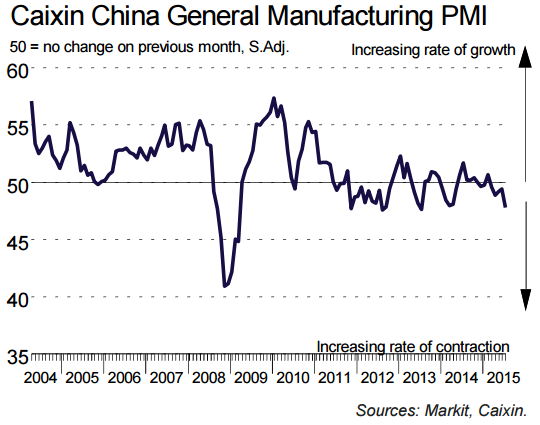

Caixin (formerly HSBC) manufacturing PMI from China comes in lower than the flash

47.8 in July (final)

- Flash was 48.2

- June was 49.4

- Employment cut for the 21st consecutive month

- Factories cut selling prices to 6 month low

AUD down a few points

Key points from Markit:

- Output contracts at fastest pace since November 2011

- Total new work and new export business both decline solidly

- Purchasing activity falls at sharpest rate in three-and-a-half years

July data signalled that the downturn in China's manufacturing sector intensified at the start of the third quarter. Renewed falls in both total new work and new export orders led manufacturers to cut production at the fastest rate since November 2011. Softer client demand and reduced output requirements contributed to further job shedding and lower purchasing activity, with the latter declining at the sharpest rate since January 2012. Meanwhile, deflationary pressures persisted, with both input costs and output charges declining in July and at faster rates than in the previous month.

--

Over the weekend we got China official manufacturing PMI at 50 in July (vs. 50.1 expected)