A look at the loonie ahead of the Bank of Canada meeting

The Bank of Canada announces its rate decision today in what is the highlight of the US econ calendar. We're spared a session of arm waving from the governor Stephen Poloz as there won't be a presser accompanying the decision

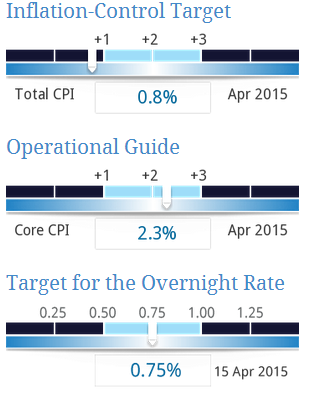

I'm sure Adam will be along soon with the view from his own back yard but generally there's no expectations for this meeting. All 23 economists surveyed by Bloomberg say that rates will remain unchanged. The BOC has a handy infograph of where they are at regarding their inflation targets and it's probably a good gauge of where they are policy wise right now

The BOC has caught a bit of luck with the fall in oil prices as their inflation had actually bee rising through the latter part of 2013 and first half of 2014. In my view this will be one country where that inflation might return faster than elsewhere and that means they could be one of the first to raise rates, or at worst, won't be far behind the US

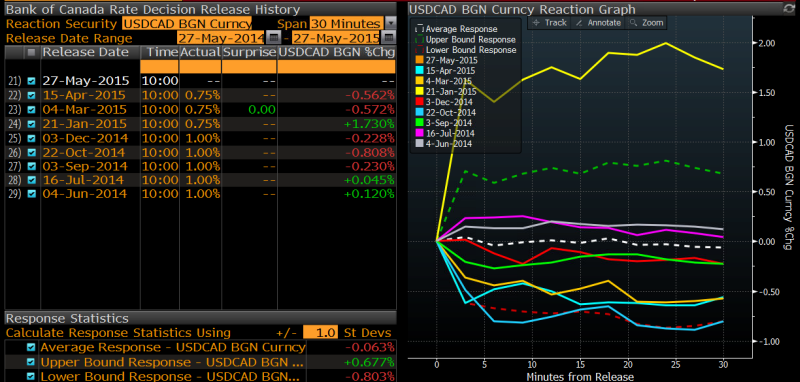

Generally trading an unchanged decision probably won't have that much effect on the CAD. I've got a funky new gadget from Bloomberg that shows the price moves over 30 minutes following the decisions since Jun 2014 for USDCAD

Reaction in USDCAD following BOC meetings

As you can see the surprise rate cut caught the market on the hop but perhaps the biggest indicator is that the pair tends to lose ground after a decision. This is not an indicator I'd lay my hat on but it's good for giving a market overview.

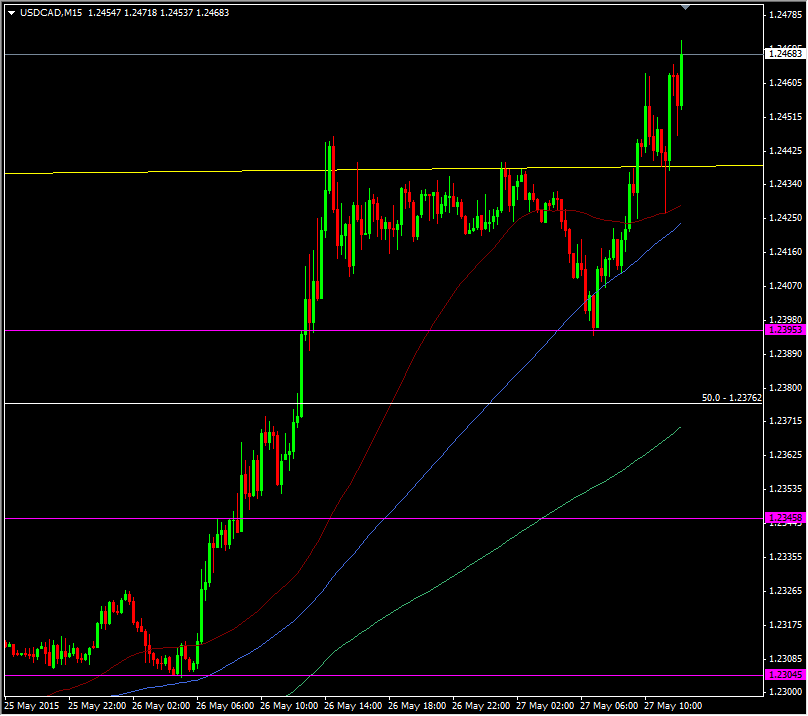

As for what's happening now in the market, the pair has pushed up to new highs again today in the wave of dollar buying across the board.

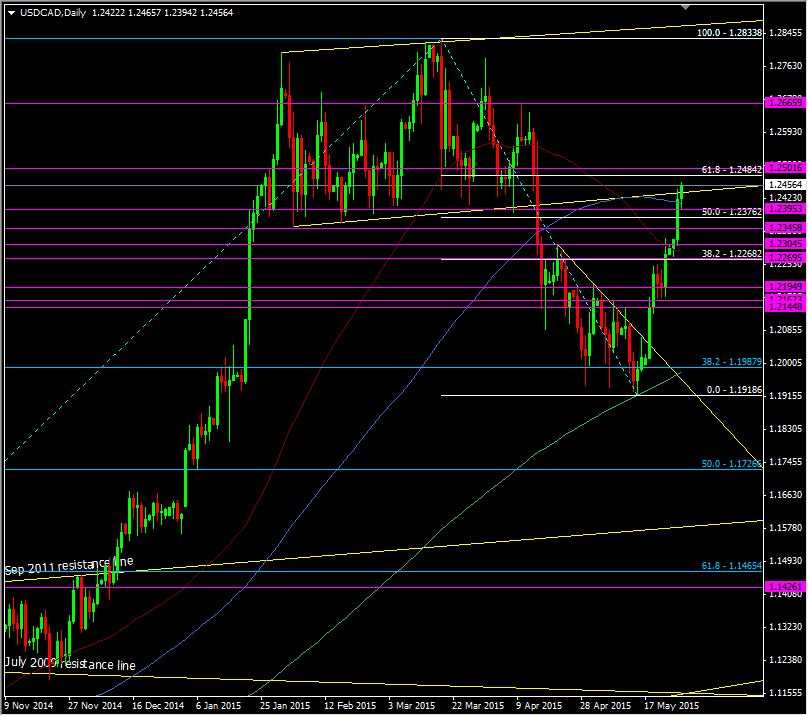

We've broken back into a channel that has formed from the beginning of the year and we're approaching the 61.8 fib of the March drop at 1.2484 and 1.2500/05 has been a former S&R level

USDCAD daily chart

The break back into the channel could open up a move back towards the 1.28+ highs but there's a few obstacles in the way. Around 1.2545/70 will be an area to watch followed by 1.2620. The bigger level on the way up is at 1.2666

While we hold the lower channel line as support (around 1.2438) the direction should be higher. At the moment anything with a USD sign on it is bullish so I'm probably stating the obvious.

1.2420/25 is the next support under 1.2438 followed by 1.2410 and 1.2395/2400

USDCAD 15m chart

A break below 1.2400 and we could see a bigger decline towards the low 1.23's

On balance I think that any falls over the BOC announcement will be fodder for the dippers so don't really envision a decent move south, unless we get some CAD bullish/hawkish headlines. As for the upside, traders may be waiting to clear the BOC before jumping onto the USD train again