I posted earlier on the China data due at 0200 GMT on Friday 19 October 2018

Wespac preview of the GDP:

- 2018 has been a year of change for China's economy, some voluntary, some forced upon it. Throughout, we have held to a sub-consensus view on growth to highlight the risks to investment (a result of ongoing structural change in their financial system and a clear focus on the quality of growth) and, more recently, from building tensions with the US and slower global growth.

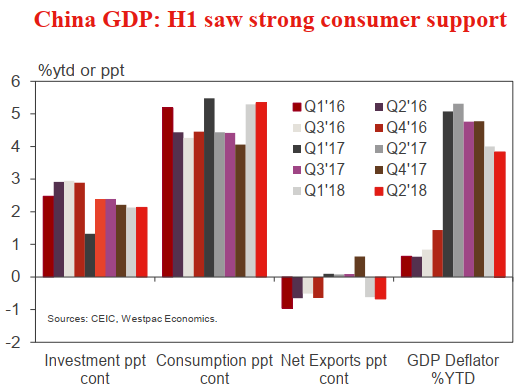

- Q3, we believe a softer pulse for the consumer (after a particularly strong first half) along with lingering weakness in business and government investment will weigh on growth. However, the race to minimise the cost of tariffs on exporters should see net exports add to momentum, having been a negative early in 2018. The net effect should be an annualised pace of gain consistent with our sub-consensus view of 6.3% for the year (1.6% q/q), but an annual rate at 6.6%yr.