The art of 'Spoofing' has been around nearly as long as markets have but in this technological age it's a whole different ball game

The WSJ reported that the regulators are trying to crack down on it. They highlight one story of a young chancer who spoofed the ICE oil market with 23,000 commands of buy and sell orders in just over 6 hours. The orders were cancelled milliseconds after going in.

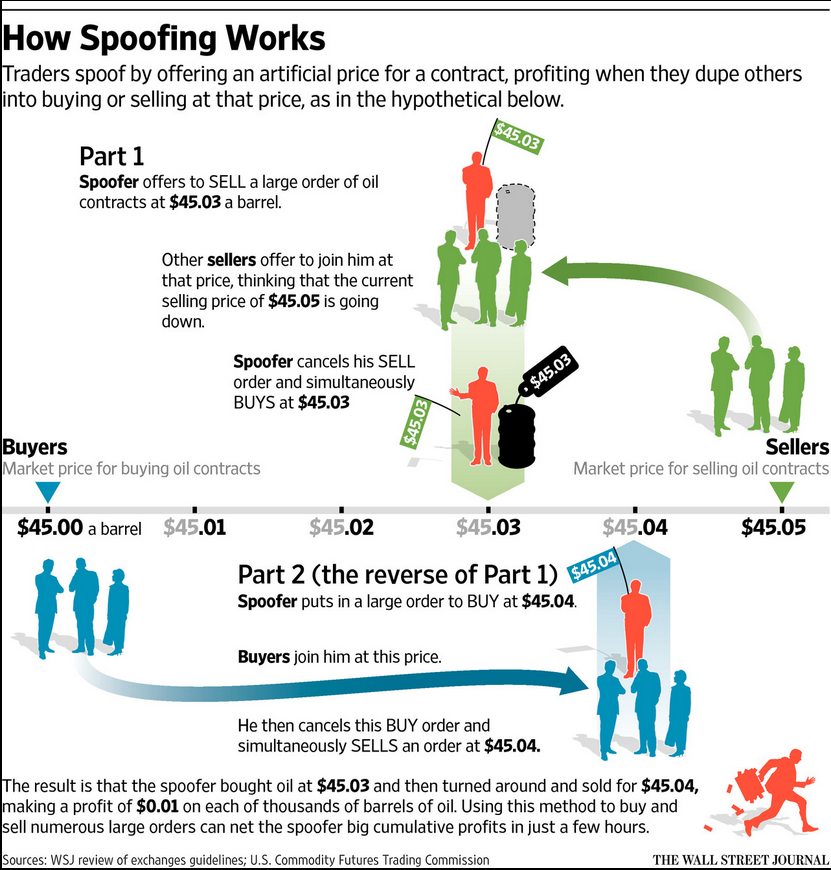

In this case the idea was to spoof the market that orders were piling up on one side of the market triggering other traders to pile in also. Then the spoofer would pick up the other side of the resulting move, then bail out as his other orders cancelled leaving those that piled in, to cover.

This is far more in depth than the spoofing that used to go on in my open outcry days but the principle was the same. Big traders would offer huge size (usually in line with a position they had) to brokers asking for a market, in the hope that they would join them on that side. If a client thought the market was well bid then chances were they would step in and lift the offers thinking the market was well supported below. The traders holding positions below the broker might let that run a bit or nail the client bid and take profit, leaving a big hole underneath.

There's many nuances with spoofing but on a level highlighted by the WSJ it makes it a big problem for markets and regulators. Only recently have US regulators been bringing successful cases against spoofers

Full details from the WSJ here (maybe gated)