There's always two sides to every story

USDJPY keeps bleeding lower, as do yen pairs in general. Traders are noting that cross trading is doing most of the damage. As reader Peter MACD pointed out, once again the pair couldn't manage a 600 pip correction.

We're into a very busy month for events and this could be the start of some sizeable flows and positioning into each event.

Abe's sales tax delay was well telegraphed but the market isn't buying into his proposed autumn package, light on detail though it is. Given how governments aren't exactly quick to the plate with economic measures you can see why the market is unsure. There's no signs of the BOJ riding in to help either. Add in the reduced expectations for the FOMC (as per Adam's post). and there's a double whammy for dollar yen.

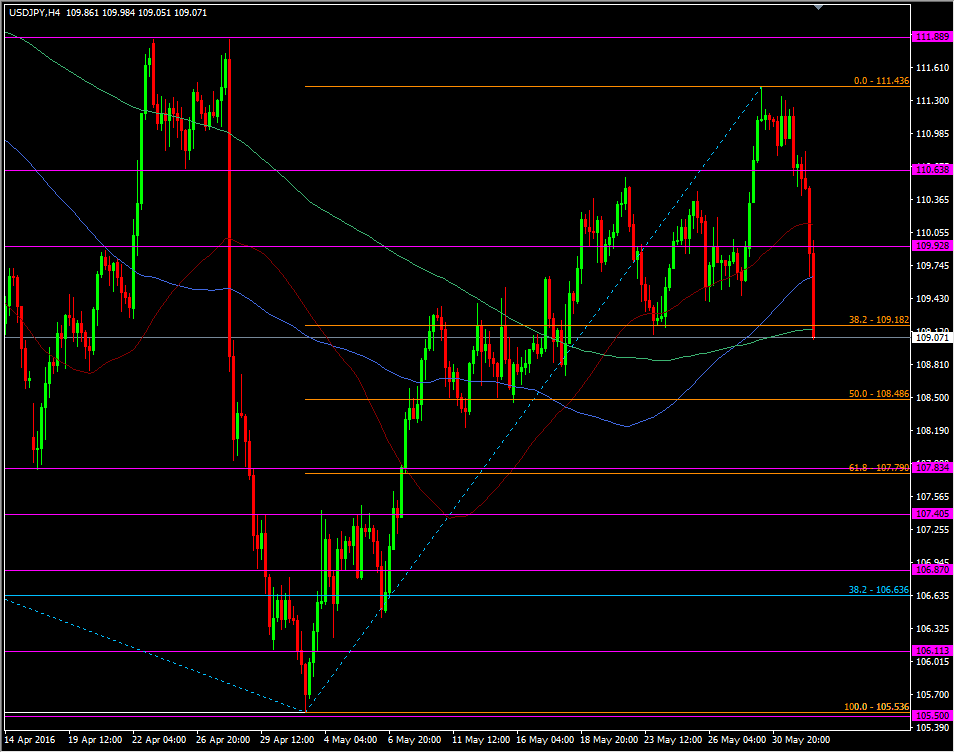

USDJPY has passed through the 38.2 fib of the late April jump, and also through the 200 H4ma

USDJPY H4 chart

We'll have to see how 109.00 performs in the lead up to the ISM. Under there support should show around 108.70/80 and then the 50.0 fib at 108.49.

An ISM trade opportunity

The way the market mood is right now I can't see any sort of USD rally lasting on a good number so I'm going to think about fading any pop. I can't even see a super number holding any gains. Depending on where we are, a jump of 30 pips or more will get me interested in a short. This might be one of those times where the market's mood trumps the data.