Dollar turns lower

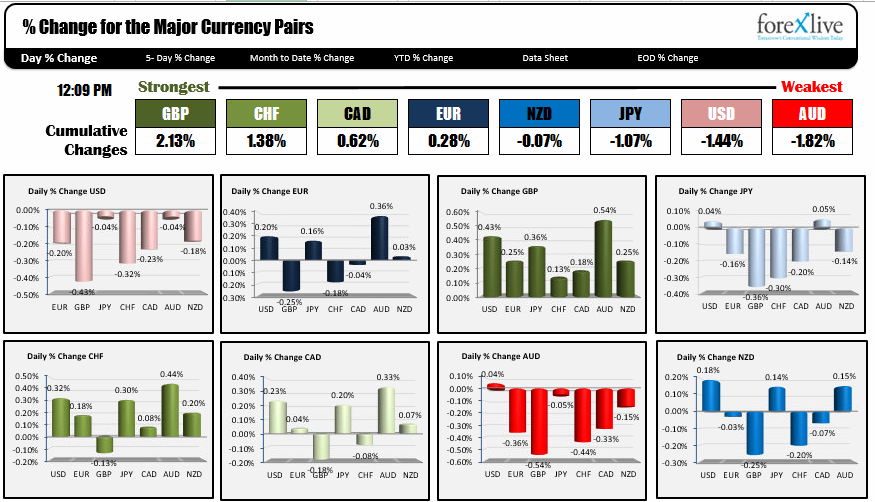

A snapshot of the forex market as traders transition into the NY afternoon session, shows that the USD has moved to the downside. In fact, the snapshot shows that the pair is down against all the major currency pairs. What is the catalyst? A weaker stock market? Bond yields are up marginally/the yield curve is a touch steeper.

The right answer might be that technically, the buyers of the dollar, saw momentum fade. The EURUSD could not keep the early NY session weakness going. The GBPUSD has followed the shorter term moving averages higher and is trading above and below the 50% of the move lower on Friday.

The USDJPY could not keep the upside momentum going - falling below trend line support and also below 100 and 200 bar MA levels (blue and green lines). The 123.00 level has been tested.

Markets are simply not seeing the dollar buying that was expected. So if the dollar can not go higher, it goes lower. It remains "one of those days". Perhaps, the dollar reasserts itself later/tomorrow/later this week, but today in NY at least, we are not seeing the buyers winning the trading battle.