metric to watch is average hourly earnings, which are expected up 2.4% y/y. That number has been as important (or more important) than jobs gained over the past six months.

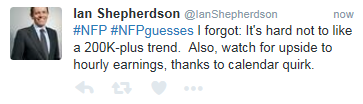

Here's the take from Ian Shephardson, who is as good as any economist when it comes to picking up on the calendar quirks in economic data.