185K jobs are expected to be added in October

The US nonfarm payroll statistics will be released at 8:30 AM. The expectations are that nonfarm payroll increases by 185K in the current month. Last month saw jobs ad a less than expected 142K. In August the number was less at 136K. Can the higher number be reached.

What is a bullish number? >200K

What is a bearish number? <160K

I could be wrong but at >200K more traders will think a Fed increase in December is likely. At less than 160K, that percentage is likely to go lower.

Risk is increased going into the report. The number can go either way dependent how the survey winds blow. So understand it is a gamble with a position going into the release. After the release you become more of a traders but risk (liquidity risk and market risk) is still great. My warning is be careful. There are plenty of opportunities to trade over the course of a month. Be around for those opportunities.

What technical levels will be eyed after the release is known for the EURUSD?

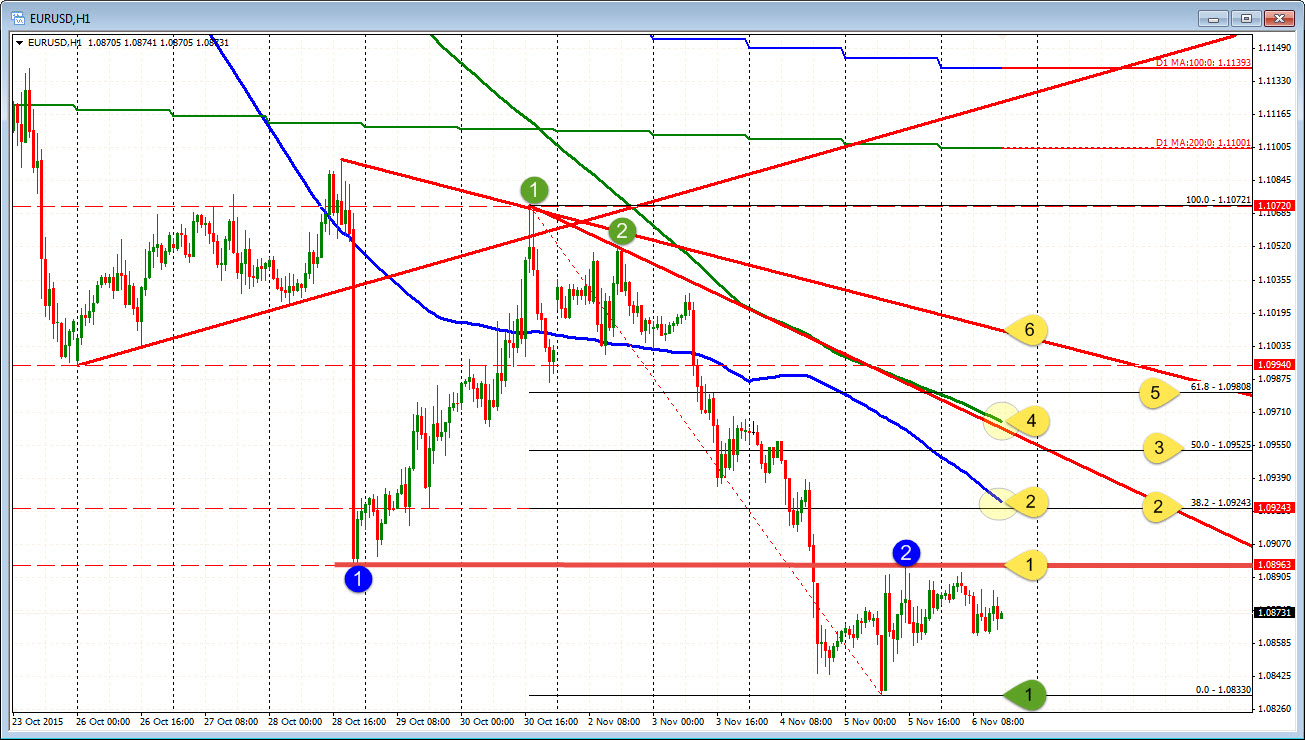

Bullish move (weaker number):

- 1.0896: was the low from October 28 and high correction yesterday.

- 1.0924-27: 38.2% of the move down from the Oct 30 high AND the 100 hour MA (blue line) The 100 hour MA was broken on Tuesday and not seen since.

- 1.09525: The 50% of the move down from Oct 30 high

- 1.0963-1.0966: Trend line and 200 hour MA (green line)

- 1.0980: 61.8%

- 1.1012: Topside trend line.

Bearish move (stronger number)

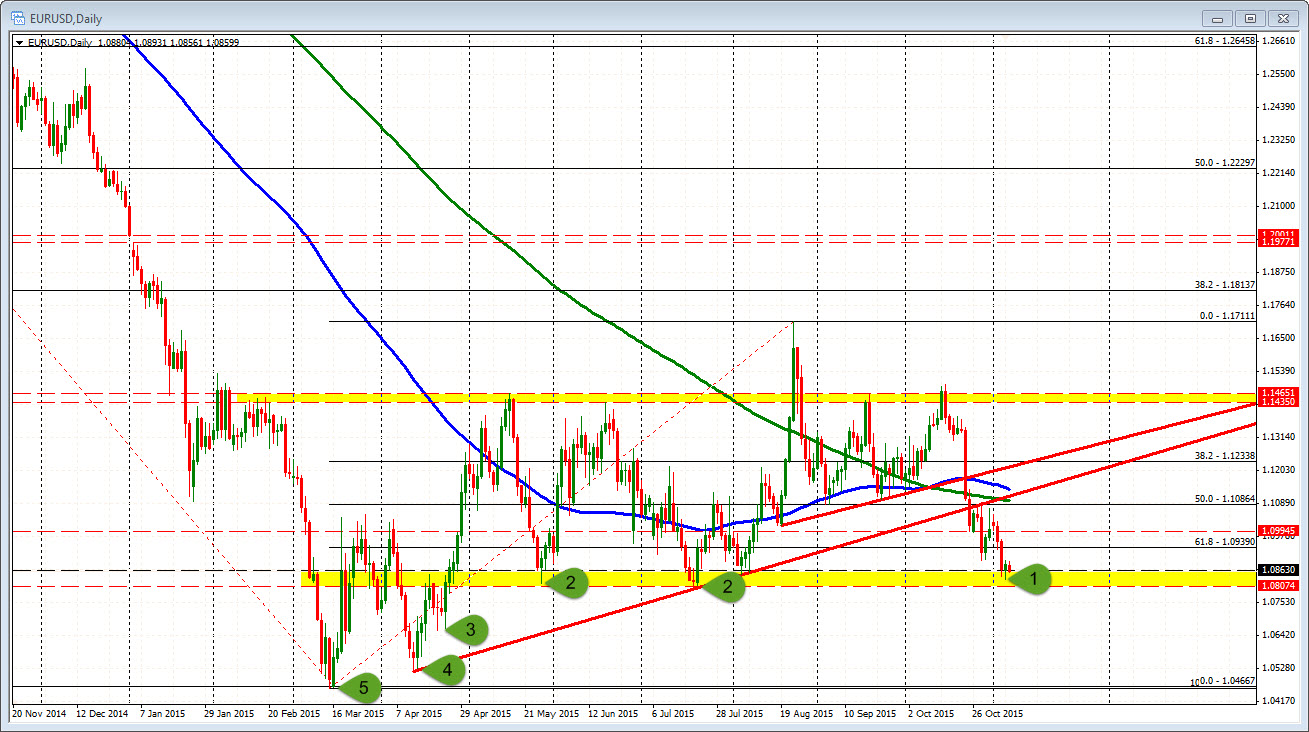

- 1.0833: Low from yesterday

- 1.0807-18: Lows from May 27 and July 20 (see daily chart below). A move below this level opens the door for bigger selling. The price will be trading at the lowest level since April. Traders will be switching focus to moving toward lows from the year. NOTE: A beat to 200K, does not necessarily mean we go to the bottom. Traders will be following corrections (pay attention to FXL for those levels), but be aware the move can toward the levels outlined in the daily chart below.