Barclays basing that headline on their most recent "Japan Bond Investor Survey"Commentary from the piece:

Comments from the piece:

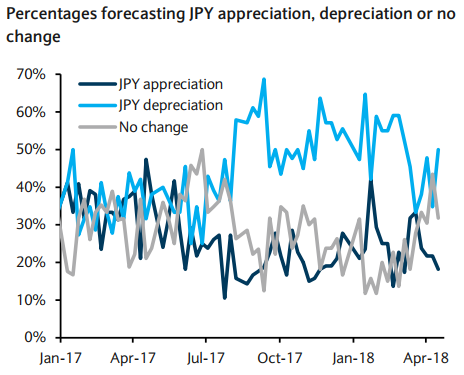

- The USDJPY outlook DI (percentage forecasting JPY appreciation minus percentage forecasting depreciation) dropped to -31.8 from -13.0, indicating stronger expectations for JPY depreciation.

- This included a noticeable shift from forecasts for no change (to 31.8% from 43.5%) to projections for JPY depreciation (to 50.0% from 34.8%), perhaps due not only to stronger expectations for higher UST yields, but also to a pullback in concerns about a trade war.

Investors see politics as the biggest driver of exchange rates

- This week's survey included a special poll on FX markets. On the factors important to the outlook for those markets, politics (68.2%) stood out, followed by interest rates and risk preference (both at 40.9%), the economy (22.7%), inflation (13.6%) and current accounts (9.1%).

- Compared with the findings of our survey conducted at end-January, this indicates a strengthening interest in politics, along with a diminished focus on fundamentals such as the economy and inflation, presumably because trade issues are currently at the center of investors' attention.