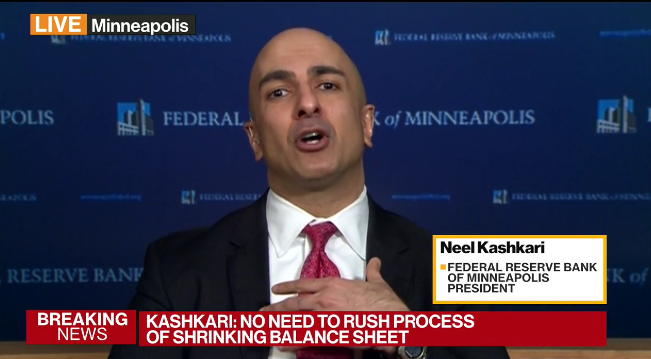

Fed's Kashkari now on Bloomberg

- Over the past 5-6 years, every one of our inflation forecasts has been wrong, always expecting inflation right around the corner, and always surprised when it's not

- Let's not keep repeating the same errors

- Why are we so worried? We're acting like we have an inflation ceiling at 2%

- Core inflation has been creeping up ever-so-slowly

- Wages are starting to creep up, but not at levels I'm concerned about

- I don't know why we're moving so quickly

- I'd be very surprised if core PCE hits 2% this year, it looks like it will be a few years before we hit 2%

- We should allow inflation to hit the target before raising rates

- The labor market still has room to improve. Prime-age participation is a key metric I'm looking at

- People want to return to normal and that's led us to making too-optimistic forecasts

- Mean revision is the religion of the Fed

- Feedback I'm getting is that better confidence isn't leading to investment

Sometimes dissents are a one-off event but Kashkari doesn't sound like he's going to get back in line.