As Brexit fears heighten the SNB will be taking a close interest 13 June 2016

Brexit is the new China and being blamed by everyone around the globe for their own woes and economic uncertainty.

Safe-haven demand for the yen and swiss franc is noticeable as a result and the Swiss National Bank have good reason to be concerned.

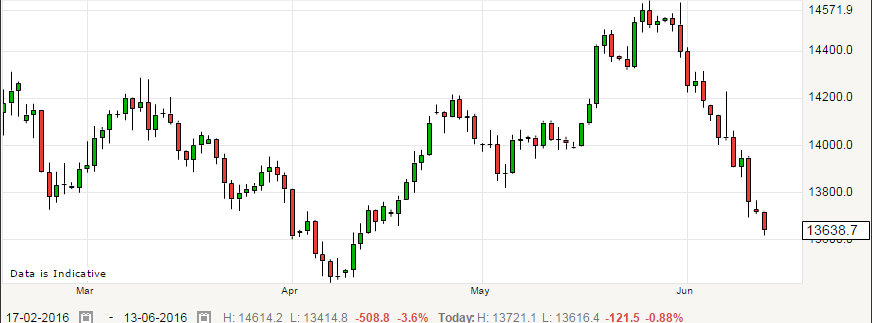

If the Leave vote wins the day then expect a flood of more money into CHF as GBP tumbles. We're now seeing GBPCHF down to 1.3626 , lows not seen since 13 April after highs less than 3 weeks ago of 1.4570 with EURCHF also falling in the past few weeks before finding demand below 1.0850 this morning.

Reasons enough for Jordan & Co to have their finger on the intervention trigger and even contemplating further interest rate cuts.

I have no doubt that the SNB will have been in already with a bit of "smoothing" but central banks are not bigger than the market and even Jordan will have learnt that harsh lesson by now. They will breathe a big sigh of relief if Remain prevails but expect them to jump in if the UK leaves and that will help stem the euro outflows as the Eurozone comes under closer inspection for fall-out.

I have been recommending dip-buys on EURCHF for a while now to good effect but this latest move and the Brexit-related connotations give reason for caution.