...well Tarullo changed the sentiment

There was a point - not too long ago - where some technical levels were being busted (see post here). The moves were pretty much across the board. It was vs all the major pairs.

Then Fed's Tarullo (speaking on CNBC) went from the Fed should be forward looking, to I need to see more evidence of inflation.

People ask me "What do I think about the Fed?" It does not really matter what I think. It is what the Fed thinks. They are the ones who hold all the cards. Do they know? Let's say, my head is spinning.

So what now?

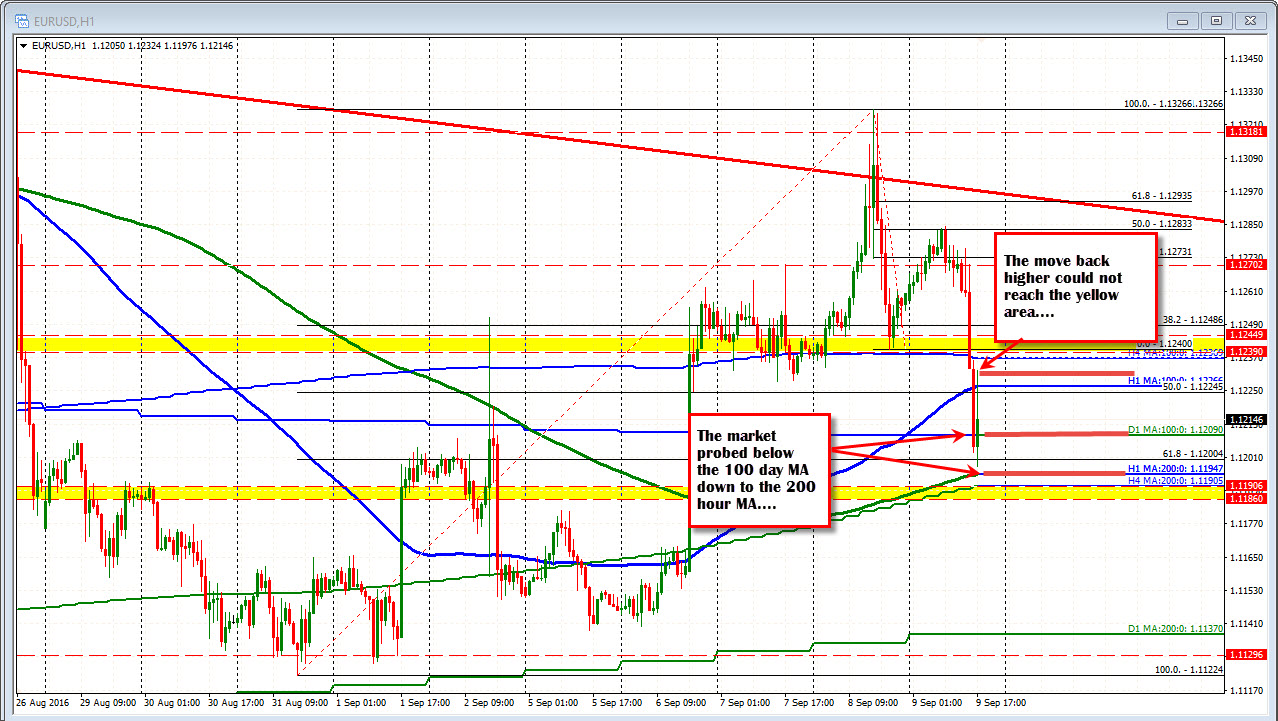

For the EURUSD, I expected the 100 day MA to find buyers. it did not on the first look. The market probed lower, and in the process looked at the 200 hour MA instead at 1.11947. The bounce off that area (the low reached 1.11976) went up to 1.1232. Remember the 1.1239-45 level? Do we have the range defined? It is certainly a possibility now that traders have been whipped around. The 100 day MA is still on my radar but is now toward the middle of the range and we are trading at that level currently.

Do we hit the reset button and find support at the 100 day MA (like the original trade idea)? Well Fed's Kaplan is now chatting. What Fed speak give us now?

"Be flexible" are the key words for the time being. The markets are choppy.